AUD/USD: key inflation data looms amid hawkish RBA signals and geopolitical tensions

As the AUD/USD steadies after breaking a losing streak, all eyes are on upcoming Q3 inflation data.

Hawkish RBA minutes and employment data fuel AUD/USD

Last week saw the AUD/USD snap a three-week losing streak, buoyed by surprisingly hawkish Reserve Bank of Australia (RBA) minutes and robust Australian employment data, offsetting risk aversion and higher US yields.

RBA vs Federal Reserve: divergent monetary policies

The hawkish tone of the RBA minutes was further emphasised by new RBA Governor Michele Bullock's speech on Wednesday, along with a robust labour force report on Thursday. This has led to an increase in the odds of an RBA rate hike in November to approximately 20%.

This more hawkish shift from the RBA stands in contrast to recent comments from Federal Reserve speakers, who have pointed to tightening financial conditions driven by rising yields, thereby offsetting the need for future rate hikes.

Diplomatic relations with China and AUD/USD

In theory, the divergent outlooks from the central banks should support the AUD/USD, as should the recent improvement in Australia's strained diplomatic relations with China. This improvement is set to be highlighted by a visit to China next month by Australian Prime Minister Albanese.

While geopolitical tensions in the Middle East may limit the upside for the AUD/USD, there still appears to be potential for a rally, especially if tomorrow's inflation data is stronger than expected.

Q3 inflation

Date: Wednesday, 25 October at 11.30 am AEDT

The market anticipates Q3 headline inflation to increase by 1.1%, up from 0.8% in Q2, fuelled by escalating fuel and electricity costs. Nonetheless, annual headline inflation is projected to moderate to 5.3% year-on-year (YoY) in Q3, down from 6% in Q2.

The RBA preferred metric for core inflation, the trimmed mean, is anticipated to rise by 1.0% in Q3, an uptick from 0.9% in Q2. However, the annual core inflation rate is expected to decline to 5% from 5.9% in the previous quarter.

Should the inflation figures significantly exceed the above estimates, the AUD/USD currency pair is likely to find support, owing to heightened market expectations of a 25-basis point RBA rate hike in November.

This would elevate the cash rate to 4.35%.

AU headline inflation chart

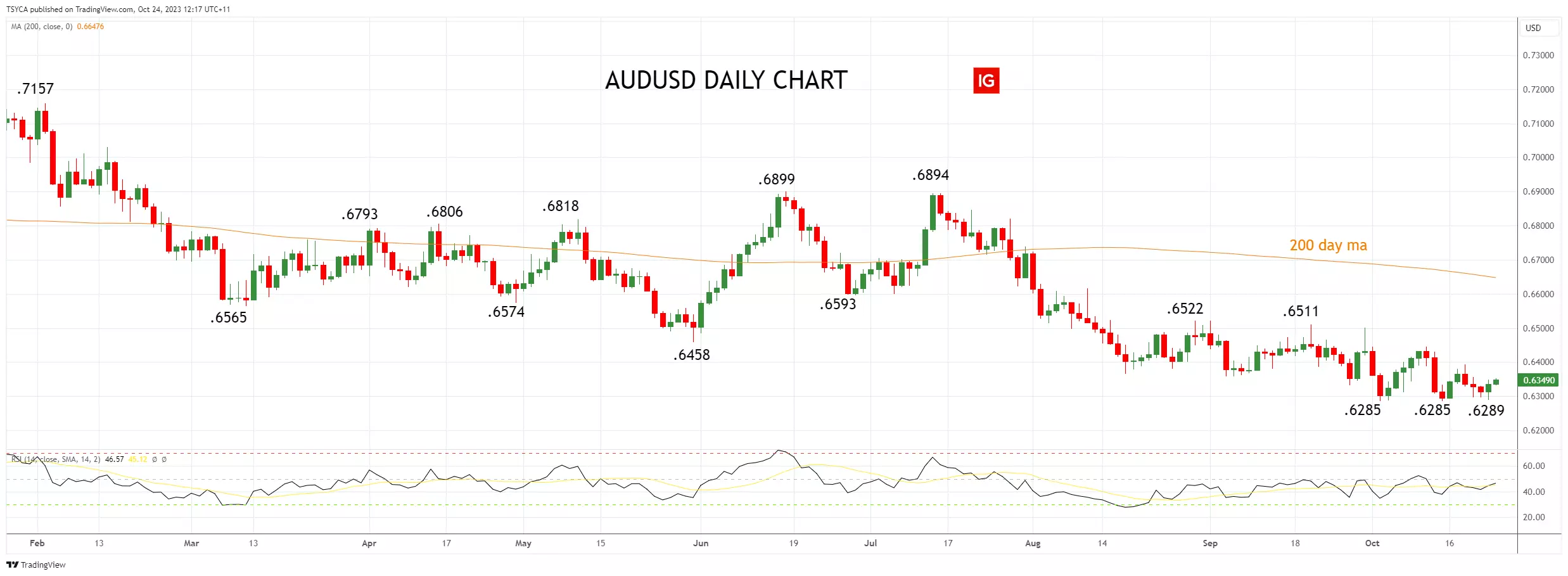

AUD/USD technical analysis

Despite a sell-off in the DXY overnight, the AUD/USD remained a reluctant participant ahead of tomorrow's Consumer Price Index (CPI) release, as geopolitical tensions in the Middle East continue to exert pressure.

From a technical standpoint, the AUD/USD exhibits a potential triple low at 0.6285, serving as a key bull-bear pivot ahead of the forthcoming CPI data. While above this level, the AUD/USD has the opportunity to test resistance at 0.6400/0.6450. Conversely, should the AUD/USD break below 0.6285 on a sustained basis, it would set the stage for a retest of the October 2022 low of 0.6170.

AUD/USD daily chart

- Source Tradingview. The figures stated are as of October 24th, 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices