Wall Street: robust US manufacturing data shakes rate cut expectations

US stocks fluctuate with strong manufacturing data reducing expectations of a Fed rate cut in June, shifting focus to upcoming job reports.

Manufacturing surge impacts Fed rate outlook

US equity markets had a mixed opening for Q2 2024, with strong US manufacturing data driving up yields and lowering prospects of a Federal Reserve rate cut in June.

The ISM manufacturing PMI increased to 50.3 in March, up from 47.8 in February, for its first time in expansion territory (above 50) in sixteen months. Within the sub-indices, the prices index rose 3.3 points to 55.8 vs. 52.9 exp, while new orders rose to 51.4 vs. 49.2 prior.

The probability of a 25bp Fed rate cut in June has fallen to a coin toss (56%), and there are now only 66 basis points (bp) of rate cuts priced for 2024, down from expectations of 170bp of rate cuts at the start of the year. The risks appear to be for even fewer or delayed rate cuts due to strong US economic growth.

Further insights into the scope and timing of rate cuts will come from tonight's release of JOLTS Job openings before Friday's pivotal non-farms payrolls data previewed below.

What is expected from non-farm payrolls

Date: Friday, 5 April at 11.30am AEDT

In February, the US economy added 275k jobs, 75k above consensus forecasts. The stronger-than-expected headline number was offset by weakness within the remainder of the report. The prior two months' jobs growth was revised down by 167k. The unemployment rate rose to 3.9% in February from 3.7%, and average hourly earnings increased by 0.1% MoM, less than the 0.3% expected.

While traders foresee stability in the labour market, any emerging weaknesses could prompt reactions from both markets and the Fed, especially after Chair Powell's recent hint at rate cuts should unemployment unexpectedly surge.

In March, the US economy is expected to add 200k jobs, and for the unemployment rate to remain at 3.9%. Earnings growth is expected to increase 0.3% MoM, which would see the annual rate ease from 4.3% to 4.1%.

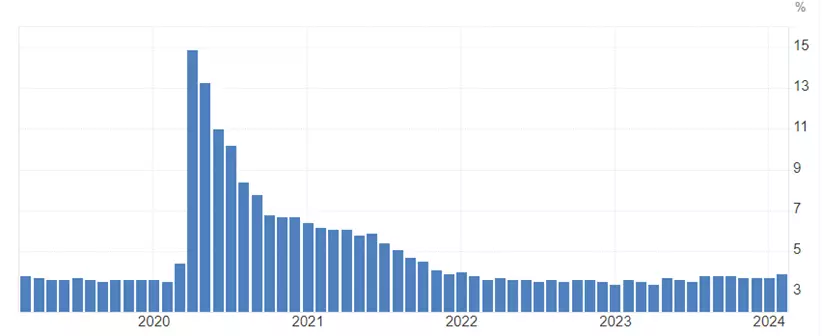

US unemployment rate chart

S&P 500 technical analysis

The S&P 500 made a fresh record high in the final session of quarter one before a weaker session overnight kicked off the second quarter of the year.

Buyers expecting the uptrend to extend towards 5350 will look towards support at 5200 and again at 5170 to contain weakness, using the lows of March 5055/5040 area as the reassessment level.

Aware that if the S&P 500 were to see a sustained break of support at 5055/5040, it would warn that a short-term high is likely in place and that a deeper pullback towards 4800 is underway.

S&P 500 daily chart

Nasdaq technical analysis

The Nasdaq ended quarter one on a high, and spent the opening session of the second quarter consolidating gains just below fresh record highs.

Buyers expecting the uptrend to extend towards 18,750 will look towards support at 18,200 and again at 18,000 to contain weakness, using the lows of March 17,750/00 area as the reassessment level.

Aware that if the Nasdaq were to see a sustained break of support at 17,750/00, it would warn that a short-term high is likely in place and that a deeper pullback towards 17,000 is underway.

Nasdaq daily chart

- Source TradingView. The figures stated are as of 2 April 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only