Bank of Japan (BoJ) preview: Fresh outlook report to take centre stage

The BoJ is set to hold their monetary meeting across 25 – 26 April 2024.

Previous March meeting marked a historic policy shift

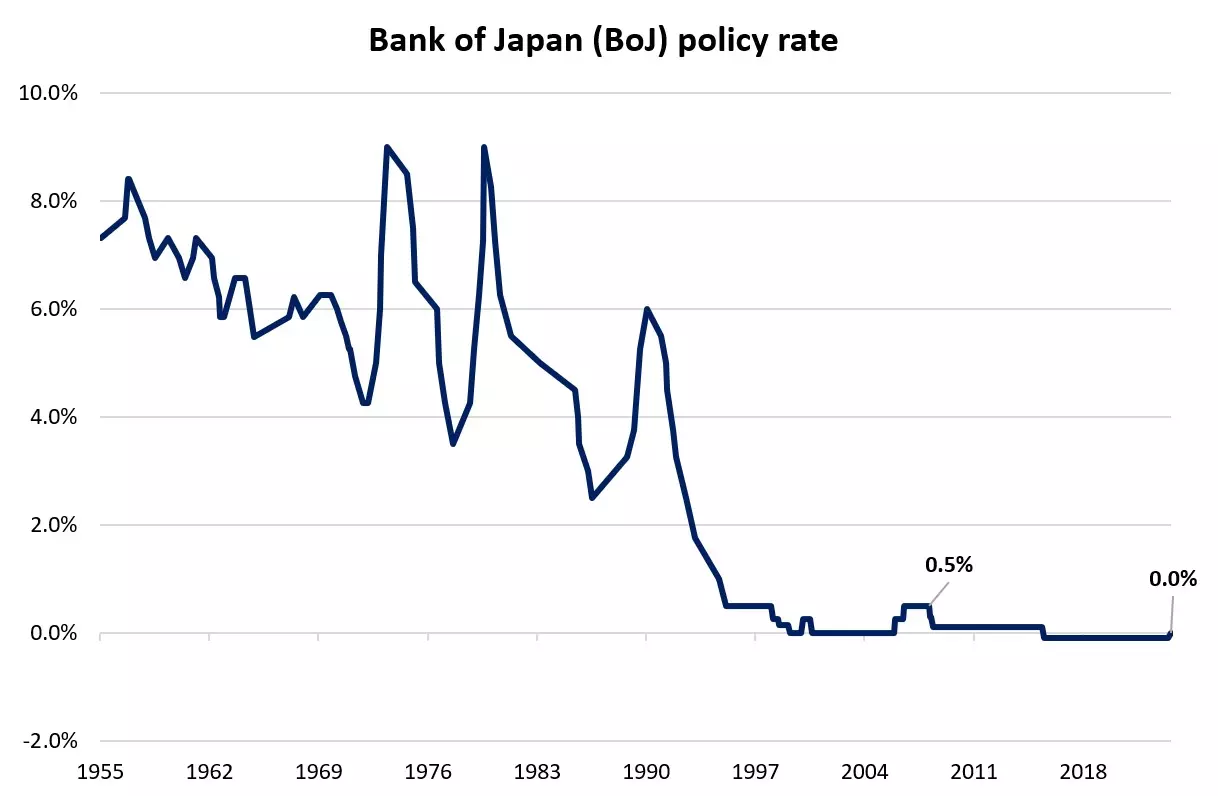

The BoJ is set to hold their monetary meeting across 25 – 26 April 2024. At the previous meeting, the BoJ raised its key short-term interest rate from -0.1% to a range of 0% - 0.1% for the first time in 17 years. The central bank also removed its yield curve control (YCC) policy and scaled back its asset purchases – ending purchases of equity exchange traded funds (ETFs) and J-REITs but will continue to purchase Japanese Government Bonds (JGBs) with “broadly the same amount as before”.

The policy shift ensued from a stronger-than-expected outcome in this year’s annual wage negotiations (shunto), which validated hopes that a virtuous wage-price spiral could bring its ‘sustainable and stable 2% inflation’ target in sight. Japan’s biggest companies agreed to raise wages by 5.28% for 2024, its highest in 33 years.

However, markets were also quick to take notice of the BoJ’s dovish language around further tightening, which anchored views for a more gradual pace of policy normalisation. With some reservations around economic risks, the central bank guided that it “anticipates that accommodative financial conditions will be maintained for the time being”.

What to expect at the upcoming BoJ meeting?

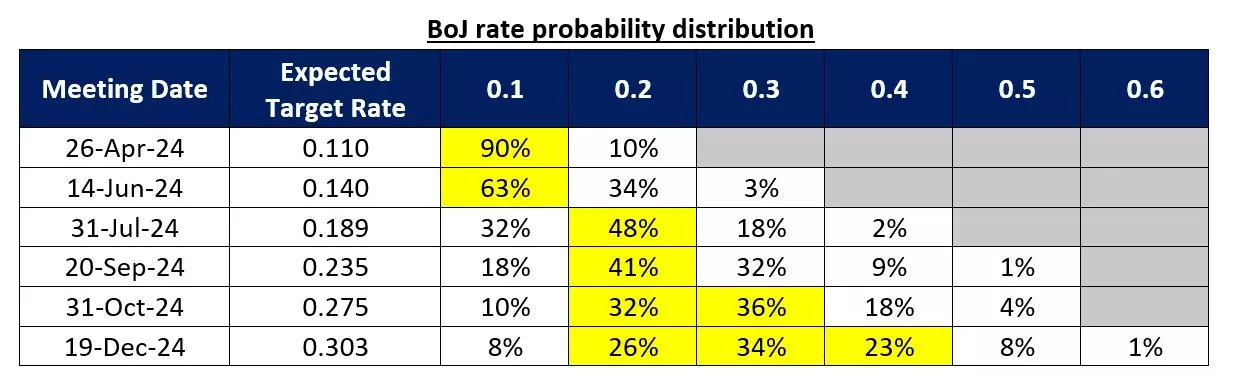

At the upcoming meeting, the BoJ is widely expected to keep policy settings on hold, having previously indicated patience in its future policy assessments while a back-to-back policy shift may seem overly aggressive. Current rate expectations are leaning for further rate adjustment only in the July or September meeting.

Focus to be on BoJ’s quarterly outlook report and press conference

Focus for the upcoming meeting will be on the BoJ’s quarterly outlook report. Eyes will be on how the weaker yen and surging oil prices in recent months will raise the bar on its inflation outlook, which will set expectations for the central bank’s next rate move.

Market chatters are for FY2025 core inflation forecast to be raised from 1.8% to 2.0%. The first forecast for FY2026 will also be unveiled, which is expected to be at around 2%.

While Japan’s inflation has cooled slightly in March (core: 2.6% vs 2.8% prior, headline: 2.7% vs 2.8% prior), pricing pressures continue to run above the central bank’s 2% target for the second year running, which may support further policy normalisation efforts.

Recent comments from the BoJ Governor Kazuo Ueda have laid the groundwork, guiding that the central bank is "very likely" to raise interest rates if underlying inflation continues to go up, and will begin reducing its huge bond buying at some point in the future.

Any wording shift in the press conference on close watch as well

At the previous meeting, the BoJ Governor’s justification to keep accommodative monetary conditions in place was that ‘there is some distance for inflation expectations to reach 2%’. With any upward revisions in the upcoming inflation forecasts, market participants will be watching for any shift in wordings from the Governor in the upcoming press conference.

USD/JPY: FX intervention remains on watch

Rising US-Japan bond yield differentials has paved the way for USD/JPY to touch its highest level since 1990, with the pair breaking above its previous forex (FX) intervention level (October 2022) around the 150 - 152 level.

While Japan authorities have been stepping up intervention warnings lately, with Finance Minister Shunichi Suzuki recently saying that authorities “would take appropriate actions against excessive movements”, the lack of any concrete follow-through seems to point to some tolerance and spur views that it may be just jawboning to limit the decline in the yen. Nevertheless, any signs of intervention will remain on watch and drawing reference from 2022, the amount of yen-buying may determine if a top is seen.

Near-term, an upward trendline seems to serve as a previous support-turned-resistance line for the pair, with buyers potentially facing a test of resistance at the 154.80 level. While daily relative strength index (RSI) is pointing to near-term overbought conditions, further rise in US Treasury yields may keep the pair supported. In the event of a retracement, the 153.00 level may be on watch as immediate support to hold.

Nikkei 225: Correction territory being tested

The unwinding in the broader risk environment, particularly in rate-sensitive tech, has dragged the Nikkei 225 index into technical correction territory, falling by as much as 10.7% over the past one month. While the index is attempting to stabilise into the new week, sentiments remain weak for now, with its daily RSI dipping to its lowest level since December 2023.

Near-term, the 36,700 level (last Friday’s low) may serve as immediate support to hold, with any subsequent breakdown potentially paving the way towards the 35,700 level next. On the upside, the 38,000 level will be on watch, where a resistance confluence stands from an upward trendline and its daily Ichimoku Cloud.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only