Micron Technology shares soar 20% as AI drives Q2

Micron Technology (MU), all sessions on the IG platform, saw shares climb by a fifth as artificial intelligence memory sales turned an expected loss into a profit.

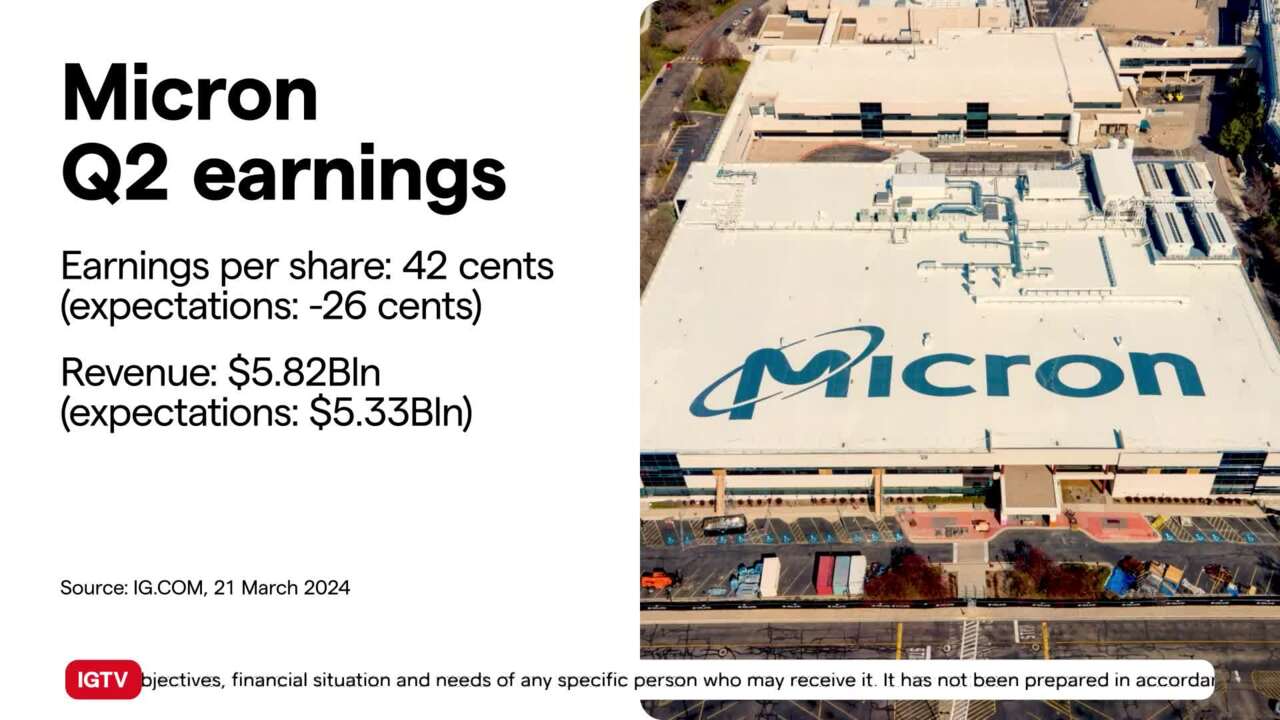

MU announced second-quarter fiscal 2024 results at an adjusted 42 cents against an expected loss of 26 cents. Revenues also came in higher at $5.82 billion over forecasts of $5.35 billion, up from $3.69 billion in the same quarter last year. The outlook was also an improvement on expectations in its fiscal third quarter. Micron expects to report revenue of $6.60 billion, above the $6.02 billion expected by analysts.

(AI Video Summary)

Micron Q2 earnings causes 20% share price increase

Micron Technology, a company that makes computer memory chips, had a really good second quarter. After releasing their financial results, their stock price went up by 20%. This was because the company did even better than people expected and gave positive predictions for the future.

Instead of losing money like experts thought, they made 42 cents per share. Their revenue was also higher than expected at $5.82 billion. This is a big jump from last year when their revenue was only $3.69 billion. Not only did their income improve, but their net income also went from a loss of $2.3 billion to a gain of $793 billion.

Buying and selling Micron stock

Since the good news came out, lots of people have been buying and selling Micron Technology's stock. At the end of the day, there were no sell orders at a price of $113.70 per share. This is the highest the stock has ever been. Because of this, experts predict that the stock will go up even more today, by about 17-18%.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only