FX forwards explained

An FX forward contract is an agreement between two parties to buy or sell currency at a specified price on a predefined expiry date. Learn more about forex forwards in this guide.

Start trading today. Call 0800 195 3100 or email newaccountenquiries.uk@ig.com. We’re available from 8am to 6pm (UK time), Monday to Friday.

Contact us: 0800 195 3100

Start trading today. Call 0800 195 3100 or email newaccountenquiries.uk@ig.com. We’re available from 8am to 6pm (UK time), Monday to Friday.

Contact us: 0800 195 3100

What are forex/currency forwards?

Forex/currency forwards are derivatives that give you the obligation to buy or sell FX at a specific price, on a specific date in the future. FX forwards are traded over the counter, and they are not standardised for everyone.

Remember, with forex trading, you’re speculating on currencies without taking ownership of the physical assets. You can choose between FX forwards, spot currency trading or FX options. Many individuals prefer trading forex forwards because it enables them to take positions over the longer term without paying overnight funding costs.

Forex/currency forwards essentials

Keep these four things in mind when thinking about trading currency forward contracts:

You’re always trading a currency pair with FX forwards

When you trade FX forwards, you are agreeing to trade a currency pair at a set price on a set date in the future. This means you intend to buy one currency (base currency) and sell another (quote currency)at a predetermined price because you believe one of the currencies will strengthen against the other by a specific date.

You can buy or sell FX forwards

Buying a forex forward

If you want to buy forex forwards, you would be betting that the base currency will rise against the quote over a certain period of time. Let’s say EUR/USD is trading at 1.1900, with a buy price of 1.1910 and a sell price of 1.1890. You believe EUR will rise against USD over the next six months, so you agree to buy EUR/USD at a price of 1.1910 at a specified date in the future.

After the six months have passed, EUR/USD is trading at 1.2210, with a buy price of 1.2220 and a sell price of 1.2200. You execute your contract at the agreed buy price of 1.1910, which is 0.0310 less than the current buy price.

Selling a forex forward

Similarly, you would sell an FX forward contract if you think the quote will rise against the base currency over a certain time period. For example, if EUR/USD is trading at 1.1900, with a buy price of 1.1910 and a sell price of 1.1890. You believe USD will rise against EUR over the next three months, so you agree to sell EUR/USD at a price of 1.1890 at a specified date in the future.

After the three months have passed, EUR/USD is trading at 1.2190, with a buy price of 1.2200 and a sell price of 1.2180. You execute your contract at the agreed sell price of 1.2180, which is 0.0290 more than the current sell price. You would still have to pay the agreed amount and would suffer a loss.

You can speculate on forex markets over a longer timeframe, with no overnight costs

Trading forex forwards means you can speculate over a longer timeframe, as when you buy or sell a forward contract, it only has to be honoured at a specified date in the future. You won’t have to pay any overnight funding costs to keep your positions open, but the spreads when opening positions will generally be wider than those offered on spot forex markets.

You can hedge other positions with currency forwards

Hedging with forwards involves opening a contract that will offset risk to an existing trade, such as an open spot forex position. For example, selling an FX forward contract is a popular method of protecting yourself against the depreciation of a currency.

How to trade forex/currency forwards

Make sure FX forwards is how you want to trade currency

Besides trading forex forwards, you can also trade spot forex or FX options. Plus, we’re one of the few UK providers to offer forex trading on Saturday and Sunday with our Weekend GBP/USD, Weekend EUR/USD and Weekend USD/JPY offerings.

| Forex forwards | Forex options | Spot forex | |

| How it's priced | Based on spot price | Based on spot price | ‘On the spot’, with continuous, real-time pricing |

| Weekday trading hours | 9pm Sunday to 10.15pm Friday (UK time) | 9pm Sunday to 10.15pm Friday (UK time) Break from 8-9pm for daily options |

9pm Sunday to 10.15pm Friday (UK time) |

| Weekend trading hours | Not available | Not available | 8am Saturday to 8.40pm Sunday (UK time) on GBP/USD, EUR/USD and USD/JPY |

| How many pairs can I trade? | 33 | 9 | 80+ |

| Costs and charges | Larger spread but no overnight funding charges | Higher premium but no overnight funding charges | Narrower spread but with overnight funding charges |

| Risk to capital | You could lose more than your deposit (margin) | Limited to premium if you buy put or call, could lose more than premium if you sell | You could lose more than your deposit (margin) |

| Expiry | Yes | Yes | No |

Learn more about forwards trading

Get more details on how forward contracts work and how they’re different from futures contracts.

Pick the currency pair you want to trade

You can choose from over 80 currency pairs, including:

- Major currency pairs, eg GBP/USD, EUR/USD, and USD/JPY

- Minor pairs, eg USD/ZAR, SGB/JPY, CAD/CHF

- Emerging currency pairs, eg USD/CNH, EUR/RUB and AUD/CNH

- Exotic pairs, eg EUR/CZK, TRY/JPY, USD/MXN

Open a trading account

You can trade FX forwards with a spread betting account. Spread betting is a derivative product, which means you only need a margin (deposit) to open your position.

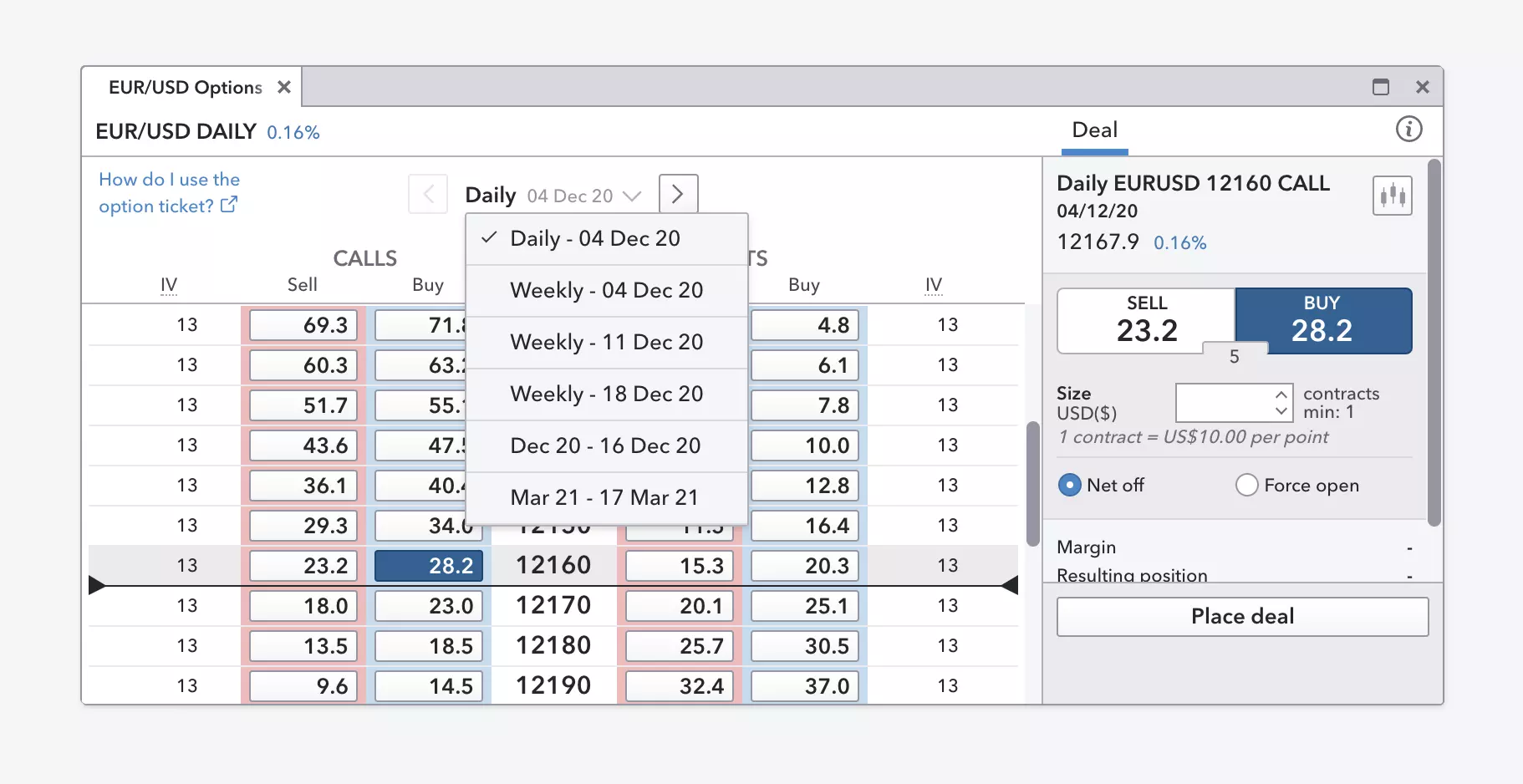

Choose your timeframe

Decide when you want to honour your forward contract – ie when you want the expiry date of the contract to be. You can close a forward contract trade before the expiry date of the contract arrives.

Choose whether to buy or sell

You can go long (buy) or short (sell) a forex forward contract. You’d go long if you believed that the underlying currency pair’s price will rise, and you’d go short if you believed it will fall.

Open and monitor your position

Once you’ve decided whether to buy or sell your chosen currency pair, you can monitor your position on our forex trading platform using the free tools and indicators available to you. Remember to stay abreast of any news and events that may affect the price of the FX pair you’re trading.

Develop your forex knowledge with IG

Find out more about forex trading and test yourself with IG Academy’s range of online courses.

Try these next

Explore spread betting and learn how you can use it to speculate on positive or negative market movements.

Learn about trading contracts for difference, and see how you can trade the markets using this derivative.

Discover everything you need to know about futures contracts, including how to trade them.

Try these next

Explore spread betting and learn how you can use it to speculate on positive or negative market movements.

Learn about trading contracts for difference, and see how you can trade the markets using this derivative.

Discover everything you need to know about futures contracts, including how to trade them.