Haleon climbs above IPO price after FY earnings

The company, a spin-off from GSK in the summer of 2022, punched back up above its listing price of 335p in a strong 7% move after good full-year earnings.

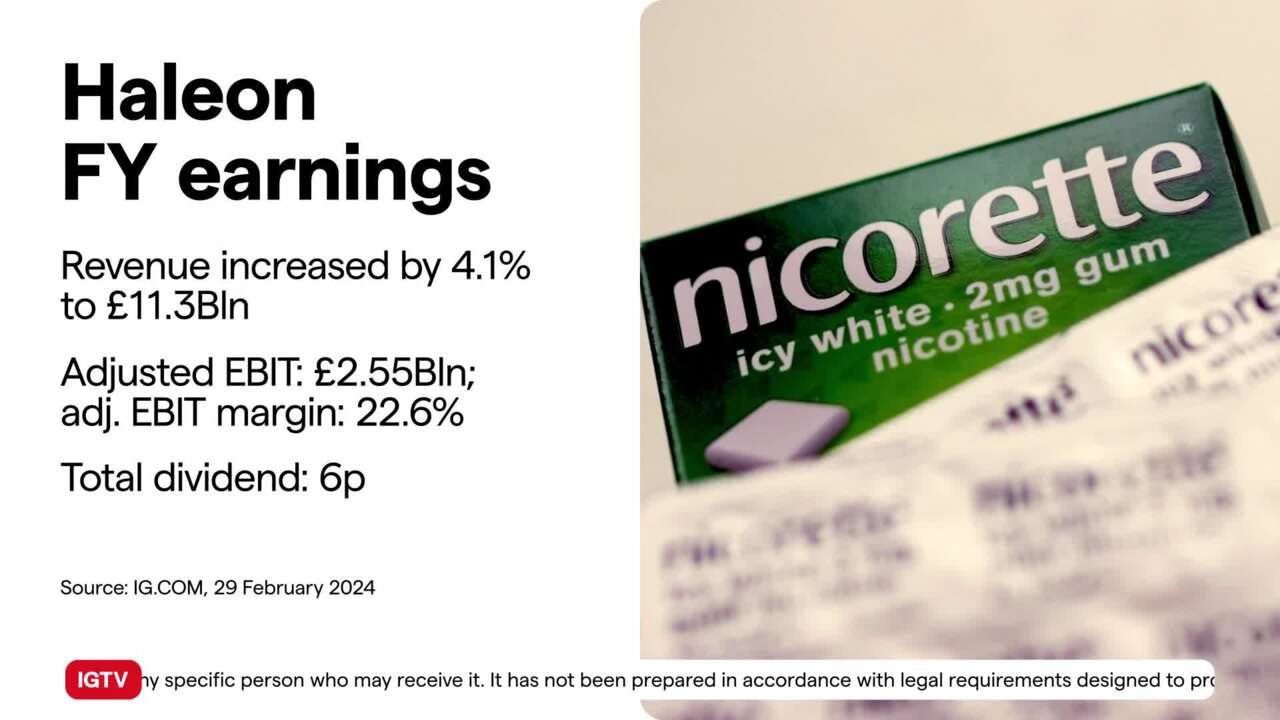

Organic growth climbed 8.0% and revenues were up +4.1% to £11.32bln driving a 10.4% rise in adjusted operating profit. Operating margins were even better off, climbing 22.6%, up 50bps. Dividend also climbed with a proposed payout of 35% of cash available - up from 30% last year. Making a final dividend of 4.2p per ordinary share. The company also said that forward dividends will grow, at least, in line with adjusted earnings.

(AI Video Summary)

Heleon

The health care spinoff from GSK, known as Leon, has been doing really well lately. Their financial results have been strong, causing their stock to rise. Heleon's organic growth has gone up by 8 percent and their revenue has increased by 4.1 percent to reach a whopping 11.3 billion pounds. But that's not all - their adjusted operating profit has seen a significant increase of 10.4 percent. And if that wasn't enough good news, their EBIT margin has improved by 50 basis points to 22.6 percent. All of this is great for Leon's bottom line.

But wait, there's more! Heleon has also decided to be extra generous and increase the total dividend payout from 30 percent to 35 percent of cash available. This means that shareholders will get a final dividend of six pence per share. So not only are Leon's finances looking great, but their shareholders are going to be pretty happy too.

Heleon's stock price chart

If we take a look at Heleon's stock price chart, we can see that it has gone above the initial IPO price of 335 pence on the London markets. Right now, the stock is trading at 338.4 pence, which means it has gone up almost 8 percent in just the first 20 minutes of trading. This is a clear sign that investors are reacting positively to Leon's strong financial performance. It's not surprising though, considering that the company's impressive numbers have led to higher dividends, increased profits, and revenue growth. All of this together has created a positive response in the market.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices