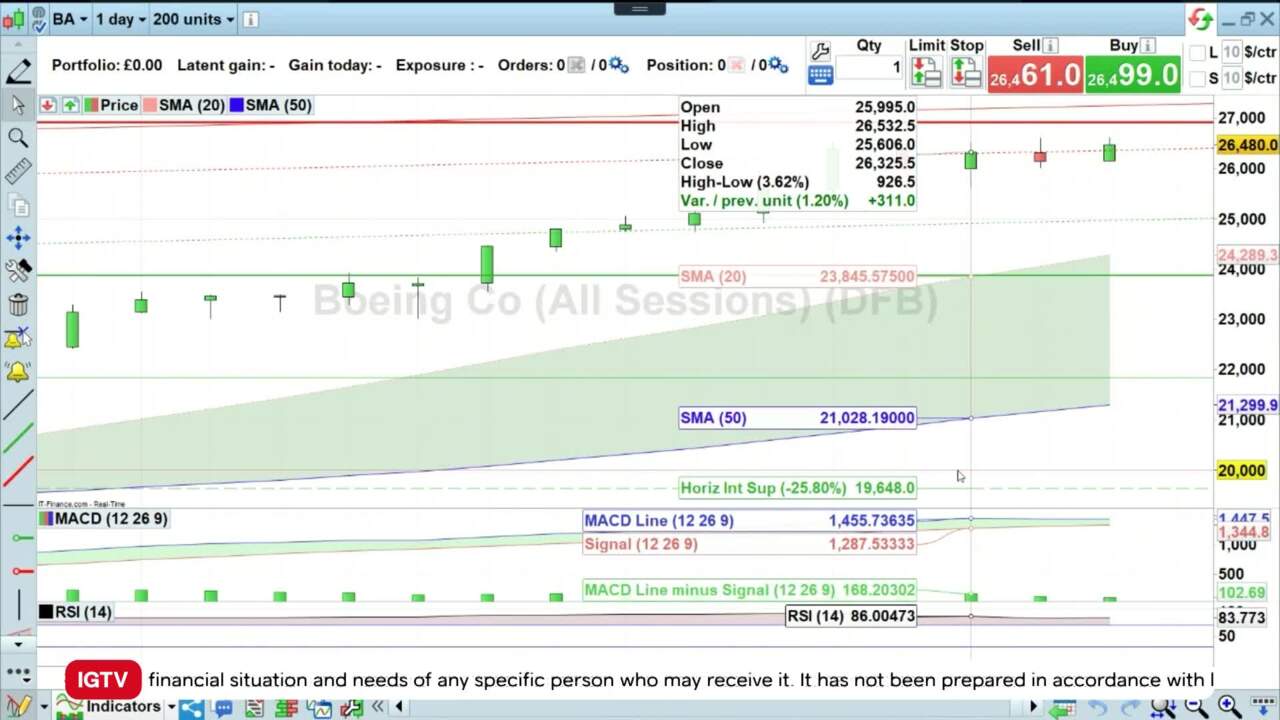

Boeing shares rise on reports it's to deliver first Dreamliner to China since 2021

Boeing, all-sessions, is tracking higher on reports that it will get the green light from China to resume deliveries of its 787 Dreamliner after two years. IGTV's Angeline Ong investigates why the news is lifting the stock.

(AI Video Summary)

Boeing shares taking flight thanks to new deal with China

Boeing, the aircraft manufacturing company, is experiencing a rise in its stock prices. According to the IG trading platform, these stocks have increased by 1.3%. This growth is attributed to reports that Boeing is about to recommence delivering its Dreamliner planes to China after a pause of more than four years. This is a significant development for Boeing as it could also mean the end of the freeze on deliveries of its profitable 737 MAX aircraft. In the past, Boeing focused on making smaller, more fuel-efficient planes for shorter flights, while Airbus concentrated on larger, long-haul planes. Nonetheless, Boeing's decision seems to be paying off as it appears ready to take advantage of its chosen target market.

Growing confidence in Boeing's safety and reliability

Despite some troubles with its planes in the past, the potential revival of Dreamliner deliveries to China is a positive turning point for Boeing. It indicates growing confidence in the safety and reliability of the aircraft. This is particularly crucial for Boeing's 737 MAX, which has been grounded since 2019 following fatal crashes. Boeing's decision to prioritise shorter-haul planes that consume less fuel aligns with the global trend of sustainable aviation. Airlines and regulators are actively seeking ways to reduce carbon emissions, making planes that use less fuel for shorter flights increasingly appealing. By resuming Dreamliner deliveries to China, Boeing is showing that its strategy is paying off and strengthening its position in the market.

Overall, the prospect of Boeing restarting Dreamliner deliveries to China is good news for the company. It suggests that the halt on 737 MAX deliveries may come to an end, which could significantly impact Boeing's profitability. Moreover, this move reinforces Boeing's commitment to smaller, more fuel-efficient aircraft, placing it in a favorable position amidst the growing demand for sustainable aviation. Investors and industry observers will now closely monitor Boeing's upcoming actions following this positive development.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices