Handle definition

What is a handle in trading?

In trading, the term ‘handle’ has two meanings, depending on which market you are referring to. In most markets, it means the whole numbers involved in a quote price, without the decimals included. In forex, it refers to the part of the quote that you see in both the buy and sell price.

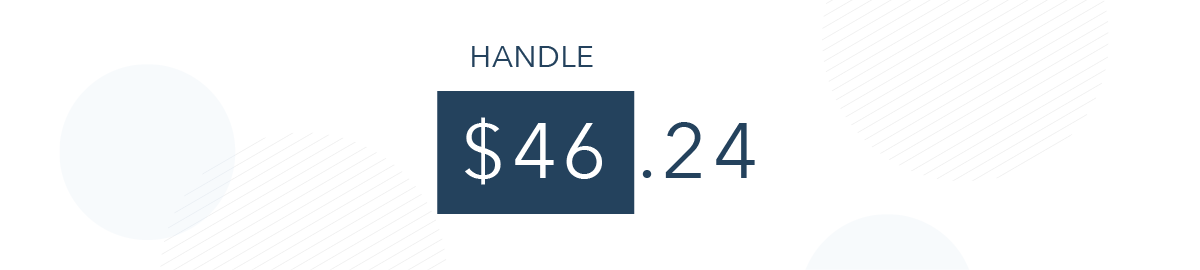

Using the handle is a faster way of referring to the price of an asset at a particular point in time. For example, if a stock is trading at $46.24, its handle is just $46.

What markets are handles most relevant to?

Handles are relevant to all financial markets, but mean different things depending on the market. Most market participants understand the handle of the specific quote price relative to the market, and therefore the full quote price does not need to be said every time.

Handle in forex trading

In forex trading, ‘handle’ refers to the part of the quote that appears in both the bid price and ask price. For example, if a currency pair can be bought for 1.6456 and sold for 1.6400, then its handle is 1.64.

Handles are especially relevant to spot and forward forex markets. Spot markets are markets that rely on current (spot) prices, while forward markets work with future prices.

However, it’s important to note that forex is generally quoted out up to five decimal places. Therefore, traders and brokers often negate the handle all together and just refer to the last two decimal places.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.

Help and support

Get answers about your account or our services.