Instacart: is the IPO market finally warming up?

Boosted by Arm’s promising debut on the NYSE last Thursday, Instacart has set its initial offering price at the top of the range it announced last week. Angela Barnes has more.

Instacart trading on the New York Stock

Instacart, a popular grocery delivery service, is about to start trading on the New York Stock Exchange today. This means that anyone can buy and sell shares of the company, just like a stock. Instacart decided to go public after seeing the success of another company called Arm, which also recently started trading. In fact, Arm did so well that Instacart decided to increase the price range for its shares.

Instacart value

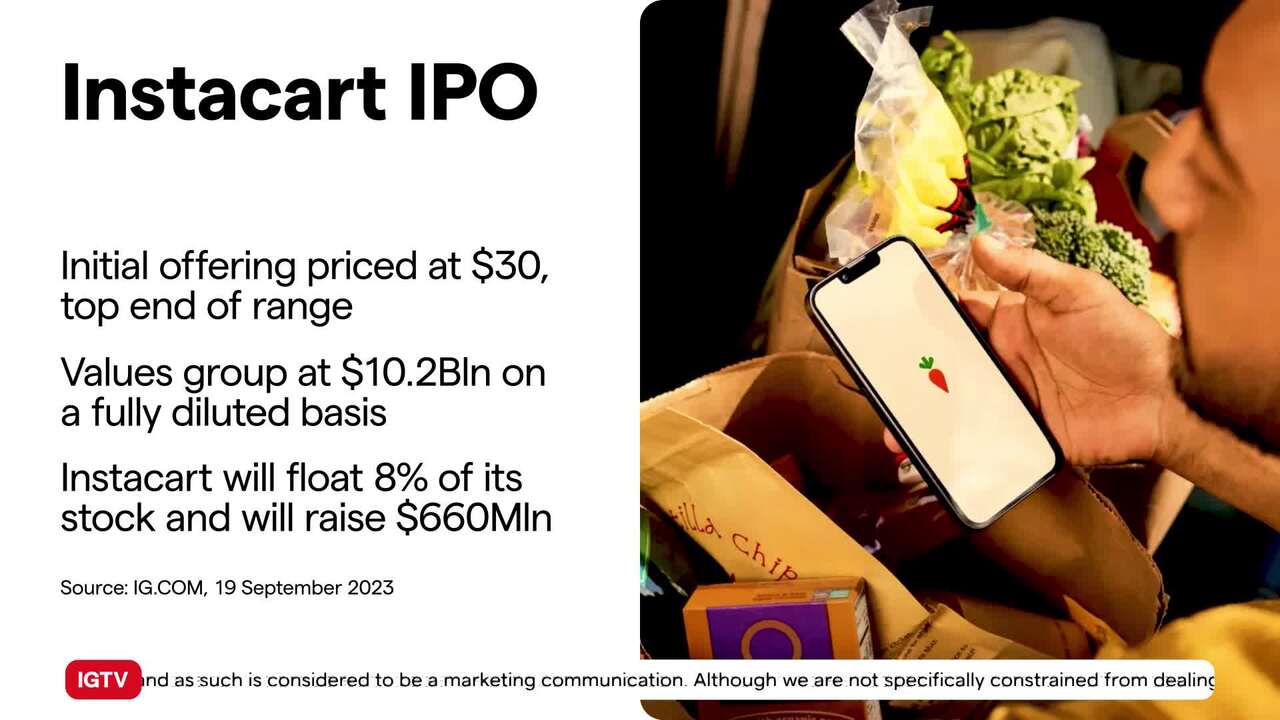

To give you an idea of the value of Instacart, the company has priced its shares at $30 each, with a total value of $8.3 billion. However, some people think that the company is actually worth more - around $10.2 billion. To raise even more money for its operations and expansion, Instacart plans to sell 8% of its stock, which could bring in around $660 million.

Instacart IPO

This IPO (Initial Public Offering) is a big deal for Instacart, as it aims to meet the increasing demand for online grocery delivery services during the COVID-19 pandemic. However, the company faces tough competition from other players like Amazon and Walmart. Instacart's IPO is following in the footsteps of Arm, which had a successful debut as a publicly traded company. This is a good sign that the market is open to investing in tech-related companies like Instacart.

Learn more about the Instacart IPO

The grocery delivery sector

While Instacart is expected to raise a lot of money with its IPO, its success depends on a few things. It needs to keep attracting new customers and finding new ways to expand. The grocery delivery sector is always changing, so Instacart needs to stay ahead of the competition by offering great service and new ideas. In summary,

Instacart is going public on the New York Stock Exchange, hoping to raise a lot of money for its grocery delivery service. It faces competition from big companies likeAmazon.com and Walmart, but with the growing demand for online shopping, Instacart has a chance to succeed.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices