Fast-moving markets can mean exciting opportunities for traders. Discover how to take advantage of volatility in a variety of ways – and trade over 17,000 markets with tight spreads – at IG. Plus explore the range of tools we offer to help you find the right trade quickly in turbulent markets.

The benefits of trading volatility with IG

Trade over 17,000 markets, including the VIX and the EU Volatility Index, plus volatility ETFs including the VIX ETF.

Keep cost down with our competitive spreads

Minimise your risk, even in volatile market conditions, with our range of effective risk management tools.

Trade 24/71, with the largest range of weekend markets and out-of-hours stocks offered by any provider.

Get expert support whenever you need it – our friendly team is on hand around the clock to help with any queries.

Stay on top of market movements and key events with custom alerts by text, email or push notification.

What is volatility trading?

When you trade volatility, you take a view on the future stability of a financial asset’s value. Instead of trading on the price either rising or falling, you’re predicting whether or not it will see movement – in any direction.

Volatility trading is particularly valuable when world events are driving markets to spike or move erratically. If you’re expecting a significant market reaction, but you’re unsure which way it will go, volatility trading enables you to take a position – and to profit if your forecast is correct.

Volatility traders frequently take positions on markets that are derivatives of other underlying markets. For example, the popular Volatility Index (VIX) is based on movements in the US S&P 500 index.

Ways to trade volatility

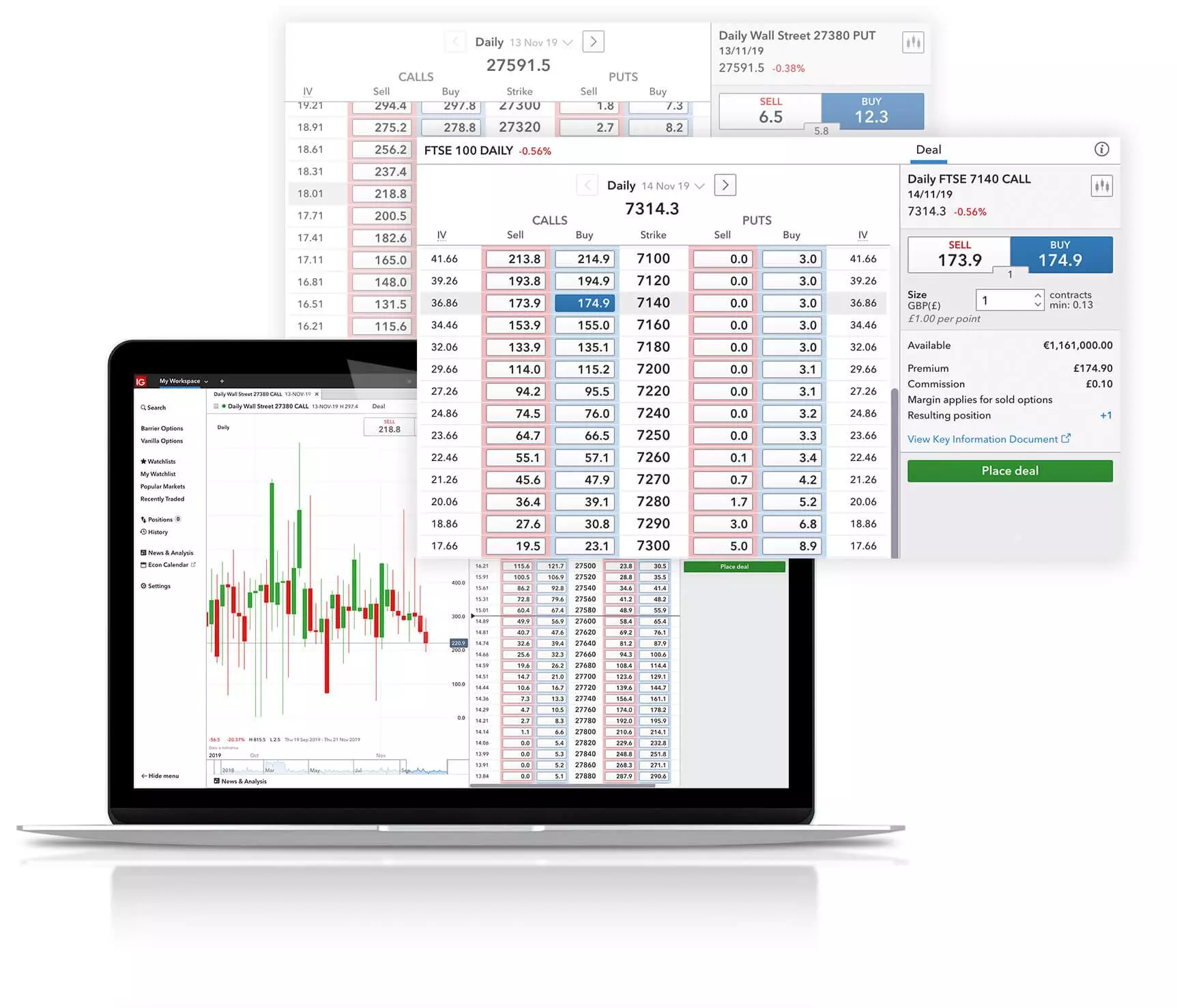

Choose from three different strategies that enable you to take a position on volatility. You can: seek out volatility in traditional markets; trade a volatility product such as the VIX; or use our flexible options contracts.

- Volatile markets

- VIX

- Options

Seeking volatility in traditional markets

Volatility can hit almost any market, driven by macroeconomic and geopolitical events or factors that uniquely affect a particular sector or asset.

Which markets are most volatile?

While periods of volatility across global markets can be triggered by geopolitical and other events, certain financial assets are inherently volatile – typically moving by large numbers of points in a normal day. Take a look at some examples below.

- Indices

- Commodities

- Forex

Dow Jones

Compare the Dow (Wall Street), currently trading at around 23,000, with the S&P 500 (US 500) at around 2500. Given the difference in the relative value of these indices, it’s easy to see why the Dow typically exhibits much larger intraday movements than the S&P 500.

The DAX

For similar reasons, even in the UK the DAX (Germany 40) is often more popular with traders than the FTSE 100, which Is around 55% smaller and tends to be considerably less volatile.

Oil

Oil has a long-standing reputation for volatility, as its price is readily destabilised by political unrest and economic developments. The 2020 oil price war is a case in point, with record increases in supply alongside waning demand causing the Brent Crude price to plummet.

Gold

Traditionally seen as a safe haven for investors in uncertain markets, gold has found a new role more recently. With the onset of the coronavirus pandemic, the metal appeared to lose its lustre and its price grew surprisingly unpredictable and volatile.

GBP/USD

The value of the pound against the dollar typically reacts strongly to any political upheaval or uncertainty in the UK. Recent examples have included Brexit and its fallout, as well as the spread of the Covid-19 virus. This caused a flight to the dollar – considered a safe haven – driving down GBP/USD.

EUR/USD

These two behemoth currencies might be expected to show more stability than most, yet the pair has also proved susceptible to the tumult of the market recently. As the coronavirus multiplied throughout Europe, EUR/USD responded with a period of unusual volatility.

Trading the volatility index (VIX)

When you trade the VIX, you’re taking a view on the emerging political and economic landscape. The VIX typically rises when global instability is increasing and falls when the prospects become clearer and more settled.

You can get an idea of the probable direction of the VIX from movements in the price of safe-haven assets such as gold and the dollar, which tend to be pushed up by increased demand during periods of uncertainty.

Another particularly valuable indicator is the yield curve: a fall in long-term yields combined with a rise in short-term yields is generally associated with growing fear in the markets. This happens when investors turn to the bond market rather than riskier assets such as stocks. Since market sell-offs tend to be volatile in nature, an inverted yield curve implies that the VIX is likely to rise and stocks to fall.

You can also trade the EU Volatility Index (VSTOXX), which tracks the volatility of Euro Stoxx 50 options.

Taking advantage of volatility with options

Options are contracts that give you the right – but not the obligation – to buy or sell an underlying asset before a certain expiry date.

They’re ideal for trading volatility, as you can use them to take a position on a wide range of financial assets in rising, falling or even flat market conditions. This means you can use them to trade low as well as high volatility.

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a market-leading service

Find opportunities to trade volatility

Stay informed about potential volatility with our free alerts service that monitors the markets on your behalf – saving you time.

You can set up automated messages by email or push notification to let you know whenever conditions or events that you specify occur. We can alert you to:

Price changes

You’ll be notified whenever a market moves by the percentage or number of points you specify.

Price levels

Find out whenever a market hits a price of your choice.

Technical conditions

Our technical indicator alerts tell you when your chosen technical conditions have been met by a market. Create alerts using a wide range of popular indicators such as Moving Average, MACD and Bollinger Bands.

Economic events

Setting up economic calendar alerts will ensure you find out in advance about upcoming events, like central bank announcements, and receive macroeconomic figures as soon as they’re released.

Risk protection in volatile markets

Minimise your risk, even in volatile market conditions, with our range of risk management tools.

Attaching a guaranteed stop to your position will put a cap on your downside risk, ensuring your position is closed at the price you select. They’re free to attach but will incur a fee if triggered.

Keep an eye on your running balance – always visible in our platform or app – so you can quickly add funds if needed.

Volatility trading strategies

A fundamental understanding of the forces driving each market can help you forecast volatility in a specific asset or sector. However, there are also technical tools that can identify potential upcoming volatility in almost any market.

For example, tightening price action with a shrinking Bollinger Band indicates that volatility is decreasing – but often precedes a sharp rise in volatility. In this situation, traders look for a significant breakout from the Bollinger Band to signal that a surge in directional movement may be under way.

Meanwhile, Average True Range (ATR) is a technical indicator which averages out a market’s price range over time. You can add the indicator to any market, over any timeframe, to help identify the historical price volatility / range over a period.

For example, the ATR added to a daily timeframe of an index would identify how many points the index is seen moving (on average) over the course of a day. The ATR indicator added to an forex pair on an hourly timeframe would identify how many points/pips (on average) the forex pair is moving in an hour.

FAQs

What does volatility mean in trading?

Volatility is the likelihood of a market making major short-term price movements at any given time. Highly volatile markets are generally unstable, and prone to making sharp upward and downward moves. Most highly volatile assets typically come with greater risk, but also greater chance of profit. This is why most traders try to match the volatility of an asset to their own risk profile before opening a position.

What causes volatility?

Major driving forces of volatility can include market sentiment and imbalances in supply and demand – both of which can be influenced by economic crises, political developments, company announcements, macroeconomic indicators and so on.

What indicators can be used to identify volatility?

The two most popular indicators used in technical analysis to identify market volatility are Bollinger bands and Average True Range (ATR). These take different approaches to looking at volatility and are often used together when examining the markets.

You might be interested in…

Get daily ideas for trades straight to your inbox.

Follow the impact of the virus, and how we can help you navigate the volatility.

Find out more about our transparent fee structure.

Open an account now

1 24/7 means all week apart from ten hours from 6am to 4pm Saturday (UTC+8), and 20 minutes just before the market opens on Monday morning. Our trading hours are based on UK GMT hours, and are converted to UTC+8 hours. This means that the times listed are affected by UK clock changes in the year, and will be adjusted by +/- 1 hour accordingly.