What are derivatives and how do you trade them?

Many of the most popular trading products in the world are derivatives. Discover what derivatives are, how to trade them and a few reasons why you might want to trade using them.

What is a derivative?

A derivative is a contract between two or more parties that derives its value from the price of an underlying asset, like a commodity. Derivatives are often used as a means to speculate on the underlying’s future price movements, whether up or down, without having to buy the asset itself.

As no physical assets are being traded when derivative positions are opened, the contracts can be traded over the counter (OTC) or on an exchange. You can take a position on a large range of underlying assets, including:

Types of derivatives

There are various types of derivatives. These all have unique characteristics and are used for different reasons. However, derivatives like options and futures contracts can be difficult to trade as they often require large capital outlays or accounts with brokers that buy and sell on your behalf.

An alternative is to use a provider like us to speculate on the price movements of a derivative via CFD trading.

CFDs are also a form of derivatives as they track the price of an underlying market.

For example, you can take a position on a futures contract listed on an exchange without buying or selling the actual contract. Rather, you’d use a CFD to predict whether the future’s price will rise or fall, based on market conditions. If you think the price will rise, you’d buy (go long) whereas if you think it’d fall, you sell (go short).

While this means you can make a profit or a loss, whatever the market’s doing – based on whether you predicted its movements correctly or not – this form of trading isn’t without risk. Short-selling in particular can bring significant profits or losses, as there’s no limit to how high a market’s price can rise.

CFDs are leveraged forms of trading, meaning that you’ll put up a small initial deposit (called margin) to open a larger trade. This is a small percentage of the total value of your position. However, both profits and losses are calculated based on the full position size, not your margin amount, which means both could significantly outweigh your initial deposit.

CFD trading

When you trade CFDs, you’re entering into a contract for difference, which is an agreement to exchange the difference between the opening and closing price of your position.

CFD trades enable you to speculate on the price of an asset by going long (buying) or going short (selling). You can trade on the spot, as well as options and futures prices with CFDs.

CFDs are also free from stamp duty, plus losses can be offset against profits for tax purposes.1 However, there are risks associated with trading CFDs, as we’ve covered above.

Futures contracts

Futures are financial contracts in which two parties – one buyer and one seller – agree to exchange an underlying market for a fixed price at a future date. Futures give the buyer the obligation to buy the underlying market, and the seller the obligation to sell at or before the contract’s expiry. The unique aspects of futures contracts are that they are standardised and traded on exchanges. The exchanges guarantee payment, so counterparty risk is lessened. You can trade on futures markets with us using CFDs.

Futures are also leveraged, so it’s important to remember that your profit or loss will be determined by the total size of your position, not just the margin used to open it. This means there is an inherent risk that you could make a loss (or a profit) that could far outweigh your initial capital outlay.

Options contracts

Options give one party the right (but not the obligation) to purchase or sell an asset to the other at a future date at an agreed price. If the contract gives the option for one party to sell an asset it is called a put option. If it gives the option for one party to buy an asset it is called a call option. You can trade on options prices with us using CFDs.

Options are leveraged products much like CFDs; they allow you to speculate on the movement of a market without owning the underlying asset. This means profits can be magnified – as can your losses, if you’re selling options. When buying call options as CFDs with us, you’ll never risk more than your initial payment when buying, just like trading an actual option, but when selling call or put options your risk is potentially unlimited (although your account balance will never fall below zero).2

What is derivatives trading?

Derivatives trading is when you buy or sell a derivative contract for the purposes of speculation. Because a derivative contract ‘derives’ its value from an underlying market, they enable you to trade on the price movements of that market without you needing to purchase the asset itself – like physical gold. You’d do this in the hope of booking a profit.

Derivatives can be traded over the counter (OTC) or on-exchange:

- Over the counter: the terms of the contract are privately negotiated between the parties involved (a non-standardised contract). For example, a contract between a trader (like you) and a broker (like us)

- On-exchange: another way to trade derivatives is through a regulated exchange that offers standardised contracts. These are called exchange traded products (or ETPs) and they provide the benefit of having the exchange act as an intermediary. Because the exchange guarantees payment, counterparty risk is vastly reduced

When trading derivatives with us, you’ll be taking a position using CFDs - which is an OTC product. You can also use this OTC product to take a position on futures and options prices.

This means that instead of trading on exchanges – which can be difficult and costly – you’ll be speculating on price movements exclusively.

What is the derivatives market?

The derivatives market is not a single, physical place. Instead, it consists of all OTC and on-exchange financial instruments that derive their worth from an underlying asset.

The derivatives market plays an important role in the global financial system. Well-known exchanges listing derivatives include:

- The Chicago Mercantile Exchange (CME), which is one of the world’s oldest exchanges and trades derivatives like futures and options linked to commodities and sectors, most famously the agricultural sector and soft commodities

- The Intercontinental Exchange (ICE), which trades derivatives linked to foreign exchange, commodities and more

- The ICE Futures Europe exchange, formerly known as the London International Financial Futures and Options Exchange (LIFFE), which is one of the foremost exchanges in the UK and trades options and futures, most notably on Brent Crude oil

Physical delivery and cash-settled derivatives

Although no asset is bought or sold when a derivative contract is opened, many derivatives may require the physical delivery of the underlying at a specified price on a future date.

Whether the contracts are settled with physical delivery or by cash payments from one party to another depends on the terms of the contract.

- Cash settled derivatives – this is a type of agreement in which the physical underlying asset is never involved in the transaction. Instead, the contract is settled with a monetary amount which represents the value of that underlying (for example, for current price of a gold ingot). All derivatives traded with us are cash-settled

- Physical delivery derivatives – this contract is an agreement to exchange the actual underlying, which must be delivered by the one party to the other at the derivative’s expiry date. This can be less convenient for the trader in terms of taking possession of, storing and selling or maintaining the asset, for example if the underlying being traded is livestock, large amounts of precious stones, etc.

Why trade derivatives?

Here are four reasons why you may want to consider trading derivatives:

- Speculation

The beauty of speculation is that you don’t have to take ownership of anything, but can still make a profit (or a loss) on various financial assets, simply by making a prediction on the market direction. You’d either buy or sell derivatives in the hope of your prediction being correct. For example, if you think the FTSE 100 is set to rise over the coming weeks, you could buy CFDs on a FTSE 100 futures contract. If, however, you think the FTSE 100 may depreciate in price, you’d sell (go short) with CFDs.

- Trading rising and falling markets

With derivatives, you can trade both rising and falling markets, meaning you can profit (or make a loss) even in a depressed or volatile economic environment. You’d go ‘long’ if you think the price of an underlying asset will rise; and ‘short’ if you think it’s going to fall. To open a long position, you’d elect to ‘buy’ the market. When going short, you ‘sell’ the market when opening your trade.

- Trading with leverage

You can use derivatives to increase leverage. This enables you to take a position for a fraction of the cost of the position’s total value (for example, using $10 to open a position worth $300). However, be aware that this magnifies the size of both the potential profits and the losses that can be made.

For example, you can use leverage to take a position on an index futures contract at a fraction of the cost of the actual asset. But, trading with leverage increases your risk as you stand to lose more than your margin amount. This is why you take steps to manage your risk.

Read more about the impact of leverage on your trading

- Hedging

Traders, investors or businesses can also use derivatives for hedging purposes, which means opening a second position that will become profitable if another of your positions starts to make a loss. In this way, you can mitigate your risk by gaining some profit and limit your losses overall, without having to close your initial position.

For example, a farmer wanting to lock in a price for future crops would agree to sell the crops at a specified price on a set future date. The farmer lessens the uncertainty about future market conditions by hedging his trades so that he can make a profit and limit loss no matter what the market does.

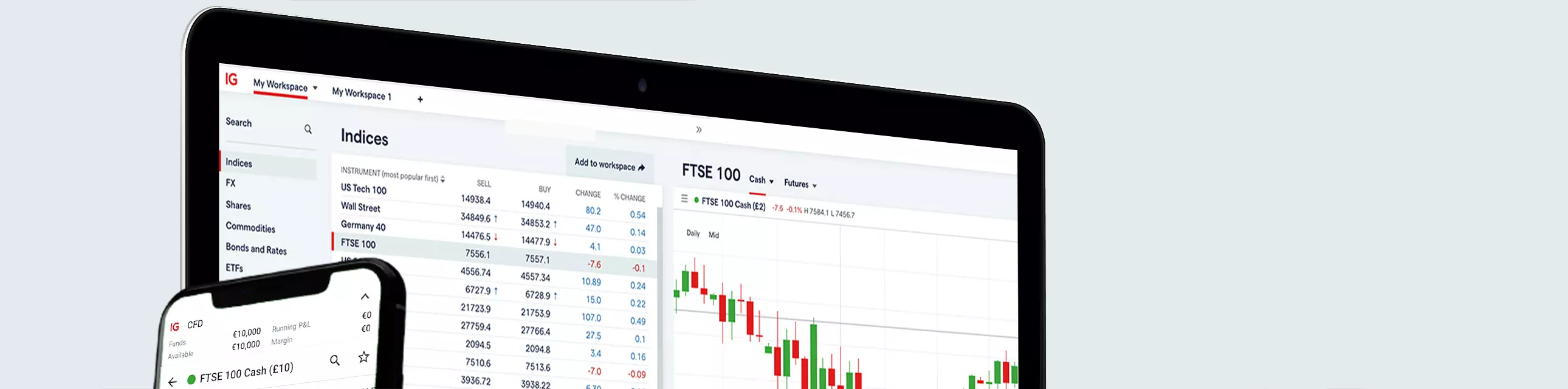

How to trade derivatives with us

You can trade derivatives with us in a number of ways. Whether OTC or on-exchange, derivatives trading requires large capital outlays and a brokerage account – which is why traders rather use a platform like ours. With us, you can trade 17,000+ markets using CFDs. When trading contracts for a difference (CFDs), you’ll be exchanging the difference between the opening and closing price of your position.

In addition to 12,000+ popular stocks and ETFs from exchanges around the globe, you can also take positions on the prices of exchange-listed options and futures. All our trades are cash-settled. To take a position on a market:

- Create an account or practise on a demo

- Select your preferred market

- Take steps to manage your risk

- Place your trade and monitor your position

Examples of derivatives trading

Speculation

Say you want to speculate on the price of the Nasdaq (known on our platform as the US Tech 100). You’d need to use a type of derivative, in a trading platform, to do this.

After some thought, you decide to use CFDs to take out a longer-term position predicting what the Nasdaq will do in the future – this is called a futures contract.

If you think the Nasdaq exchange is set to rise over the coming weeks, you’d buy a futures contract (also known as going long), but would sell (go short) if you thought the Nasdaq’s price would fall.

Let’s assume you think the Nasdaq will appreciate in price. So, you decide to go long, with $100 that the exchange’s market price will go up by your futures contract’s expiry date. If the exchange’s price does go up by 5 points, you’ll make a profit of $500 ($100 x 5 points). If the Nasdaq’s price falls by 5 points, you’d make a loss of $500 instead.

Hedging

Let’s look at an example. You think the price of Brent Crude may go down, so you want to hedge your oil shares with us using CFDs. So, you go short on 10 Brent Crude oil CFD contracts. CFDs are calculated based on the difference between the market price when you open your position versus when you close it, and a single standard Brent Crude oil contract is equal to $10 per point.

So, for each point the Brent Crude price falls, you’d make $100 ($10 multiplied by 10 contracts). Likewise, for every point that the oil price appreciates, you’d make a $100 loss.

FAQs

Are derivatives leveraged?

Yes, derivatives are leveraged products. This is because all derivatives involve putting up a smaller amount initially in order to open a larger position, rather than paying the full amount of an asset upfront as you would with investing.

Are derivatives traded on an exchange?

On-exchange derivatives (also known as exchange-traded products or ETPs) are traded on an exchange, while over the counter (OTC) derivatives aren’t.

Are CFDs derivatives?

Yes, CFDs are a type of derivative you can trade with us.

Where can I trade derivatives?

You can trade derivatives on any financially regulated trading platform. Our platforms are award-winning,3 and we’re considered the world's No.1 CFD provider.4

What markets can I trade with derivatives?

There are many markets you can trade with derivatives – in fact, we offer over 17,000 to choose from. With us, you can use CFDs to trade on futures and options, indices, thousands of shares, currency pairs (forex), commodities, interest rates, bonds and more. See our markets to trade for more info.

How can I trade derivatives?

First, you’ll decide whether you want to trade derivatives via CFDs. Then you’ll open an account with us and open your first position. If you still want to get a feel for the derivatives market first and practise before using real money, you’ll open a demo account with us.

Try these next

Find out what futures are and how to trade them.

Learn the basics of trading options with us.

Trade some of our exclusive 24/7* markets on weekends

1 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

2 Negative balance protection applies to trading-related debt only and is not available to professional traders.

3 Best Finance App, Best Multi-Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024.

4 Based on revenue (published financial statements, 2022)

* 24/7 excludes the hours from 10pm Friday to 8am Saturday (UK time), and 20 minutes just before the weekday market opens on Sunday night.