Why trade cryptocurrencies with IG?

Trade both rising and falling markets on leverage

Protect your capital and cap your losses with guaranteed stops1

Trade with a FTSE 250-listed provider with 47 years of trading experience2

Take advantage of low spreads and ultra-fast order execution on our award-winning platform3

Speculate on a selection of major cryptos, or get wider exposure with our Crypto 10 index CFDs

Trade directly from charts and perform in-depth analysis with powerful technical indicators

What cryptocurrencies can you trade with us?

With us, you can trade CFDs on 11 major cryptocurrencies, two crypto crosses and a crypto index - an index tracking the price of the top ten cryptocurrencies, weighted by market capitalisation.

Prices above are indicative only and subject to IG’s website terms and conditions.

How to trade cryptocurrencies with us

When trading cryptocurrencies with us, you’ll do so using CFDs.

| Main advantage | Trade rising and falling markets on margin |

| Main risk | CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Losses can exceed your margin deposit, so it’s important to manage your risk |

| Available to | All clients |

| Traded in | Over-the-counter contracts |

| Commission | There will be no commission charge for crypto CFDs, and we charge spread instead4 |

| Trading platforms | Web platform, mobile app, third-party crypto trading platforms like MT4 and ProRealTime |

What is cryptocurrency trading?

When you trade cryptocurrencies on CFDs, you’re speculating on whether the price will rise or fall and you don’t own any underlying coins.

What are the benefits of trading cryptocurrency CFDs with us?

Magnify your exposure with leverage and go long or short on the price. You can do this without the expense of an exchange account.

How do I start trading cryptocurrencies CFDs?

- Open a CFD trading account

- Find an opportunity

- Take a position

- Monitor your trade

Open a cryptocurrency trading account - apply today

Fill in our simple online form

We’ll ask a few questions about your trading experience.

Get swift verification

We aim to complete the verification process as quickly as possible so you can start trading on a huge range of markets.

Fund your account and trade

Or practice on a demo if you’d prefer.

How much does it cost to trade crypto CFDs?

Spreads and margin

We do not charge commission for Crypto CFDs. So, the most important fee to consider when trading cryptocurrencies is the spread – the difference between the buying and selling price.

The spread is our fee for executing your trade. We strive to keep our spreads among the lowest on the market. If you keep your short-trade open all through the night, you’ll be charged for overnight funding. Fees are also changed for forex trading.

When trading CFDs, you’ll open your position on margin – a deposit that’s only a fraction of your total exposure. Please remember, though, when trading on margin, your losses can significantly exceed your original deposit.

| Market | Dealing hours5 | One point means | Minimum Spread6 | Limited Risk Premium7 | Retail margin required8 |

| Bitcoin | 24 hours | $1 | 36 | 50 | 10% |

| Bitcoin Cash | 24 hours | $1 | 2 | 1.5 | 10% |

| Bitcoin Cash/Bitcoin | 24 hours | 0.0001 BTC | 6 | 10 | 10% |

| Ether | 24 hours | $1 | 5.4 | 3 | 10% |

| Ether/bitcoin | 24 hours | 0.0001 BTC | 3 | 2.7 | 10% |

| Litecoin | 24 hours | $1 | 7 | 0.9 | 10% |

| EOS | 24 hours | $0.01 | 1.3 | 7.2 | 10% |

| Stellar | 24 hours | $0.01 | 0.2 | 0.2 | 10% |

| Cardano | 24 hours | $0.01 | 1.4 | 0.7 | 10% |

| Polkadot | 24 hours | $0.01 | 9.1 | 18 | 10% |

| Dogecoin | 24 hours | $0.01 | 0.1 | 0.1 | 10% |

| Chainlink | 24 hours | $0.01 | 7.8 | 12 | 10% |

| Uniswap | 24 hours | $0.01 | 5.2 | 10 | 10% |

| Crypto 10 index | 24 hours | $1 | 120 | 27 | 10% |

Trade on crypto markets with the world’s No.1 choice for CFD trading9

Trade anything, anywhere, anytime on our award-winning platform3

- Web-based platform

- Mobile trading app

- Third-party crypto trading platforms

Our web-based platform

Take full control of your bitcoin trading with our online platform. We offer unique price alerts, interactive charts, and a suite of risk management and research tools.

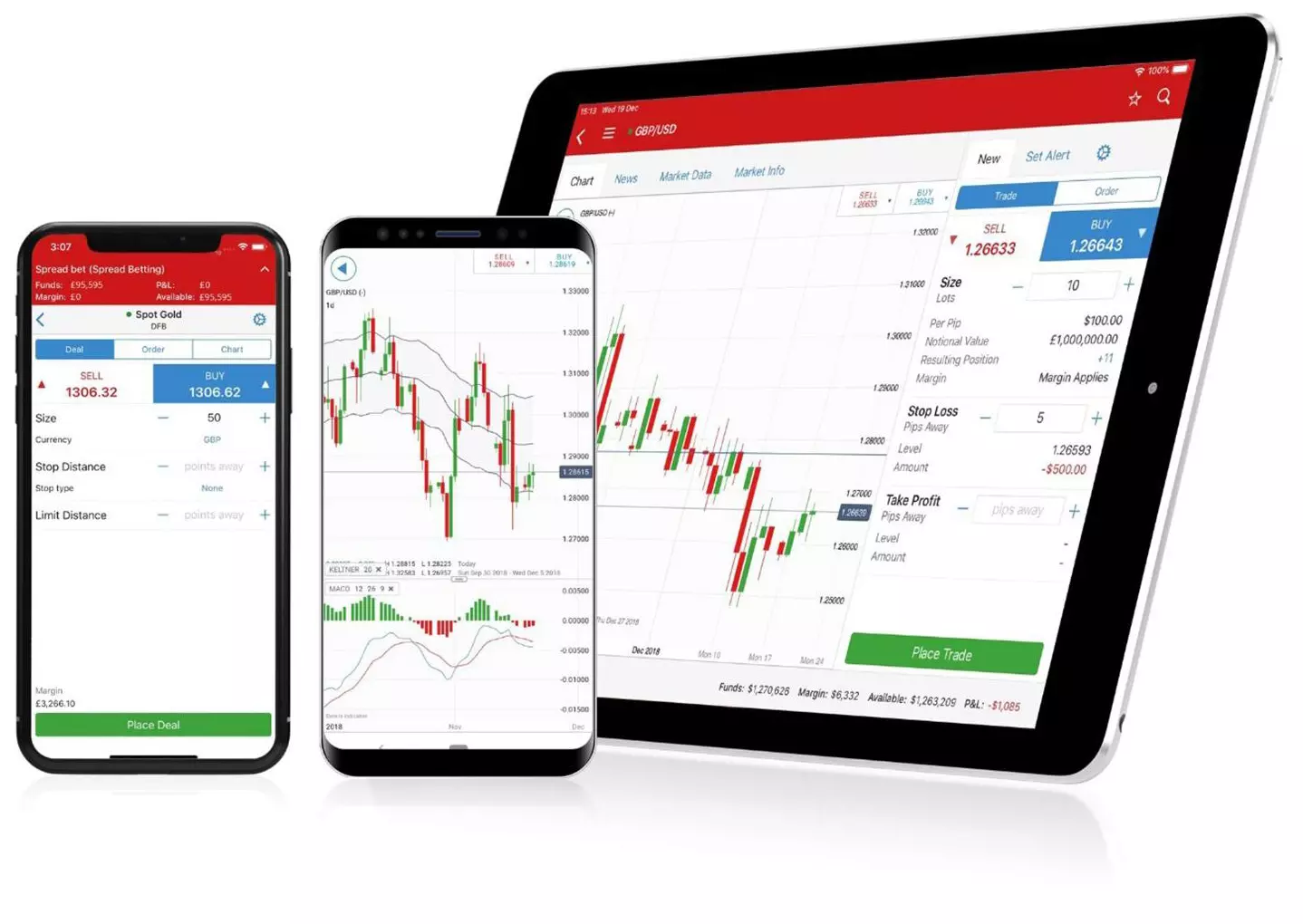

Mobile trading apps

Trade on bitcoin on the go, wherever and whenever. Our tablet and mobile trading platform has been optimised for iPhone and Android.

Third-party trading platforms

Automate your bitcoin trading with our built-in access to a range of advanced third-party platforms, like MT4, ProRealTime and APIs.

You can choose the platform that suits your preferences and strategy – with unique price alerts, interactive charts and a suite of risk management tools available on each.

Latest news on cryptos

FAQ

Which cryptocurrencies are included in the Crypto 10 index?

Our Crypto 10 index tracks the prices of the ten biggest cryptocurrencies, weighted by market capitalisation. While this is adjusted every quarter, typical examples include:

- Bitcoin

- Ether

- Ripple

- Litecoin

- Bitcoin Cash

- EOS

- Stellar

You might be interested in…

No switch account? No problem. Position yourself long or short with Bitcoin CFDs

Take advantage of ethereum (ether) CFD price movements

Find out everything you should know about the next Bitcoin halving

1 Stop-loss orders close your position automatically if the market moves against you. Normal stop-loss orders are free, but there’s no guarantee of protection against slippage. Guaranteed stops will close your position exactly the price you specified, but incur a premium if triggered.

2 IG is part of IG Group Holdings Plc, a member of the FTSE 250.

3 Best Finance App, Best Multi-Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024.

4 Other fees and charges may apply

5 Cryptocurrencies markets close at 6am on Saturday morning (UTC+8), then reopen on Saturday at 4pm (UTC+8). Please note that your account can go on margin call during the weekends as the cryptocurrencies market is open.

6 Please note that in times of high volatility, our minimum spreads can increase significantly.

7 A guaranteed stop premium is charged if your guaranteed stop is triggered. The potential premium is displayed on the deal ticket, and can form part of your margin when you attach the stop. Please note that premiums are subject to change, especially going into weekends and during volatile market conditions.

8 Please note that tiered margins apply; this means that more margin may be required for larger positions. See our margins page for further details. You can find the tiered margins for each market from the Get Info section in our dealing platform.

9 Based on revenue (published financial statements, August 2024)