European stocks gain ahead of key economic data from US, UK, and Eurozone

European equities tick upwards, with investors eyeing upcoming US CPI, UK inflation, and GDP figures that could sway FTSE's trajectory and reshape UK's interest rate cut forecasts.

European equity markets made modest gains overnight ahead of a big week of economic data in the US, Eurozone, and UK.

While the US CPI release will claim centre stage tonight, an expected rise in UK inflation on Wednesday night, which will be followed by a soft UK GDP number on Thursday, will provide another reason for the embattled FTSE to continue to underperform its peers post the recent hawkish BoE meeting,

Ahead of the inflation and GDP data, the UK rates market, which before the BoE meeting had a total of 100bp of rate cuts priced for 2024, has postponed its expectations of a first BoE cut from May until August, and now has only three rate cuts in total priced for 2024.

What is expected from the UK inflation report for January (Wednesday, February 14th at 6.00pm)

In December, the annual rate of headline inflation surprised to the upside at 4%, above consensus expectations, looking for a fall to 3.8%. It was the first rise in inflation in ten months and appears to have played a central role in last month's hawkish Bank of England interest rate meeting.

In January, the preliminary consensus expectation is for annual headline inflation to rise to 4.2% YoY from 4%, above the BoE's projection of 4.1% YoY. Core inflation is expected to increase to 5.2% YoY from 5.1% in November and December.

UK core inflation chart

What is expected from the UK GDP report (Thursday, February 15th at 6.00pm)

The British economy expanded by 0.3% MoM in November, for its fastest rate of growth in five months, following a -0.3% fall in October.

GDP is expected to contract by -0.2% MoM in December based on weaker-than-expected retail sales, wet weather and industrial action by rail and healthcare workers.

UK GDP MoM chart

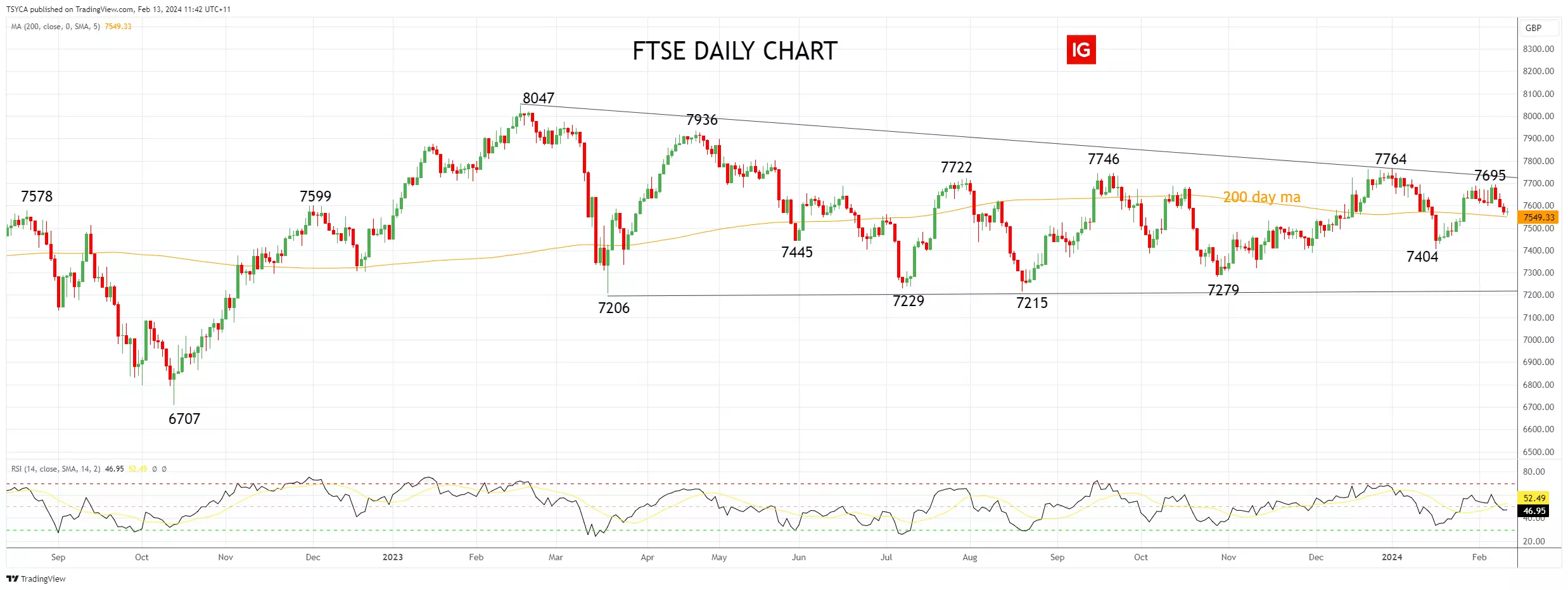

FTSE technical analysis

For the past eight months, the FTSE has been encapsulated below horizontal and, more lately, resistance at 7750ish and above support at 7200.

While the FTSE remains above the 200-day moving average at 7550, it can still retest horizontal and trendline resistance at 7730/60 with a break above here, opening up a test of the April 7936 high, with scope to the 8047 high.

However, should the FTSE see a sustained break below the 200-day moving average at 7550 posts this week's inflation and GDP data, it would warn of another leg lower initially towards the 2024 year-to-date last at 7404, before range lows 7280/7200ish.

FTSE daily chart

DAX technical analysis

In our updates in mid to late January, we noted that due to the nature of the three-wave decline from the early January 17,123 high to the mid-Jan 16,464 low, it was likely a corrective sequence, and that the DAX would push to new highs.

Last week, the DAX finally made a new high at 17152. However, given the bearish RSI divergence and based on our wave count, which suggests the up move could now be complete, we remain of the view a 5-10% pullback is not too far away.

DAX daily chart

- Source: TradingView. The figures stated are as of 13 February 2024. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices