EUR/USD, EUR/GBP and GBP/USD post ECB rate hike, ahead of FOMC and BoE rate decisions

Outlook on EUR/USD, EUR/GBP and GBP/USD following last week’s ECB rate hike ahead of this week’s Fed and BoE monetary policy meetings.

EUR/USD trades in 3 ½ month lows post ECB rate hike

Last week EUR/USD briefly dropped below its $1.0636 May low to $1.0632 following the European Central Bank’s (ECB) tenth rate hike in a row to 4.00% on its deposit rate and its dovish outlook. This week traders await the Federal Reserve’s (Fed) rate decision, expecting it to keep rates on hold.

A slide through and daily chart close below Thursday’s low at $1.0632 could lead to a drop towards the January and March lows at $1.0516 to $1.0484. For now the cross seems to hold, though, and while it continues to do so, the 7 September low at $1.0687 may be revisited.

Provided the currency pair remains below the last reaction high at $1.0769, seen last Tuesday, the July-to-September downtrend remains intact.

EUR/GBP traders await Fed and BoE rate decisions

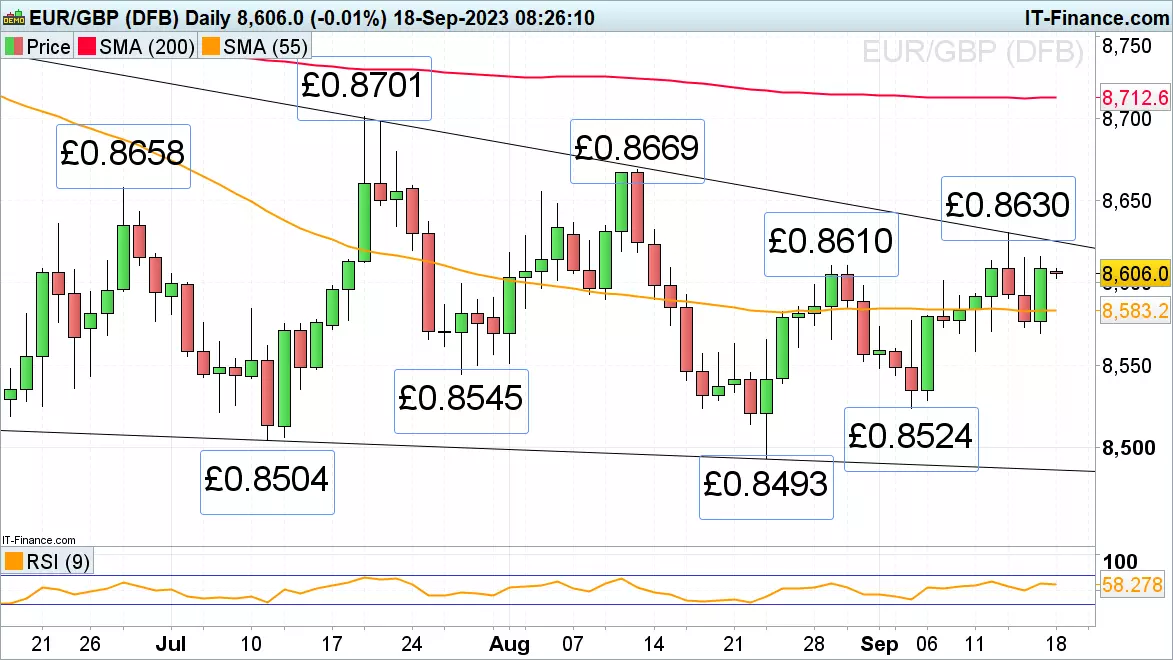

EUR/GBP remains within its June-to-September sideways trading range, now back above its 55-day simple moving average (SMA) at £0.8583, as traders await a rate decision by the Bank of England (BoE) on Thursday. The majority of analysts expect a fifteenth consecutive rate hike to 5.5%.

Only a rise above last week’s high at £0.863 would push the $0.8658 to $0.8669 June and August highs to the fore.

Minor support is seen along the 55-day SMA at £0.8583 and at Friday’s £0.857 low. While it continues to hold, immediate upside pressure should be maintained.

GBP/USD trades below its 200-day SMA

GBP/USD continues to slide as the majority of traders is expecting to see a rate hike at Thursday’s BoE monetary policy meeting.

The cross now trades below its 200-day SMA at $1.2434, which may act as minor resistance, and approaches its 3 ½ month low at $1.2379. A slip through it and the next lower June low at $1.2369 would target the May trough at $1.2309.

Minor resistance above the 200-day SMA remains to be seen at the 7 September low at $1.2446 and further up around the $1.2549 late August low and last Monday’s high.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only