Alphabet earnings preview: advertising, cloud and AI

Alphabet Inc. is set to announce its third-quarter earnings on October 24th after US markets close. What can we expect from the three pillars of the search engine king? Will the tech giant continue its rally until the year-end?

Alphabet Inc. is set to announce its third-quarter earnings on October 24th after US markets close. What can we expect from the three pillars of the search engine king? Will the tech giant continue its rally until the year-end?

Alphabet earnings date

Alphabet Inc. is scheduled to reveal its third quarter 2023 financial results on Tuesday, October 24, US Eastern Time after market closes.

Alphabet earnings expectation

| Q3 Estimate | Q2 | YOY | |

| Revenue | $75.77 billion | $74.6 billion | 10.2% |

| EPS | $1.45 per share | $1.44 per share | 36.8% |

Alphabet earnings key watch

Advertising revenue

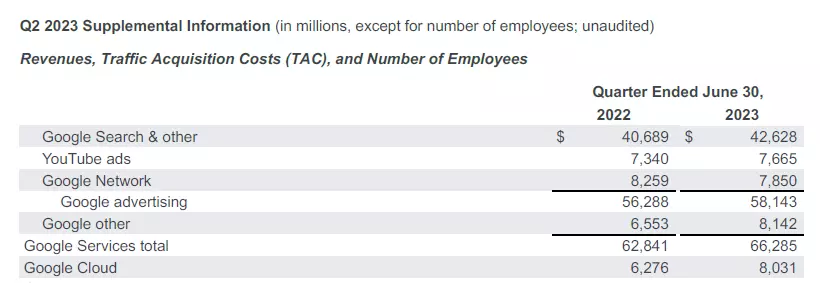

In the previous quarter, Google's advertising revenue increased by 3% from the same period last year, making up 77% of its total revenue.

Despite a prevailing slowdown in ads spending, Google advertising is expected to enjoy modest growth during the third quarter. It is estimated that advertising income will grow by 8.2% year-over-year, generating approximately $58.94 billion in the September quarter.

Cloud

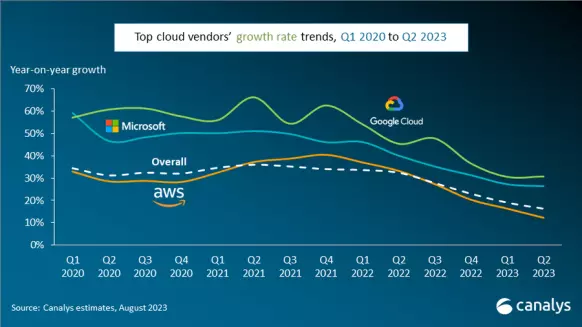

Following a remarkable 31% year-on-year growth in Q2 2023, Google Cloud continues to build up its robust momentum in the fiercely competitive cloud market. This momentum is primarily driven by its expanding range of cloud services and the growing number of data centers in its network. According to Zacks' estimates, Google Cloud's revenue is projected to grow by 24.3% from the prior-year quarter, reaching $8.54 billion in Q3.

AI

Alphabet's strong commitment to integrating AI techniques into its search business is expected to boost its revenues in the search sector. Furthermore, with claims of collaborating with 70% of generative AI startups, Google Cloud's strategy of harnessing its partner ecosystem in the AI gold rush not only promises to enhance Google Cloud's profitability but also positions the search engine giant advantageously to capitalize on the opportunities emerging from the impending AI boom.

Nevertheless, a significant question remains: can Google's integration of chatbot AI technology compete with the thriving specialized AI tools and platforms, and what will be the impact of this integrated search engine on its other revenue streams?

Alphabet techinical analysis

In the face of fierece competition in the realms of artificial intelligence and rising interest rates, Alphabet's stock price has surged by nearly 60% this year, outperforming the Nasdaq composite, which has recorded a 29% increase year-to-date.

Based on the weekly chart, the price has steadily moved along an ascending trajectory since early this year. The peak from April 2022 at $142 appears to be a significant resistance level for now. A decisive break above this level would clear the path for the price to challenge its all-time high abvove $149. On the flip side, according to the daily chart, the price might seek immediate support from the 20-day MA, which is situated near $135 in case of a retreat.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices