Can Tuesday’s US CPI reading stop the rout in global equity indices?

Can decent inflation data and optimism about the Fed's aid to banks lift market sentiment?

Is Tuesday’s lower inflation reading enough to stop the rout in equity indices?

With the US annual Consumer Price Inflation (CPI) falling to 6% in February as expected and this being the lowest reading since September 2021, US equity indices got a boost on Tuesday and ended the day significantly higher, regaining some of their last few days’ sharp losses due to the collapse of Silicon Valley Bank (SVB).

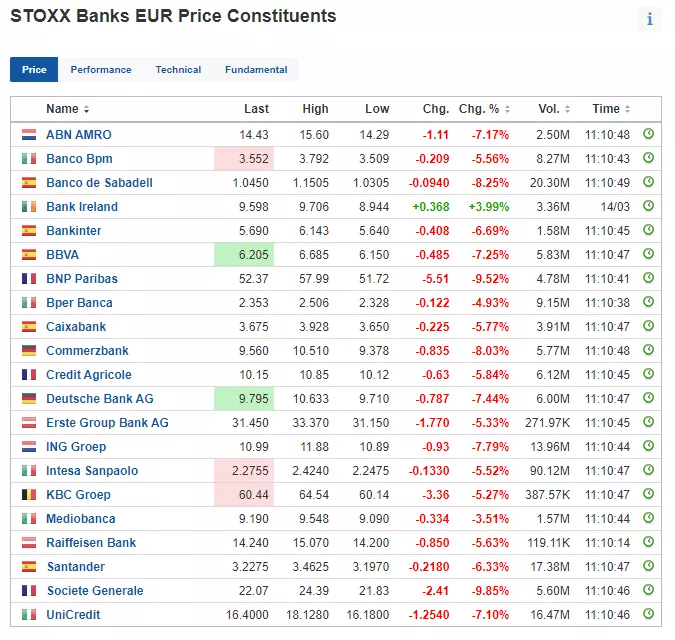

While European equity indices at first benefitted from the rally from their US counterparts, they resumed their descents on Wednesday morning due to ongoing worries regarding the impact rapidly rising interest rates may still have on European banks’ balance sheets with these again falling by on average over 5%, led by Credit Suisse’s over 20% drop.

STOXX Banks EUR Price Constituents

What about the US inflation picture?

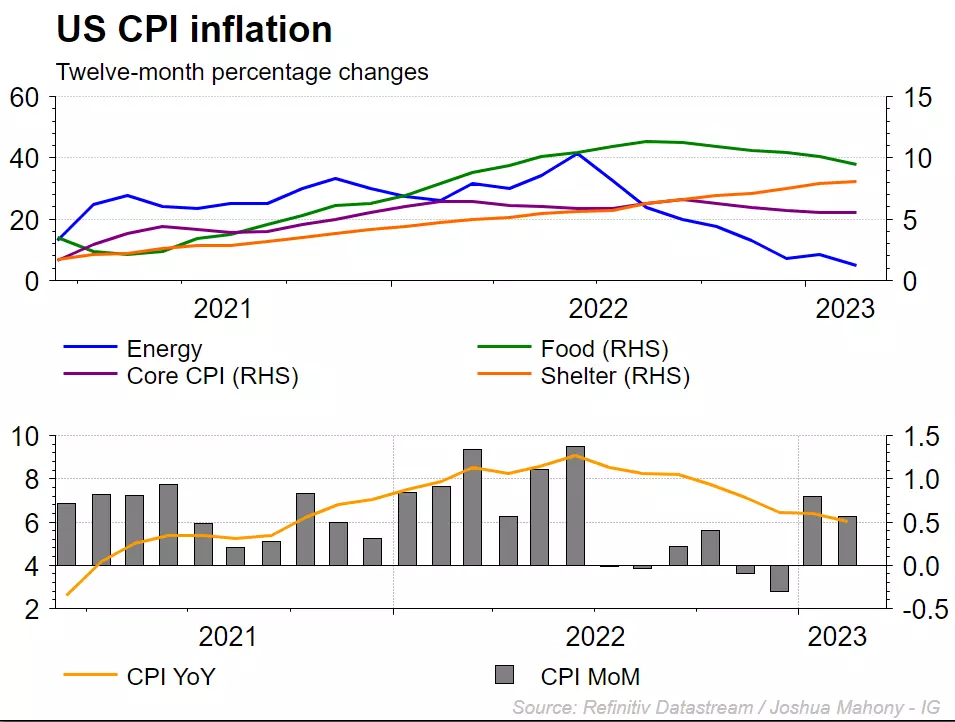

Yes, there are signs that inflationary pressures are easing as a result of the Fed's tightening campaign over the past year with core inflation, which excludes food and energy prices, falling to 5.5%, the lowest level since late 2021, but these same rate hikes may have led to large bond portfolio losses for banks other than SVB if they didn’t hedge these appropriately, which was the top-20 US bank’s downfall.

The question thus is whether investors’ initial positive reaction to the latest US inflation data can be sustained or whether fear of the collapse of another bank may lead to sustained selling pressure and the resumption of the 2022 bear market.

The Labor Department's CPI report showed monthly inflation rose 0.4% in February from January, in line with expectations, resulting in a slowdown in annual inflation to 6%, the lowest since September 2021.

Even so, the same report showed that core inflation slightly exceeded expectations, underscoring a still challenging macro environment.

US CPI inflation

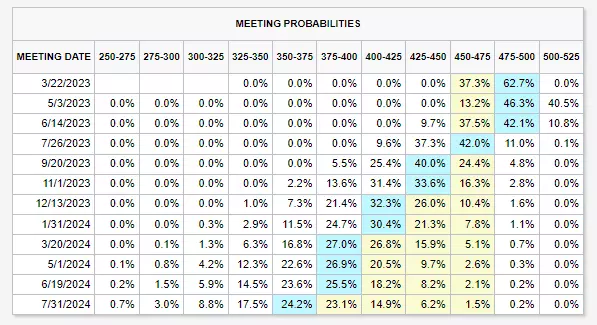

Investors have been speculating that the Fed may soon pause its tightening cycle as fears grow over the health of the broader financial system following the SVB bankruptcy and the closure of Signature Bank.

On the business side, US regional bank stocks regained ground after several tumultuous sessions, with First Republic Bank, for example, making back a large part of recently lost ground as the president of the bank declared to CNBC that he has not seen large capital outflows and that they have obtained additional liquidity after signing agreements with JPMorgan and the Federal Reserve (Fed). The stabilising action by the regulators has stopped the massive withdrawals of funds which has, at least for now, calmed the entire sector in the US.

Furthermore, market bets have swung from a 70% probability of seeing a 50-basis point rate hike at next week’s FOMC policy meeting to a 37.3% chance of seeing no rate hike at all and a 62.7% change of seeing a 25-basis point hike.

US Fed meeting probabilities

With the European Central Bank (ECB) expected to disregard the current market woes and to remain solely focused on bringing inflation down to its 2% target, a 50-basis point rate hike to 3.5% may still be on the cards for Thursday’s monetary policy meeting, fuelling Wednesday’s banking sector sell-off and general risk-off sentiment.

The question is whether Wednesday’s rout in European equities will spill over to US markets or whether these can have a calming influence on their European peers.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices