Trading isn’t for everyone. Learn why the majority of traders lose, and how you can improve your chances of trading profitably.

The short-term goal of leveraged trading

CFDs are a type of leveraged trading, typically used to take short-term speculative views on market movements. In contrast to buying and holding assets as investments for months or years, there is no meaningful interest income or dividend yield from a CFD position.

In other words, short-term trading (using CFDs, or other leveraged products like futures, options or turbo warrants) is a zero sum game. In the absence of transaction fees, the net profit and loss (P&L) of all short-term speculative traders is zero – with the profits of successful traders balanced by the losses of unsuccessful traders.

What does this mean for trading profit?

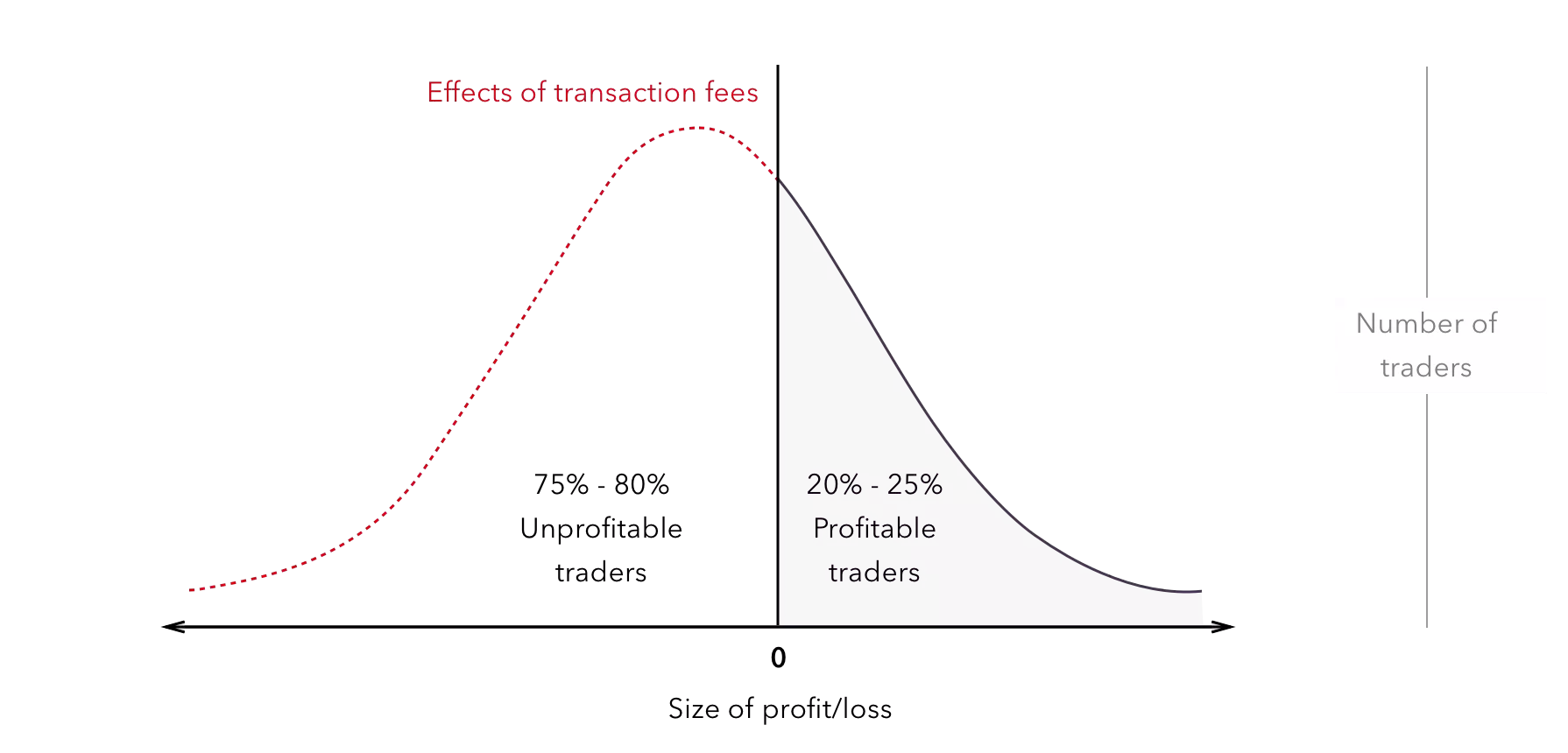

The distribution of trader outcomes, again in the absence of transaction fees, can be visualised as a bell curve centred on zero. Relatively large numbers of traders will register a small profit or loss, and relatively small numbers of traders will register a large profit or loss. Overall, in this hypothetical fee-free case, there would be equal numbers of profitable and unprofitable traders either side of the zero P&L axis:

What impact do transaction fees have?

Transaction fees form an inevitable part of trading for all market participants, from private individuals to the largest banks and hedge funds. The fact that trading is not free of costs shifts the bell curve to the left. This leads to the typical results seen for all short-term speculative products – including CFDs – where the average trader P&L is a loss equal to the sum of transaction fees paid, and where the majority of traders lose.

For CFD traders, results vary across firms and preferred underlying asset classes. But typically 75-80% of traders tend to lose, and 20-25% of traders tend to win over the course of a year:

Maximising your chances of trading profitably

Trading successfully requires considerable skill and shrewd market insight. However, there are certain steps that you can take to maximise your chances of trading profitably. These all centre on minimising your transaction fees:

Select a provider that charges low explicit transaction fees

You should consider overnight funding charges and commissions, as well as the spread, when selecting a provider. Some providers boast of very tight bid/ask spreads but charge large overnight fees. Some, particularly in the FX world, market ‘no dealing desk’ services with minimal bid-ask spreads – but charge significant commissions on transactions. IG Bank strives to offer some of the most competitive and transparent transaction fees in the market.

Select a provider that provides good-quality trade execution

From a trader’s point of view, poor execution is economically equivalent to additional hidden transaction fees. If your provider offers low transaction fees but is unable to reliably fill your order, you should consider choosing a provider with better liquidity and a more robust execution algorithm. At IG Bank we offer some of the deepest liquidity in our industry, with a policy of delivering price improvements to our clients whenever we are able.

Learn how our execution policy benefits our traders, and the price improvements you could receive

Adopt a trading style that minimises the fees you pay

It is rarely a good idea, for instance, to take small profits or losses only slightly larger than your transaction fees. Frequent trading in this manner, often called scalping, will tend to push your overall result toward a loss unless somehow justified by the underlying dynamics of a specific market.

At the other end of the spectrum, swing trading attempts to capture gains in a market between an overnight hold and several weeks, minimising the times you pay the spread.

Be disciplined

You should have a clear idea of the following ahead of placing a trade:

- Why you are entering a position

- When you will take profits if proven right

- When you will take a loss if proven wrong

You should have the discipline to stick to your plan as events unfold. Disciplined trading maximises your exposure to a chosen strategy and market while minimising the number of trades placed, and hence the sum total of transaction fees paid.

Fill in our simple online form

We’ll ask a few questions about your trading experience.

Identity verification

We can verify your identity in 6 different ways.

Fund your account and trade

Or practise on a risk-free demo if you’d prefer.

Start trading now

Log in to your account now to access today’s opportunity in a huge range of markets.

Differences in client profitability between providers of leveraged trading

Different providers have different proportions of profitable and unprofitable traders. These differences can give you valuable information about the average level of fees a provider charges, as well as the efficiency of their execution. You should use this metric with some caution, however, as other factors may drive inter-firm differences. For example:

Different product offerings

Firms specialising in CFDs on individual equities may show a different profitable/unprofitable client split to a firm specialising in CFDs on FX.

This may largely result from a difference in characteristic trade frequencies and fees per trade between these different asset classes, rather than from any particular competitive difference in transaction fees or trade execution efficiency.

Size of client sampling

Very small firms, with a limited number of clients, may generate a client profitability statistic that varies significantly from quarter to quarter.

This is much more likely to reflect statistical noise resulting from the firm’s small sample size, rather than any quarter-to-quarter alteration in the commercial terms or execution quality offered by the firm.

Greater number of trades

A firm offering a broad spectrum of products, used by many traders, may show an apparently worse ratio of profitable to unprofitable traders than a specialist firm used by a small pool of traders. The reason for this is that when trader results are split over a greater number of trades there is a sharper bell curve, resulting in a larger proportion of trader results falling to the left of the zero P&L axis.

What our clients say about our demo trading account

What is the number one mistake traders make?

- We reveal the top potential pitfall and how to avoid it

- Learn from data gleaned from over 100,000 IG accounts

- Discover how to stick to your plan and increase chances of success