Seasonal trends in the forex market

Traders often use fundamental or technical analysis to assess the foreign exchange market. However, there is another method for predicting price trends and that is to use seasonality - the evolution of price itself.

Seasonality analysis is arguably a method more familiar to equity traders, with terms like ‘January effect’, ‘Santa Rally’, and ‘turn-of-the-month effect’ often cited in the explanation of the price movements within equity markets. But seasonality can also be found within the forex market, as with technical analysis, statistical significance rises when large numbers of traders are harbouring the same expectations.

Trends in the forex market

Examining seasonal trends in the forex market brings forth some of the most traded currency pairs and a variety of interesting phenomenons. Some of these seasonal trends are supported by fundamental reasons.

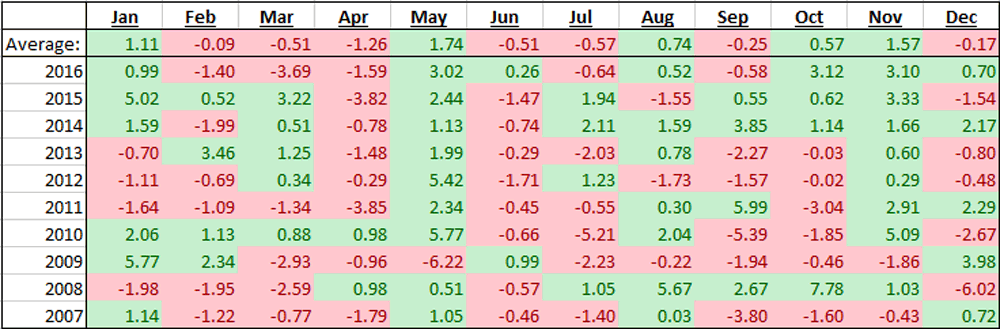

US dollar in May?

Historical data on the USD index shows that it has mostly gained in the month of May, rising nine times out of ten in the ten years to the end of 2016. Expanding the sample size to thirty years (between 1987 and 2016), a regression test would suggest that this remains the case with an almost 90% confidence level. One fundamental explanation for the trend is the seasonal improvement in economic momentum going into each second quarter in the US, supporting a strengthening of the US dollar against other major currencies.

USD index seasonality chart

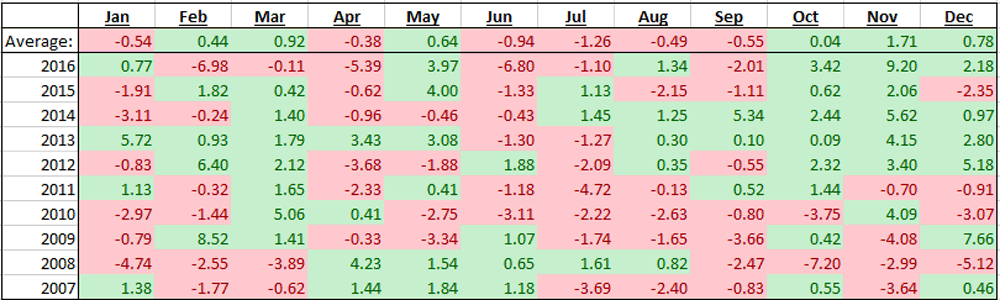

USD/JPY and the business cycle?

Looking at seasonality in USD/JPY (大口) often brings up March. Given the Japanese business cycle, you would expect a large repatriation of funds that month, which should boost the yen. However, Japanese yen has only risen against the US dollar in March 30% of the time over the last ten years, reminding us of the pitfalls in using seasonality assumptions alone.

A more prominent trend appears in October, where the Japanese yen weakness had been apparent 70% of the time in the last ten years. While it may be difficult to pin this to any single fundamental reason, an improvement in risk sentiment may in part be responsible for the flow. Seasonal uplifts for US equity markets through the third quarter earnings season, especially in the past couple of years, does make for soft demand for perceived safe havens like the yen. Once again, a regression test of the past 30-years data supports this to be true at close to 90% confidence.

USD/JPY seasonality chart

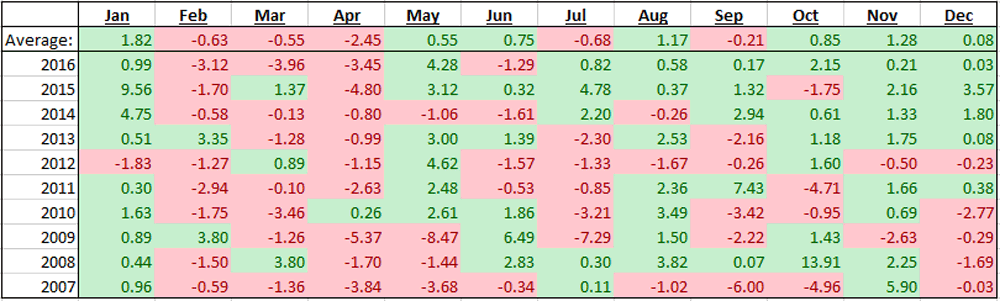

Commodity currencies

Commodity currencies are sensitive to the idiosyncrasies of commodity prices. Take the Canadian dollar (CAD) and US crude as an example. February through April has traditionally been strong months for WTI crude, with the prices rising in 90% on February for the past ten years. Whether it is anticipation of the summer driving season in the US or a switchover to summer-blend fuels, this trend appears to have a clear impact upon the oil exporting country’s currency against the US dollar. One thing to note, though, is that despite the strong correlation in the past ten years, a regression test finds little significance here.

USD/CAD seasonality chart

Application

Depending on the situation at hand, the application of one or a mixture of analyses could facilitate forex traders in forming a trading idea and there are certainly no 'best' methods of analysis.

There has been a vast amount of literature and analysis given over to dispelling the significance of seasonality in the foreign exchange market. Some have also suggested that seasonal components that were significant in the past have dissipated in recent times.1 Indeed, the maths of seasonality suggests that the finding is a reflection of the average and is certainly not the rule. However, should a trend be repeating itself a good 80% to 90% of the time, it may not be the wisest idea to go against it when you have the same investment horizon. Vice versa, a strong bias can also find support from seasonal trends.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Explore the markets with our free course

Discover the range of markets you can trade on - and learn how they work - with IG Academy's online course.

Turn knowledge into success

Practice makes perfect. Take what you’ve learned in this forex strategy article, and try it out risk-free in your demo account.

Ready to trade forex?

Put the lessons in this article to use in a live account. Upgrading is quick and simple.

- Trade over 80 major and niche currency pairs

- Protect your capital with risk management tools

- Analyse and deal seamlessly on smart, fast charts

Inspired to trade?

Put the knowledge you’ve gained from this article into practice. Log in to your account now.