Pullback definition

Discover events that could move the markets

Keep up to date on economic announcements with the IG economic calendar.

What does a pullback tell you?

A pullback tells you that the overall market trend has temporarily paused. This could be down to several factors, including a momentary loss of trader confidence after certain economic announcements.

As a result, pullbacks are often seen as an opportunity to buy an asset that is in an overall uptrend. However, traders should be careful to not buy into a pullback too early, especially without a risk management strategy, in case it turns out to be a reversal.

Several indicators, including moving averages and pivot points, can help you to determine whether a pullback is actually a reversal. This is because these indicators highlight levels of support. If the pullback breaks through this level of support, it is likely to be a reversal.

Traders can use CFDs to take advantage of a pullback or even a reversal. This is because CFDs enable a trader to go short and speculate on markets declining; as well as long and speculate on markets rising.

Example of a pullback

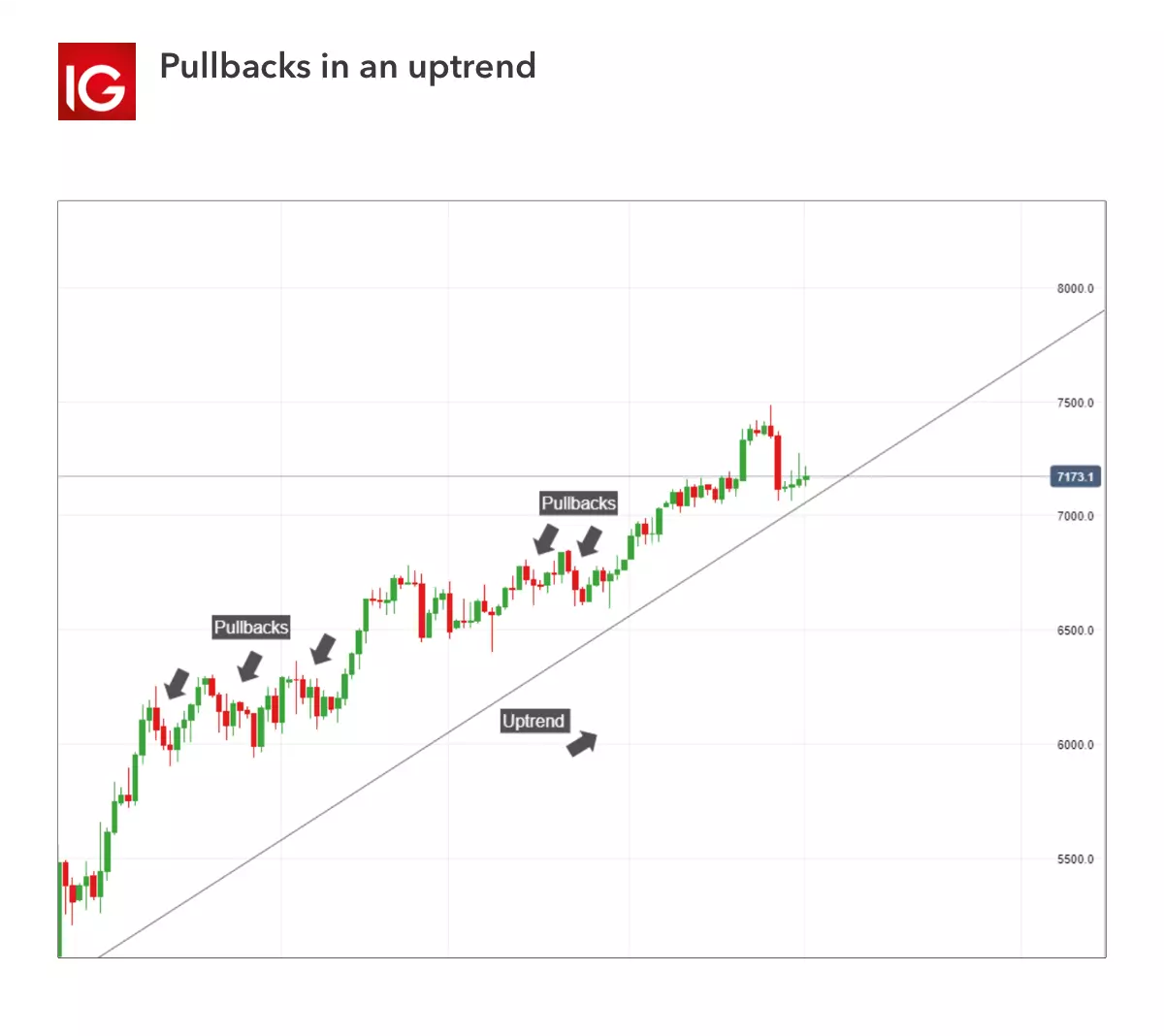

The price chart below provides an example of several pullbacks during an overall uptrend. Notice how the pullbacks are only temporary and that the overall trend resumes after each dip.

Pullback vs reversal

The most significant difference between pullbacks and reversals is that a pullback is temporary, while a reversal is a more permanent change in the direction of an overall trend. Pullbacks usually last for a few trading sessions, while a reversal can signify a complete change in market sentiment.

Build your trading knowledge

Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.

Help and support

Get answers about your account or our services.