Markets Q2 outlook

Global market risk appetite improved generously in the first quarter despite the financial threat of Silicon Valley Bank’s collapse. By the end of Q1, there was no sign from the VIX market ‘fear gauge’ of stress in stock markets. Things were looking slightly different from the MOVE index, which is basically the Treasury market equivalent of the VIX.

At one point MOVE was up almost 65% in the first quarter following the fallout of SVB. But, thanks to efforts from the Federal Reserve and the government to protect depositors, bond market volatility notably cooled in the final few weeks of the first quarter. This allowed traders to focus on what the Federal Reserve could do in the future.

Fed rate hike expectations were slashed compared to where market pricing was at the end of last year. Long story short, traders potentially see the central bank cutting rates down to about 4.25% from the 5% prevailing upper bound at the end of March. As bank volatility cooled, traders indulged in assets that would benefit the most from this.

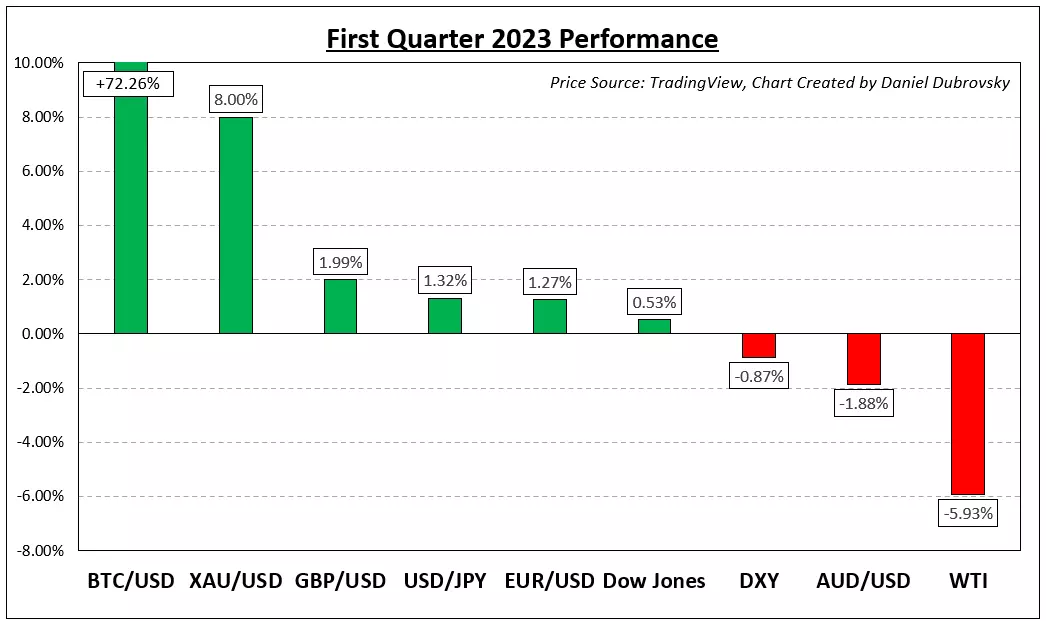

As a result, the tech-heavy Nasdaq 100 outperformed, soaring over 20% and entering a bull market. That was the best 3-month gain since the immediate recovery after the 2020 pandemic crushed stock markets. Traders also piled into cryptocurrency, with Bitcoin ripping over 70% higher. Treasury yields declined as traders priced in a dovish Fed, denting the US Dollar.

What lies ahead for global markets? All eyes will be on the United States to continue judging the aftermath of SVB’s collapse. The saying goes when the US sneezes, the world catches a cold. However, the threat of a recession could unwind a lot of upside progress seen across asset classes in Q1. Meanwhile, if the economy holds up, markets will have to price out rate cuts.

With that in mind, the path ahead remains uncertain. What is becoming clearer is that major central banks across the world are either preparing to wind down tightening cycles or are already there as economists continue monitoring inflation expectations. Labor markets remain tight, opening the door to sticky inflation. With that in mind, what are the key event risks traders should watch ahead?

This information has been prepared by DailyFX, the partner site of IG offering leading forex news and analysis. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only