EUR/GBP stable but GBP/USD and AUD/USD slip to multi-month lows on rising US yields and dollar

Outlook on EUR/GBP, GBP/USD and AUD/USD as ‘rates higher for longer’ is expected to last well into 2024.

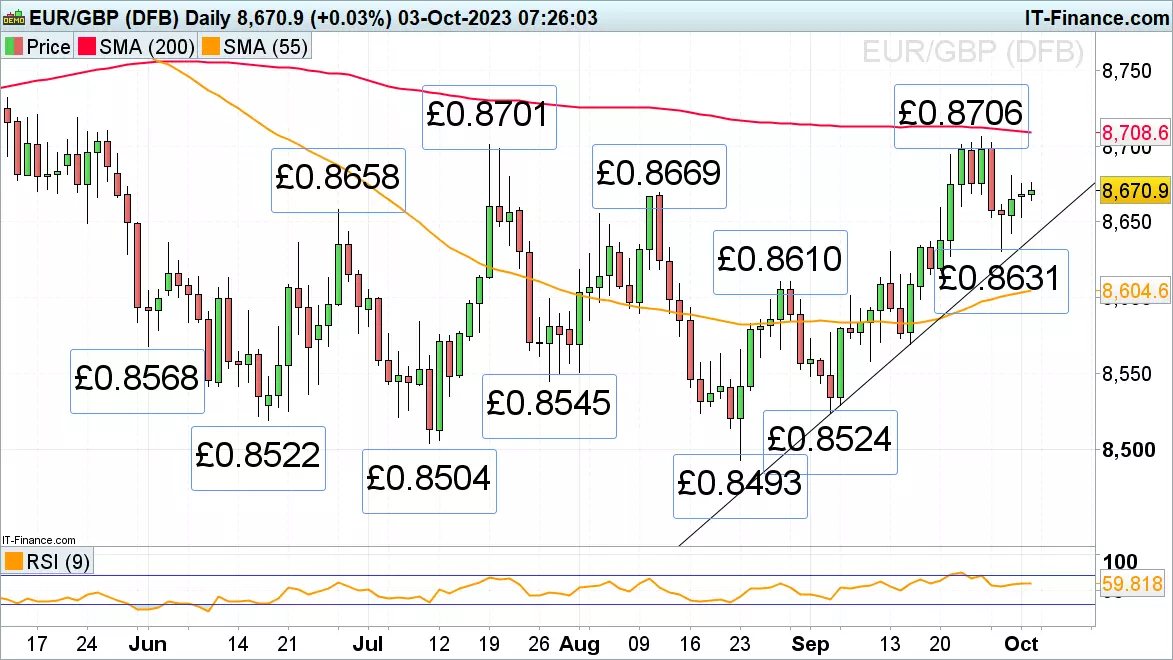

EUR/GBP remains bid while above £0.8631

EUR/GBP's fall from its £0.8706 September peak made last week took it to Thursday’s £0.8631 low from where it is recovering as Germany is shut for reunification day and the British pounds weakens during the UK Conservative party conference which is accompanied by rail and tube strikes.

A rise above Friday’s high at £0.868 could lead to the September peak and the 200-day simple moving average (SMA) at £0.8706 to £0.8719 being revisited.

Support below Monday’s low at £0.8654 is seen along the September-to-October uptrend line at £0.8638 and also at last week’s low at £0.8631.

GBP/USD drops to new six-month low

GBP/USD has resumed its descent and swiftly fell to a new six-month low at $1.2093 as the US dollar continues to appreciate amid rising US yields, solid manufacturing purchasing managers index (PMI) and as investors believe that the ‘rates higher for longer’ period will last well into 2024 following mixed hawkish and dovish Federal Reserve (Fed) committee member comments.

The mid-March low at $1.2011 and the minor psychological $1.20 mark are thus next in sight.

Minor resistance sits at last week’s low at $1.2111. The September downtrend channel resistance line at $1.224 together with Friday’s high at $1.2271 represent key resistance. While below it, the steep downtrend remains in place.

AUD/USD falls to eleven-month low

The appreciating US dollar and the fact that the new Reserve Bank of Australia (RBA) governor Michele Bullock during her first meeting kept the central bank’s cash rate unchanged at 4.1% led to AUD/USD dropping to an eleven-month low at $0.6306.

The next lower potential downside targets are the $0.6273 November 2022 low and the $0.6171 October 2022 trough.

Strong resistance above last week’s low at $0.6332 can be found between the mid-August low at $0.6365 and the 21 September low at $0.6385. While the cross remains below its $0.6511 to $0.6522 late-August and September highs, the medium-term downtrend will remain intact.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices