AUD/USD gains for third week amid RBA's hawkish stance and upcoming CPI report

AUD/USD marks three weeks of gains as it eyes RBA's stance and key CPI data, navigating seller resistance.

The AUD/USD has notched up three consecutive weeks of gains, but this upward trend comes with a twist. Every time the pair ventured above the .6562 mark, aligning with the 200-day moving average, sellers swiftly emerged.

The trajectory of the AUD/USD's future gains hinges on a trio of factors: 1. sustained positive risk sentiment, 2. the RBA's unwavering hawkish stance, and 3. a fresh impetus for the US dollar's climb, which has been on the sidelines lately despite a recalibration of expectations for Fed rate cuts in the US rates market.

This week's Australian inflation update, the January Monthly CPI indicator, is set to play a pivotal role in clarifying the RBA's position.

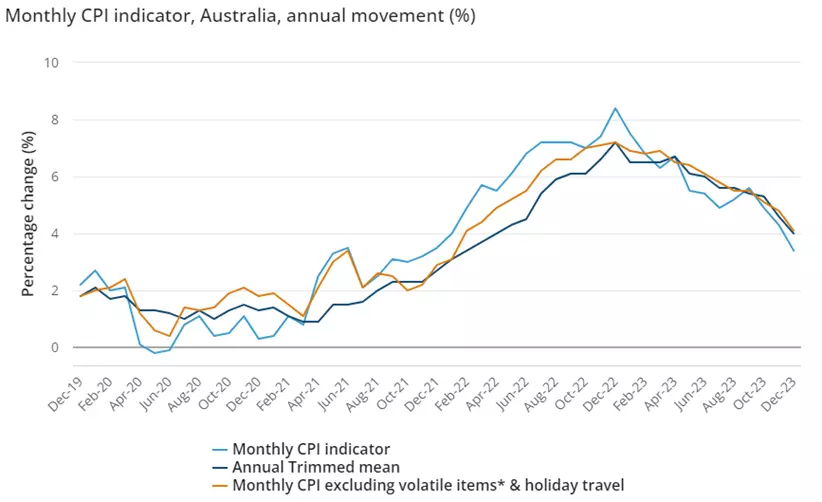

What's on the radar for this week's Monthly CPI indicator (Wednesday, February 28th at 11:30am):

The latest data, unveiled in late January, indicates a cooling in Australia's inflation both quarterly and monthly. A quick recap reveals:

- The headline inflation edged up by 0.6% in Q4, charting an annual pace of 4.1% YoY, undershooting the 4.3% forecast.

- The RBA's preferred inflation gauge, the trimmed mean, ascended by 0.8% QoQ, bringing the annual Trimmed Mean down to 4.2% YoY from Q3's 5.2%.

- December's Monthly CPI indicator showed a year-on-year increase of 3.4%, slightly below the 3.7% anticipated.

- Excluding volatile items, December's Monthly CPI indicator advanced by 4.2%, decelerating from November's 4.8%.

For January, expectations are set for the Monthly CPI to tick up to 3.5% YoY, mainly attributed to base effects. Despite this, the anticipated easing in inflation and a slackening labour market could pave the way for the RBA to shed its tightening bias in the months ahead. This shift is anticipated to precede a sequence of rate reductions, starting with a 25 basis points (bp) cut in August followed by another in November

Monthly CPI indicator chart

AUD/USD technical analysis

In recent weeks, the AUD/USD has stabilised and reclaimed some ground it lost during its sell-down from the December .6871 high.

The AUD/USD now needs to see a sustained move above the 200-day moving average at .6562 and above the mid-January .6625 high to warn that a more robust recovery is underway.

Aware that the longer it spends lingering under the 200-day moving average, the more chance there is of a retest of the mid-February .6442 low with scope towards weekly support near .6310.

AUD/USD daily Chart

- Source:TradingView. The figures stated are as of 26 February 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices