Nike shares lower, warns on revenue amid competition squeeze

Nike shares indicated lower after the group warned its revenue are set to shrink as it faces off newer brands. IGTV's Angeline Ong looks at the numbers to find out how rising competition is keeping Nike on the slow lane.

(AI Video Summary)

Nike shares drop

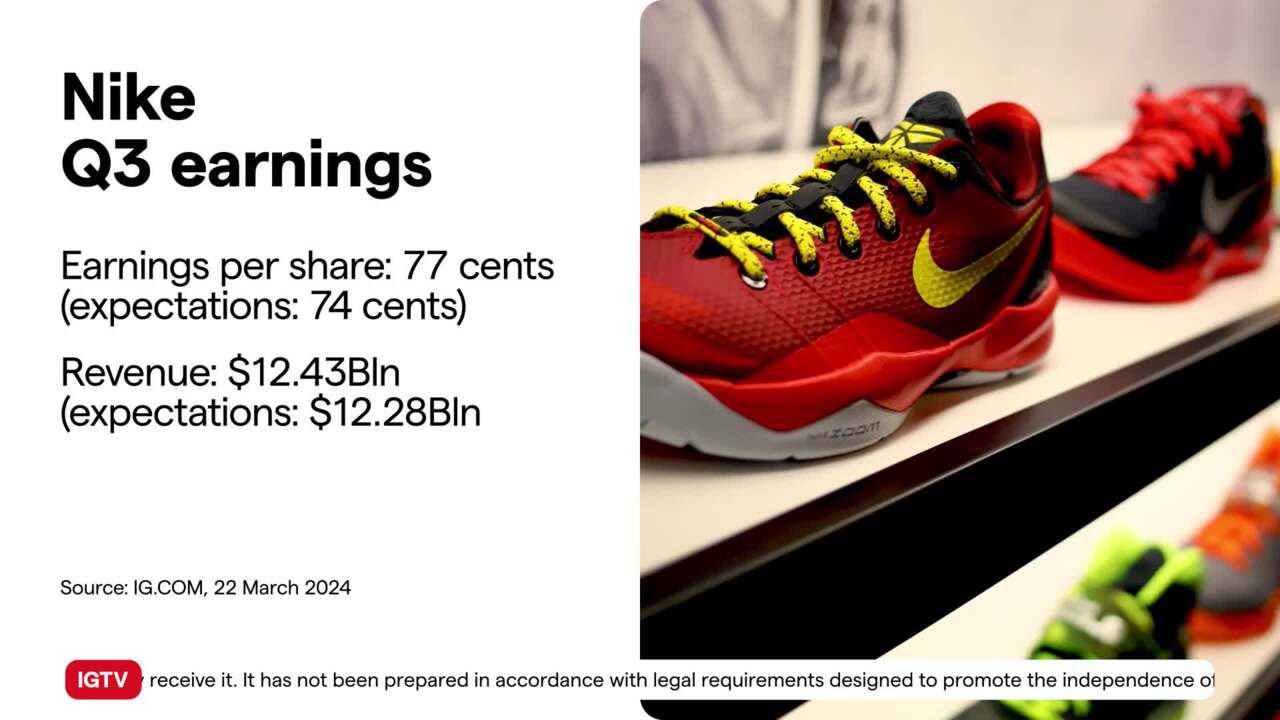

Nike shares have fallen before the market even opened because the company announced that its revenues will be lower in the first half of 2025. They expect a decrease of a few percent. However, it's not all bad news for Nike, as their earnings per share were higher than expected at 77 cents, compared to the anticipated 74 cents. Additionally, their revenues were slightly higher than predicted at $12.43 billion instead of the projected $12.28 billion.

Nike's competitiveness

To try and stay competitive in a crowded market, Nike has been trying to replace their old sneaker styles with trendier ones. However, this strategy hasn't made a big impact on their stock prices, as they're currently slightly down. If you want to see how the market is reacting to this news, it would be a good idea to look at the 15-minute chart on the tastylive platform. This chart shows how the stock price changes over a short period of time.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only