Investors watch for further progress at Ocado

Recent full-year results from Ocado showed promise, but can the upcoming trading statement deliver?

Investors watch for further progress at Ocado

Recent full-year results from Ocado showed promise, but can the upcoming trading statement deliver?

Ocado’s full-year figures unveiled a return to profitability for the full-year, though the news was overshadowed by the falling out with Marks & Spencer.

As is usually the case for Ocado, it will be about more than just what UK consumers put into their baskets each week. The main focus is on the ongoing rollout of its technology to other supermarkets around the globe, and the licensing income this provides. On this point there appears to be some cause for concern, with only three new warehouses expected this year.

Investors will also watch for any update on the group’s battle with M&S over its joint venture, something that hangs over the company like a dark cloud.

Technical analysis on the Ocado share price

Ocado’s share price, down around 38% year-to-date, continues to trade around its October 2023 low at 446.0 pence ahead of Tuesday’s first quarter (Q1) trading statement. It dropped to 430.8p in early-March and has been trying to stay above this low since then.

Ocado Weekly Chart

Were the Ocado share price to slip through its 430.8p early-March trough, the October 2022, March and June 2023 lows at 403.0p to 342.0p would be in sight.

Ocado Daily Chart

While the mid- to late-February highs at 541.4p to 552.6p aren’t overcome, the medium-term downtrend will remain intact.

Immediate downside pressure will remain in play while last week’s high at 496.3p isn’t overcome with the early-March low at 430.8p likely to be revisited.

A rise above 496.3p could put the 55-day simple moving average (SMA) at 525.7p back on the cards but the next higher 541.4p to 552.6p resistance zone should prove more difficult to overcome. If so, the long-term downtrend line and 200-day SMA at 598.8p to 620.8 would be in focus.

Analysts recommendations and IG sentiment

Fundamental analysts are rating Ocado as a ‘hold’ with Refinitiv data showing 6 strong buy, 5 hold and 5 sell - with the mean of estimates suggesting a long-term price target of 806.85p pence for the share, roughly 75% above the share’s current price (as of 25 March 2024).

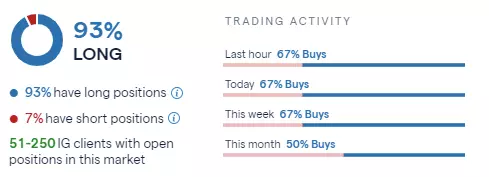

IG sentiment data shows that 93% of clients with open positions on the share (as of 25 March 2024) expect the price to rise over the near term, while 7% of clients expect the price to fall. Trading activity this month shows 50% of buys.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices