FTSE year-end struggles and DAX's record highs: focus on UK inflation report

FTSE's lackluster 2023 performance contrasts sharply with DAX's record highs. BoE's resistance against rate cuts intensifies focus on the upcoming UK inflation report.

There is no way to sugarcoat this – so let’s say it straight. The year 2023 has been entirely a forgettable one for the FTSE.

With just under two weeks before year-end, the FTSE is up a mere 2.18% CYTD. Its German counterpart, the DAX, has added 19.59%, while the French index, the CAC, is up 16.92%. Even the Australian stock index, the ASX 200, is up 5% CYTD, rubbing salt into the wound after Australia’s cricket team retained the prized ashes.

Last week, the FTSE’s attempt to break higher, following the dovish Fed meeting failed, as the BoE pushed back against expectations of rate cuts, warning that it still had “some way to go” in its fight against inflation. This puts the spotlight firmly on the UK’s latest inflation report, which is due on Wednesday at 6.00 pm AEDT.

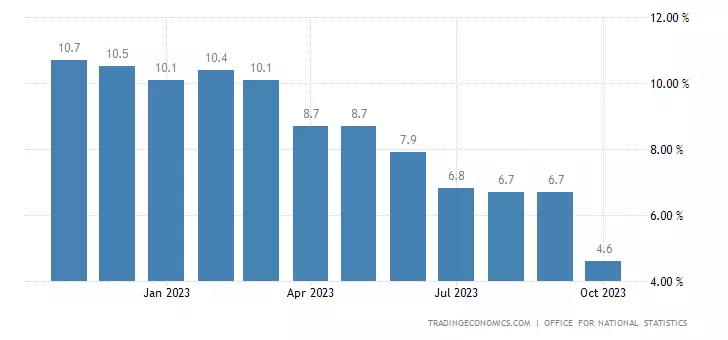

What is expected from the UK’s November inflation report?

Last month, headline inflation in the UK fell to 4.6% YoY in October from 6.7% in September. It marked the lowest rate of headline inflation in the UK since October 2021, largely due to falls in energy and food prices.

The market is looking for the headline rate to moderate to 4.3% YoY. Core inflation is expected to ease to 5.6% YoY from 5.7% in October – still way too high to contemplate BoE rate cuts.

UK inflation rate chart

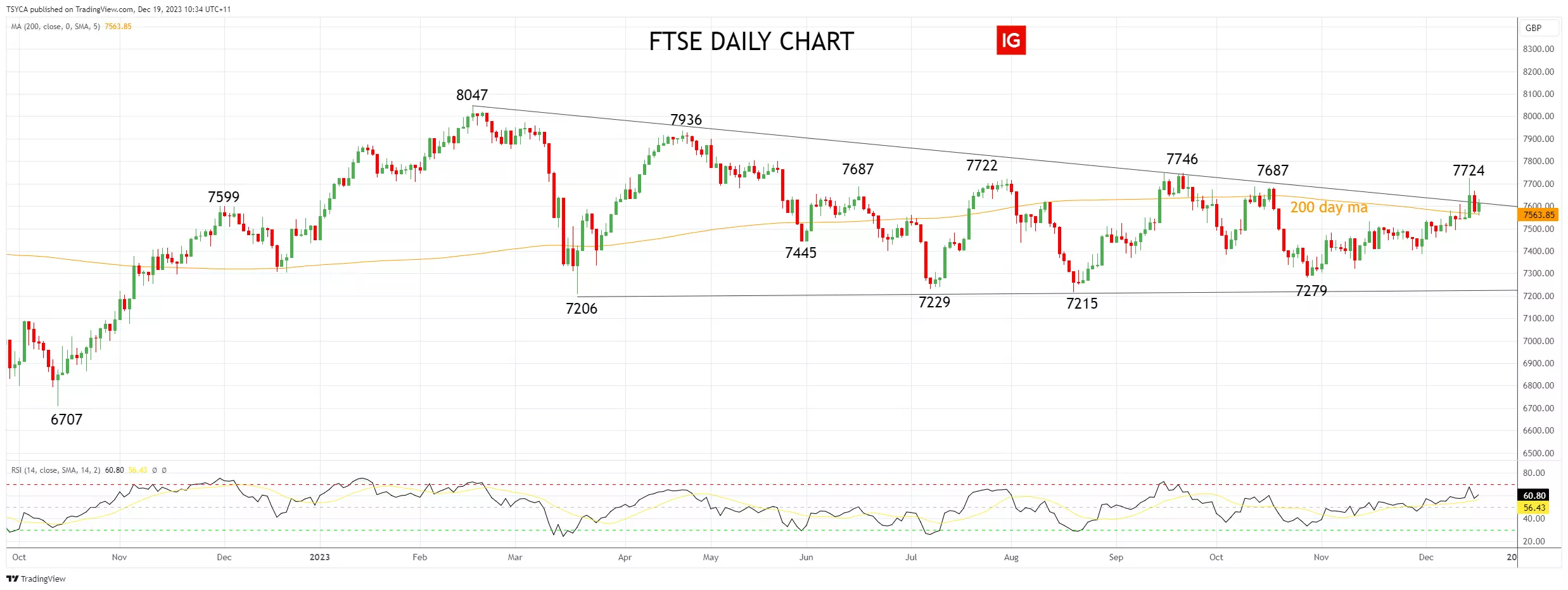

FTSE technical analysis

Last week's failed attempt to break higher saw the FTSE return to the safety of the 200-day moving average at 7563. Providing it continues to hold above the 200-day moving average (closing basis), the platform remains in place for a second attempt to break resistance at 7725/46 before a push towards the April 7936 high.

Aware that should the FTSE lose the support of the 200-day moving average and then horizontal support at 7500, a retest of range lows 7300/7200 is possible.

FTSE daily chart

DAX technical analysis

Like its US counterpart, the Dow Jones, the DAX recently traded to a new all-time high.

As viewed via the RSI indicator, the DAX is at extreme overbought levels, and while we remain bullish into year-end, we would not contemplate opening fresh longs at these levels. Instead, we would prefer to wait for a corrective pullback and signs of basing to look to open longs.

DAX daily chart

- Source TradingvVew. The figures stated are as of 19 December 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only