Why trade on Ether with us?

Trade both rising and falling Ether markets on leverage

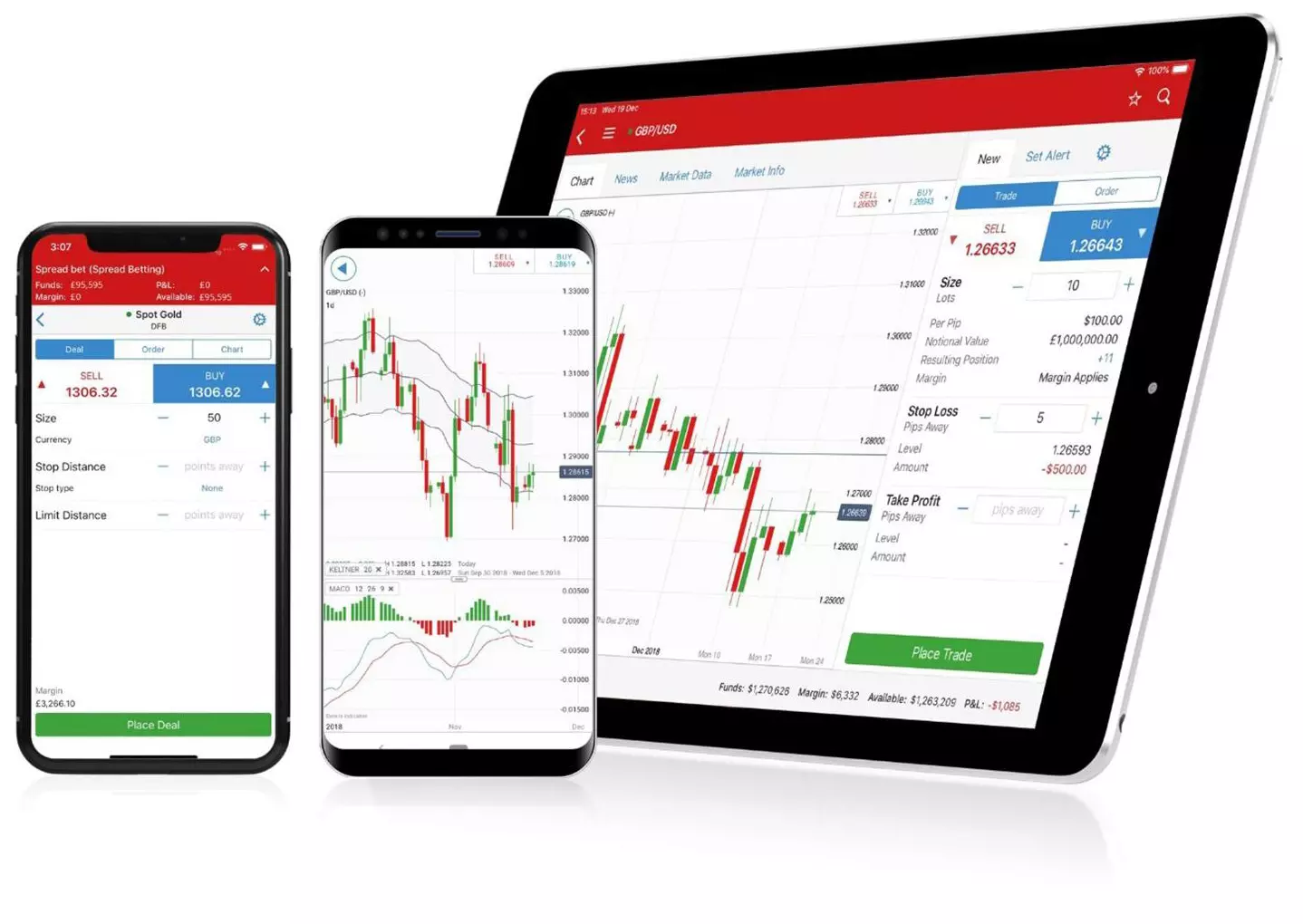

Deal on an award-winning trading platform and mobile app1

Get expert support from our customer service team 24 hours a day, except on Saturdays from 8am to 4pm (UTC+8).

Protect your capital and cap your losses with guaranteed stops2

We are a regulated provider with over 50 years of experience in financial markets

Ether spreads and margin

| Market | Dealing hours3 | One point means | Minimum spread4 | Limited risk premium5 | Retail margin required6 |

| Ether | 24 hours | $1 | 5.4 | 3 | 50.00% |

| Ether/Bitcoin | 24 hours | 0.0001 BTC | 3 | 2.7 | 50.00% |

How to trade on Ether with us

Ether works as a digital platform that adopts the blockchain technology established by Bitcoin, and expands its use to accommodate a wide variety of other applications. The cryptocurrency underpinning the Ethereum network is called ‘Ether’. When you trade on Ether with us, you’ll use CFDs to speculate on price movements. Although you can do this on our award-winning, web-based platform and mobile trading app,1 you can also choose to trade CFDs on Ether via MetaTrader 4 (MT4) or ProRealTime.

| Main advantages | Trade rising and falling markets on margin without owning Ether Set stop-loss orders to cap your risk |

| Main risk | The market for Ether can be volatile, which amplifies the inherent risks of trading on leverage |

| Available to | All clients |

| Traded in | Over-the-counter contracts |

| Commission | There will be no commission charge for Ether CFDs, and we charge spread instead* |

| Trading platforms | Web platform, mobile app, third-party crypto trading platforms like MT4 |

*Other fees and charges may apply.

What’s Ether trading?

With us, you’ll trade on Ether price movements using CFDs – a type of leveraged derivative.

Because you’re not taking direct ownership of Ether tokens, you won’t have to open an account with an exchange or create a virtual wallet.

How can I start trading on Ether?

- Create a CFD trading account

- Search for ‘Ether’ on our platform

- Take steps to manage your risk

- Open your position

- Monitor your trade

What are the benefits of trading on Ether?

- Get the best prices – which we source from multiple exchanges

- Speculate on Ether markets rising or falling

- Trade on Ether tokens without opening an exchange account or creating a cryptocurrency wallet

What are the risks of trading on Ether?

- CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage

- Because CFDs are opened on margin, your losses could substantially outweigh your initial deposit

- Ether is very volatile. Prices can move suddenly and by large increments, exposing you to the risk of high potential losses

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a market-leading service

Open an account now

Open an account now

Fast execution on a huge range of markets

Enjoy flexible access to more than 17,000 global markets, with reliable execution

Deal seamlessly, wherever you are

Trade on the move with our natively designed, award-winning trading app*

Feel secure with a trusted provider

With 50 years of experience, we’re proud to offer a market-leading service

Ether prices

Prices above are subject to our website terms and conditions. Prices are indicative only.

Trade on Ether with the No.1 CFD provider7

Enjoy a seamless trading experience with our award-winning technology1

- Web-based platform

- Mobile trading app

- Third-party trading platforms

Take full control of your cryptocurrency trading with our online platform. We offer unique price alerts, interactive charts, and a suite of risk management and research tools.

Trade cryptos on the go, wherever and whenever. Our tablet and mobile trading platform has been optimized for iPhone and Android.

Automate your Ether trading with our built-in access to a range of advanced third-party platforms, like MT4, ProRealTime and APIs.

Start trading today

Open an account in minutes and trade

Choose the world's No.1 CFD provider1

Find opportunity in over 17,000 markets.

Start trading today

Simple account opening. Easy-to-use platform. First-class customer service. Choose an established world leader in online trading.

Start trading today

Simple account opening. Easy-to-use platform. First-class customer service. Choose an established world leader in online trading.

Get the latest cryptocurrency news

How leveraged bitcoin trading works

Bitcoin contracts for difference (CFDs) give you exposure to the bitcoin price without having to actually purchase the underlying asset. This gives you additional confidence because you don’t hold any actual bitcoins, meaning you don’t need to use a wallet to store them.

It is important to remember that when trading CFDs, you are trading on leverage. While this allows you to gain exposure to a large position without having to commit the full cost at the outset, it is important to remember that both your profits and losses are greatly magnified, and your losses could exceed your deposits.

Bitcoin is usually quoted against the US dollar — so when you buy bitcoin on an exchange, you are selling USD and buying bitcoin. If bitcoin’s price rises, then you can sell it for a profit, because bitcoin is worth more USD than when you bought it. If bitcoin’s price falls, then you make a loss.

When you trade bitcoin CFDs with IG, you’re speculating on the same price movements. But instead of taking ownership of bitcoin, you’re can take a long position if you believe that the price will increase in value. As bitcoin’s price increases against the dollar, you will gain a profit. If bitcoin’s price falls, then your position will make a loss.

You can also use CFDs to take a short positions as well. So if bitcoin's price drops, you will make a profit on your short position. Conversely, if bitcoin’s price rises, you will make a loss. Our spreads start at just 40 points. Bitcoin can be traded on all our CFD trading platforms, including on MT4.

Bitcoin CFD example

You're interested in trading our Bitcoin ($) CFD. Our price is currently 12450 to sell Bitcoin, or 12500 to buy it. This price represents the value of Bitcoin against the USD, and each dollar movement in the price of Bitcoin represents a potential profit of US $1.

You believe the price of Bitcoin will rise from its current valuation, so you buy 25 contracts at 12500 (equivalent to buying 25 bitcoins at $12500 each).

The Bitcoin price rises and our new price is 12550/12600. You decide to take your profit by selling at 12550.

$12550 - $12500 = $50 move or 50 points.

Your gross profit is therefore 25 contracts x $50 = $1250

If the market had dropped to 12400/12450 instead, your gross loss would be $2500.

FAQs

Yes, you can trade Ether CFDs via MetaTrader 4. If you already have an MT4 account but want to use our services, you’ll need to create a live account before you can trade with us.

After you’ve set up a live IG account, you’ll then need to set up and fund a live IG MT4 account before you can access our MT4 CFD offering. You can then log into your pre-existing MT4 platform with your IG credentials, which will preserve all of your chart data and analysis.

If you don’t have MT4, you can download it through us and add it to your account with us. Now, you can also download MT4 for macOS.

Do I need a virtual wallet when trading on Ether with CFDs?

No, you won’t need a virtual wallet when trading with us. You also don’t have to open an account with an exchange.

When you trade on Ether via CFDs, you’re using derivatives to speculate on Ether’s price movements, and you never take ownership of actual cryptocurrency. This means you can go long or short, and the accuracy of your prediction and the size of the market movement will determine your profit or loss.

However, please remember that CFDs are complex financial instruments that can accrue losses rapidly. Always make sure you understand how they work before trading, and consider whether you can afford the risk of potential monetary loss.

Can I short Ether with IG?

Yes, you can short-sell the Ether market with us. When trading with CFDs, you’ll select ‘sell’ in the deal ticket.

But, note that when going short, your risk is unlimited because instead of falling, the market can keep rising – theoretically without limit. So, it’s important to consider setting stop-losses and correctly manage your risk.

Can I trade on Ether via mobile?

Yes. Our award-winning mobile app1 can be downloaded and used to trade CFDs on Ether. If you have an MT4 account, you can also use the MetaTrader 4 mobile app.

You can set trading alerts and trading signals for Ether in our platform. When the necessary conditions are met, you’ll receive your notifications by email or push – depending on which you prefer.

As Ethereum is a decentralised network, Ether is traded 24 hours a day, seven days a week on exchanges around the world. Our Ether CFDs are quoted from 4pm Saturday to 6am Saturday (UTC+8).

With us, you can trade on 11 major cryptocurrencies, two crypto crosses, and a crypto index – an index tracking the price of the top ten cryptocurrencies, weighted by market capitalisation.

- Bitcoin

- Ether

- Bitcoin Cash

- Litecoin

- EOS

- Stellar

- Cardano

- Bitcoin Cash/Bitcoin

- Ether/Bitcoin

- Crypto 10 index

- Cardano

- Chainlink

- Polkadot

- Dogecoin

- Uniswap

Try these next

1 Best Finance App, Best Multi-Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024.

2 Stop-loss orders close your position automatically if the market moves against you. Normal stop-loss orders are free, but there’s no guarantee of protection against slippage. Guaranteed stops will close your position exactly the price you specified, but incur a premium if triggered.

3 Cryptocurrencies markets close at 8am on Saturday morning (UTC+8), then reopen on Saturday at 4pm (UTC+8). Please note that your account can go on margin call during the weekends as the cryptocurrencies market is open.

4 Please note that in times of high volatility, our minimum spreads can increase significantly.

5 A guaranteed stop premium is charged if your guaranteed stop is triggered. The potential premium is displayed on the deal ticket, and can form part of your margin when you attach the stop. Please note that premiums are subject to change, especially going into weekends and during volatile market conditions.

6 Please note that tiered margins apply; this means that more margin may be required for larger positions. See our margins page for further details. You can find the tiered margins for each market from the Get Info section in our dealing platform.

7Based on revenue (published financial statements, August 2024)