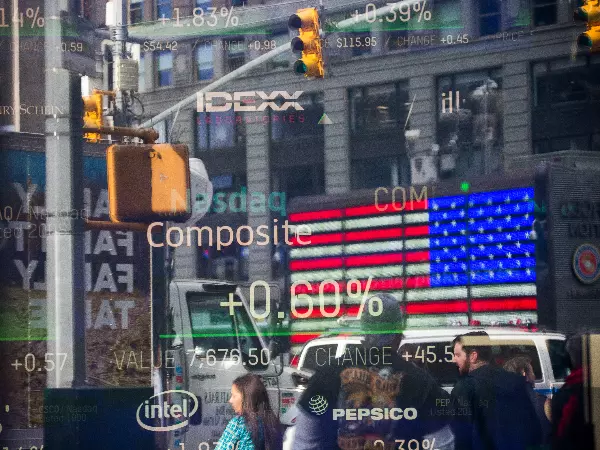

Nasdaq jumps out of bear market; Dow Jones breaks through key trend line following FOMC announcement

The US stock market welcomed the ‘no surprise’ rate hike even though the central bank also cut economic growth forecasts (GDP) from 4.0% to 2.8% and raised its inflation estimates.

The guessing game for the FOMC’s March meeting is finally over. As expected, the US Federal Reserve raised interest rates by 25 basis points and signalled hikes at all six remaining meetings this year.

It was the first increase since 2018 and more importantly, concluded the quantitative easing of the monetary policy to boost the economy from the pandemic since two years ago.

The US stock market welcomed the ‘no surprise’ rate hike even though the central bank also cut economic growth forecasts (GDP) from 4.0% to 2.8% and raised its inflation estimates. Based on Fed Chairman Jerome Powell’s view, inflation is expected to remain well above the Fed’s 2-3% target at around 4.1% throughout this year, and peak in the second half of 2022 as supply chain interruptions play out.

The S&P 500 finished up 2.2 per cent while the Nasdaq jumped 3.8 per cent and the Dow Jones soared by 2.27%.

Nasdaq

The beleaguered Nasdaq has enjoyed a rally session following FOMC’s announcement. A 3.8% lift has helped the index to jump out from the bear market territory and close above the descending trend line since the start of the year. A similar notable breaking-through can also be found from the weekly chart.

Looking ahead to the previous trend line, it now pivots to the support for the tech-heavy index. The near-term target is looking at the 50-days moving average before challenging the Feb high at 15278. In between that, the 50 weekly moving average sits around 15000 could be another pressure line to keep a close eye on.

Momentum-wise, daily and weekly RSI are suggesting a return of risk-appetite with both indicators pointing to the north from the territory of ‘oversold to neutral’.

NASDAQ DAILY

NASDAQ WEEKLY

Dow Jones

Dow Jones rallied 2.27% higher and finished the session out of the correction zone, the most significant jump in three weeks. The index is now trading at only 8% below its historic high.

The downturn trendline for the last four weeks has been breached and along with the new upward trend has been formed to provide future support. Imminent resistance can be found from the 50-days moving average, coinciding with the February low. The 100-days moving average can be viewed as the next pressure level is around 34963, which, if broken through, could safely claim an overturn for the Dow Jones.

From a mid-term perspective, the weekly chart shows that the index remains stuck to its downturn trajectory under the pressure from the ceiling. Only a close above the level of 34321 by the end of this trading week could cement the bull-biased view.

DOW JONES DAILY

DOW JONES WEEKLY

Follow Hebe Chen on Twitter @BifeiChen

Take your position on over 13,000 local and international shares via CFDs or share trading – and trade it all seamlessly from the one account. Learn more about share CFDs or shares trading with us, or open an account to get started today.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Take a position on indices

Deal on the world’s major stock indices today.

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only