Fed minutes may provide another reason to buy the USD

It's the release of the minutes of the Fed's last rate meeting at which it left the Federal Funds Rate on hold. The pause in rates followed a run of consecutive rate hikes at every meeting since March 2022.

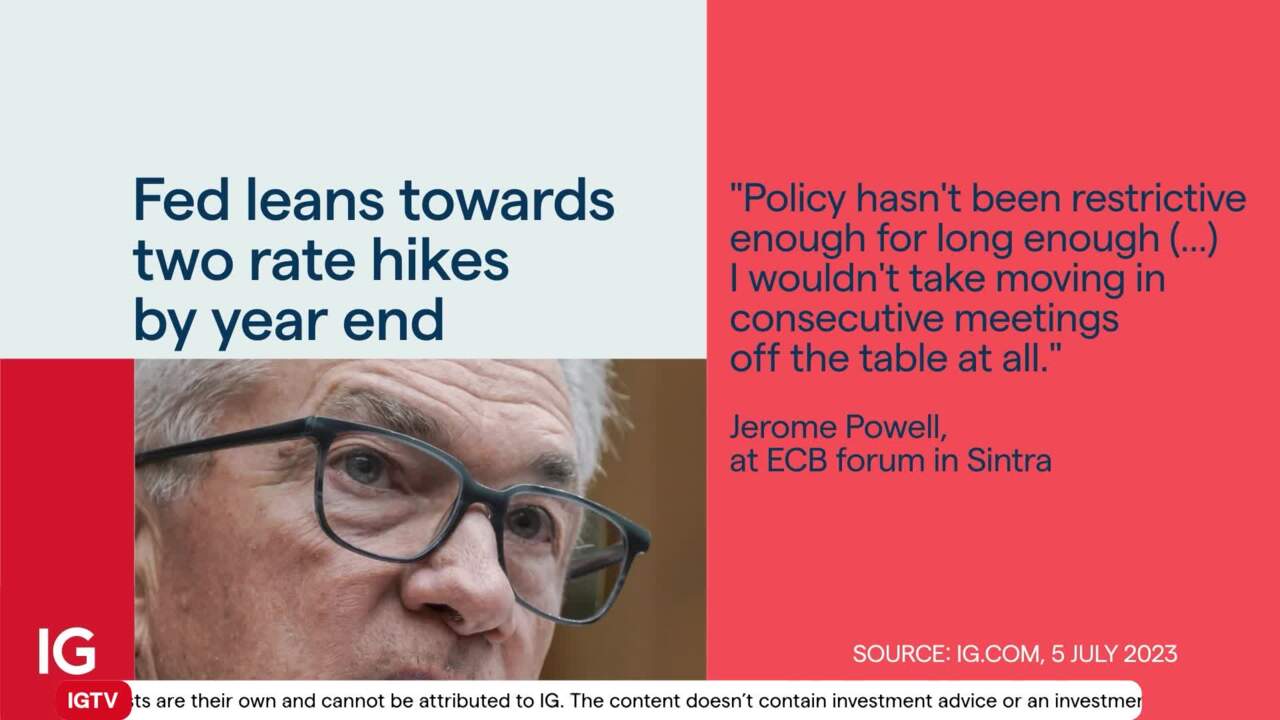

The updated economic projections suggest rates may reach 5.6% by year-end, thus suggesting two more increases. Fed Chair Jerome Powell recently reinforced the view that the board is leaning towards two rate hikes and hasn't ruled out consecutive-meeting rate increases. The latest economic projections from the Fed indicate that the fed funds rate is expected to gradually fall to 4.6% in 2024.

(Video Transcript)

Fed minutes

It's the release of Federal funds minutes of the last meeting show that we saw the Federal Reserve (Fed) keep interest rates on hold following the Independence Day holiday. As it does, the release today will force people back to their desks, I guess bringing them back to reality after what's a long weekend for many been. The pause in rates followed a run of consecutive rate hikes at every meeting since March 2022.

The updated economic projections suggest rates may reach 5.6% by year's end, thus suggesting more rate increases. The Fed chair, Jerome Powell, seen here recently reinforcing the view that the board is leaning towards two rate hikes and hasn't ruled out consecutive meeting rate increases, The latest economic projections from the Fed indicate that the Fed funds rate is expected to gradually fall to 4.6% in 2024.

USD

Let's show you what's happening with the USD. This is the dollar basket up for a third day in a row today. Despite the fact we saw the US markets out yesterday, money was going into the dollar, and I think the minutes may reveal the board's intention is to keep interest rates higher for an extended period of time, with a rate hike possibly delayed until the end of the first quarter or second quarter of 2024 if inflation falls towards that desired trajectory.

EUR

Let's take a look at the EUR very quickly, all the way down, not quite as low as we've been in the last week or so, but at 1.77 looking weak. So, if you're selling euros at the expense of the USD, your stock goes up above the 110 level, currently trading at 1 to 876.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Start trading forex today

Trade the largest and most volatile financial market in the world.

- Spreads start at just 0.6 points on EUR/USD

- Analyse market movements with our essential selection of charts

- Speculate from a range of platforms, including on mobile

Live prices on most popular markets

- Forex

- Shares

- Indices