Highest-yielding dividend stocks to watch in the UK

Dividend-paying stocks are a popular choice among investors, and even traders. With IG, you can take advantage of these stocks via derivatives trading. Read on to find out more about the top 10 stocks to watch.

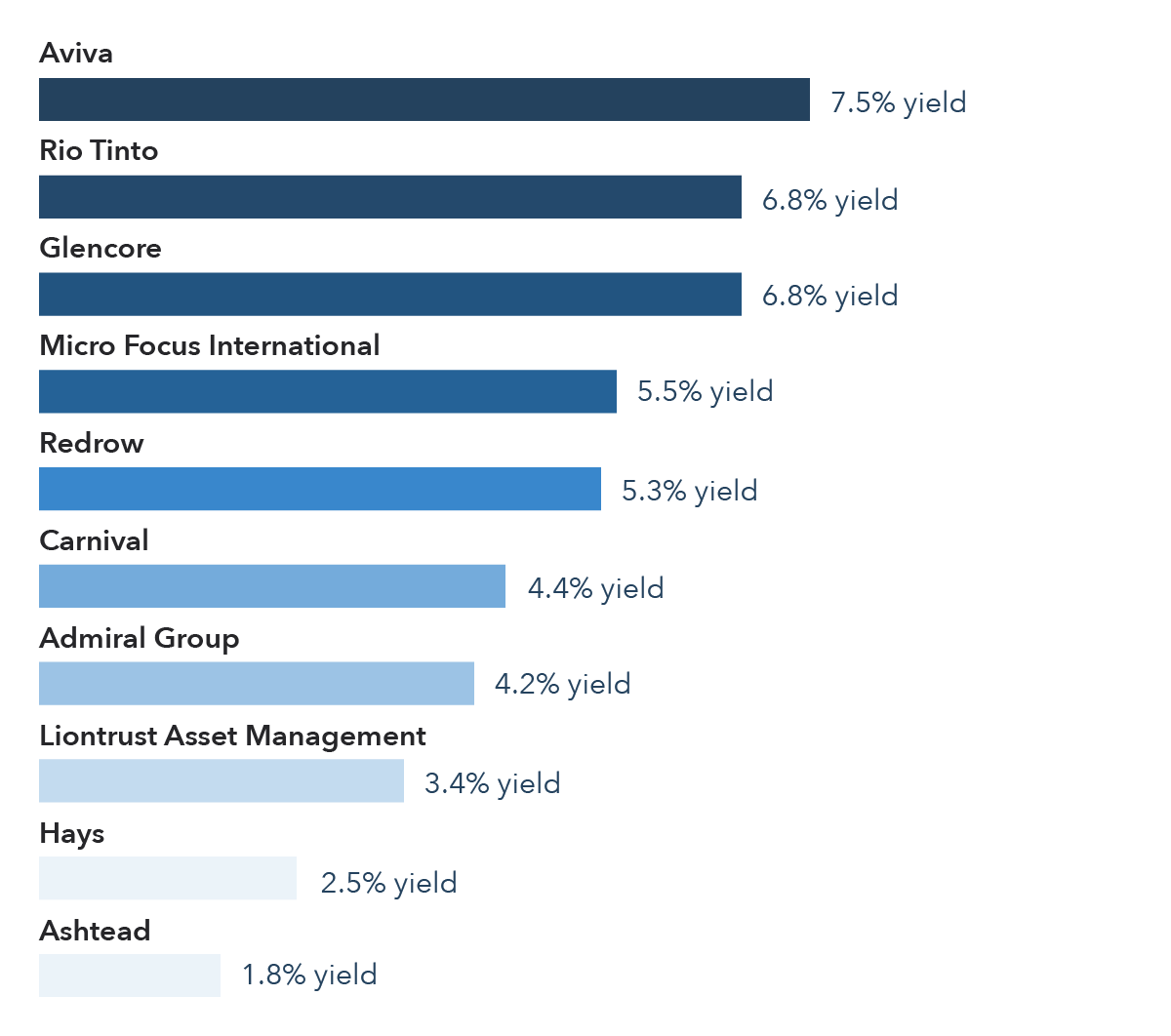

Top 10 dividend-paying shares to watch

Note: These are only some of the shares to watch and they are not necessarily the best dividend stocks in the UK in terms of yield. The list may change from time to time. If you’re looking for more dividend-paying stocks, use the IG market screener tool.

Aviva (7.5% yield)

Aviva was founded in 2000 through a merger of two British insurance firms. Since then, it has grown to serve more than 33 million customers in the general insurance, life assurance and pension sphere. Its primary listing is on the London Stock Exchange (LSE), and it is also a constituent of the FTSE 100.

Aviva remains an attractive option for dividend investors, as it has maintained a healthy pay-out over the years – covered by its thriving cash flows. In 2018, the company paid over £1 billion in dividends. However, investors should keep an eye on Brexit developments, as an economic downturn may affect Aviva’s performance.

Rio Tinto (6.8% yield)

Mining company Rio Tinto is listed on three major stock exchanges (LSE, ASX and NYSE). The business dates to 1873, and it is currently the third-largest mining company in the world. Though it has performed very well in the past, its share price is being threatened by unpredictable weather and a weakened outlook for iron ore.

Rio Tinto’s earnings have gone up by an average of 32% each year for the past five years. This kind of performance is good news for investors, and it has translated to a dividend increase most years. In August 2019, Rio Tinto announced its plan to return more than £2.8 billion to its shareholders.

Glencore (6.8% yield)

The British-Swiss company Glencore has been in the mining and commodity business since 1974. Its stock listed on the LSE in May 2011 and has remained on the FTSE 100 since then, too. Glencore is known for taking risk that other companies in the industry tend to avoid. However, it has also been in the limelight over corruption scandals, bribery accusations and financial misrepresentation, to name a few.

Preliminary results suggest strong financial performance, with a 5% increase in net income, to more than £4.7 billion. Dividends have also seen a significant increase over the past few years, rising by more than 120% between 2015 and 2019. Dividends look promising, but the stock may be more attractive to short-sellers, given the business’s questionable conduct over the past few years.

Micro Focus International (5.5% yield)

Another FTSE 100 constituent on the list of dividend stocks to watch is Micro Focus International – a global software and IT business. It has a diverse portfolio that includes more than 40,000 clients. What’s more, it has a solid dividend policy in place, covered two times over by its group earnings. Revenue-adjusted earnings per share (EPS) and dividends have increased over the past five years.

In July 2019, it was reported that Micro Focus has elaborate plans to integrate all its businesses and functions, spending more than £110 million on the integration since April 2019. These changes could drive its share price beyond £27 – a level it has never crossed before.

Redrow (5.3% yield)

Redrow is a home-building company founded in 1974. Its shares are listed on the LSE, and it is a constituent of the FTSE 250. In September 2018, the business posted record profits of £380 million. Its founder, Steve Morgan, stepped down in November 2018, but remains a shareholder. His resignation had no effect on the share price.

Redrow is a stock to watch because it has done very well, despite the far-reaching effects of Brexit on other industries. In fact, all UK housebuilders have had a stellar few years. Demand for new housing has increased, revenue is at an all-time high, and billions of dividend payments are being dished out to shareholders.

Carnival (4.4% yield)

Carnival is a British-American travel leisure company. It was founded in 1972, and it is currently listed on the LSE and NYSE (FTSE 100 and S&P 500 constituents). Carnival’s revenue relies heavily on the fuel price and the strength of the US dollar – this may affect earnings and its share price.

In 2018, Carnival reported £15.5 billion in revenue, and dividend payments were up by 20% from the previous year. It’s been a popular choice for investors, as it has been paying dividends for 10 years. Further to this, Carnival’s EPS have increased on average 26% every year for the past five years.

Admiral Group (4.2% yield)

LSE-listed Admiral Group – a financial services company – has been under the watchful eye of investors since it went public in 2004, 13 years after it was founded. Shares have been on a steady upward trajectory since its listing, and dividends have remained favourable, too.

Its 2018 financial report states an 11% increase in turnover from the previous year, 17% increase in earnings per share, and an 11% increase in the full-year dividend. Admiral Group has earned a reputation as a high-yielding dividend stock, strengthened by its ability to grow despite concerns around Brexit.

Liontrust Asset Management (3.4% yield)

Liontrust Asset Management was launched in 1995 and listed on the LSE in 1999. Based in London, it also has an office in Luxembourg, and runs eight fund management teams. In July 2019, Liontrust confirmed that it was in discussions for a possible acquisition of Neptune Investment Management, which could mean good news for investors.

Its most recent financial report demonstrated excellent growth, with a total of £12.66 billion in assets under management. Dividends per share rose by 29% in the same period, to 27p. These results echo the previous nine years’ positive figures.

Hays (2.5% yield)

Recruitment and human resources company Hays dates all the way back to 1867. It is listed on the LSE, and it’s a constituent of the FTSE 250. In recent years, the business has been plagued by slowdowns as Brexit lead to a lot of uncertainty surrounding private sector recruitment. However, growth in most of its sectors, such as Germany and Australia, remains strong.

In addition to its regular dividends, Hays declared a special dividend of nearly £73 million in August 2018. Though dividends are relatively small, the EPS looks promising to shareholders and potential investors.

Ashtead (1.8% yield)

Ashtead is a British industrial equipment hire company founded in 1947. It is yet another LSE-listed stock and constituent of the FTSE 100 on the dividend stocks to watch list. Its business is heavily influenced by weather patterns but, despite the threats of climate change, a strong US economy has caused Ashtead’s revenues to surge. However, the ongoing US-China trade tensions may weigh down momentum.

Besides the 21% increase to the dividend, there have been reports of a share buyback programme worth £500 million. These figures have given investors’ confidence in the group.

How to identify the UK’s best dividend stocks

There are a few steps you can follow to identify the UK’s best dividend stocks:

Use a market screener

You can use online resources such as the IG market screener to look for companies with a proven track record of delivering dividends. IG’s screener also makes it easy to compare high-yield dividend stocks against each other. This way, you can choose the stocks that best suit your risk profile.

Analyse past dividend payments

By analysing past dividend payments, you can get a sense of how the company prioritises them. Some companies may be so committed that they dip into cash reserves in order to keep investors satisfied, while others do the opposite and use dividend funds to pay for day-to-day activities.

If past dividend payments were very high and earnings were low, it could be a red flag. That’s because a company that spends too much on dividends maybe harming future growth. You can use ratios such as the dividend yield and relative dividend yield to determine the health of a company’s dividends.

Learn more about the company

Dividends are affected by several factors. Therefore, it’s important to learn as much about the company as possible. This includes share price activity, fundamentals and all corporate actions. These factors will help you establish a company’s overall health, as well as the prospects for dividend payments.

Read more about fundamental analysis

How to invest in the UK’s best dividend stocks

You can invest in the UK’s best dividend stocks with IG, from as little as £5. To get started, you need to open a share dealing account. This enables you to buy shares directly and own them – with the benefit of receiving dividends and possible share price growth. Alternatively, you can trade these shares using CFDs, which means you won’t own the shares, but you can speculate on upward or downward share price moves. Here’s how to get started:

- Do your research: IG Academy is a great resource for all things relating to trading and investing, including dividends and risk management

- Open an IG account: open a CFD trading account

- Place a trade: once you’ve chosen your shares, open your first position by placing a trade

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Explore the markets with our free course

Discover the range of markets you can spread bet on - and learn how they work - with IG Academy's online course.

Turn knowledge into success

Practice makes perfect. Take what you’ve learned in this shares strategy article, and try it out risk-free in your demo account.

Ready to trade shares?

Put the lessons in this article to use in a live account. Upgrading is quick and simple.

- Trade over 16,000 popular global stocks

- Protect your capital with risk management tools

- Deal on 70 key US stocks out-of-hours, so you can react to news

Inspired to trade?

Put the knowledge you’ve gained from this article into practice. Log in to your account now.