EUR/USD and GBP/USD move up, while USD/JPY drops back

Some pre-FOMC dollar weakness has allowed the euro and sterling to make some gains against the dollar, while USD/JPY is lower in early trading.

EUR/USD makes headway

Reports of an emergency in the European Central Bank (ECB) meeting have helped stabilise the EUR/USD, after the price managed to avoid additional heavy falls yesterday.

If the price continues to remain above $1.04, then additional upside towards the 50-day simple moving averages (SMA) comes into play, followed on by the $1.0727 and $1.0777. Continued declines below $1.04 would bring $1.055 into view, the low from early May. Below this, the downtrend moves into play again, with the potential for additional lower lows.

GBP/USD edges up after losses

GBP/USD has succeeded in stabilising for now above $1.20, having briefly dropped below this level yesterday. But with a new lower low having been created the downtrend is still firmly in play.

A short-term rebound would bring $1.22 and then $1.246 into view. However, this would leave the downtrend intact, and it would require a move back above $1.256 to suggest any medium-term recovery is in play. Having fallen below the May 2020 low, the risk now for sterling is a fresh move towards the $1.15 low from March 2020.

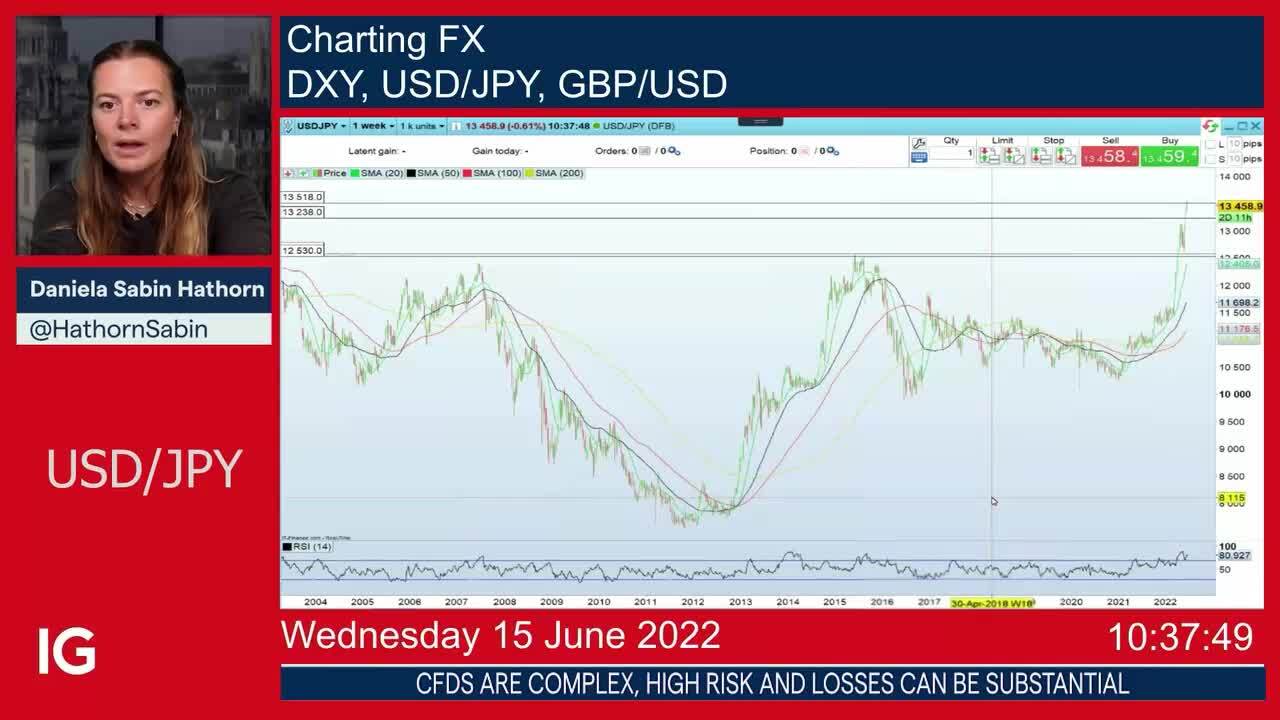

USD/JPY drops back from new high

USD/JPY (大口) is edging back in early trading, having hit a new high in its uptrend yesterday. A reversal below ¥133 would suggest a move back to March 2022 rising trendline support, or to the 50-day SMA just below it (currently ¥129.19).

For the moment some consolidation seems likely; a more cautious Federal Reserve (Fed) at today’s meeting could see the dollar weaken in the short-term, but the overall gulf in monetary policy between the Federal Open Market Comittee (FOMC) and the Bank of Japan (BoJ) should keep the general uptrend intact.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices