LVMH shares tumble after poor sales

Luxury conglomerate LVMH saw a drop in sales in third quarter (Q3), as demand for handbags moderated and sales for spirits fell after several years of stellar growth.

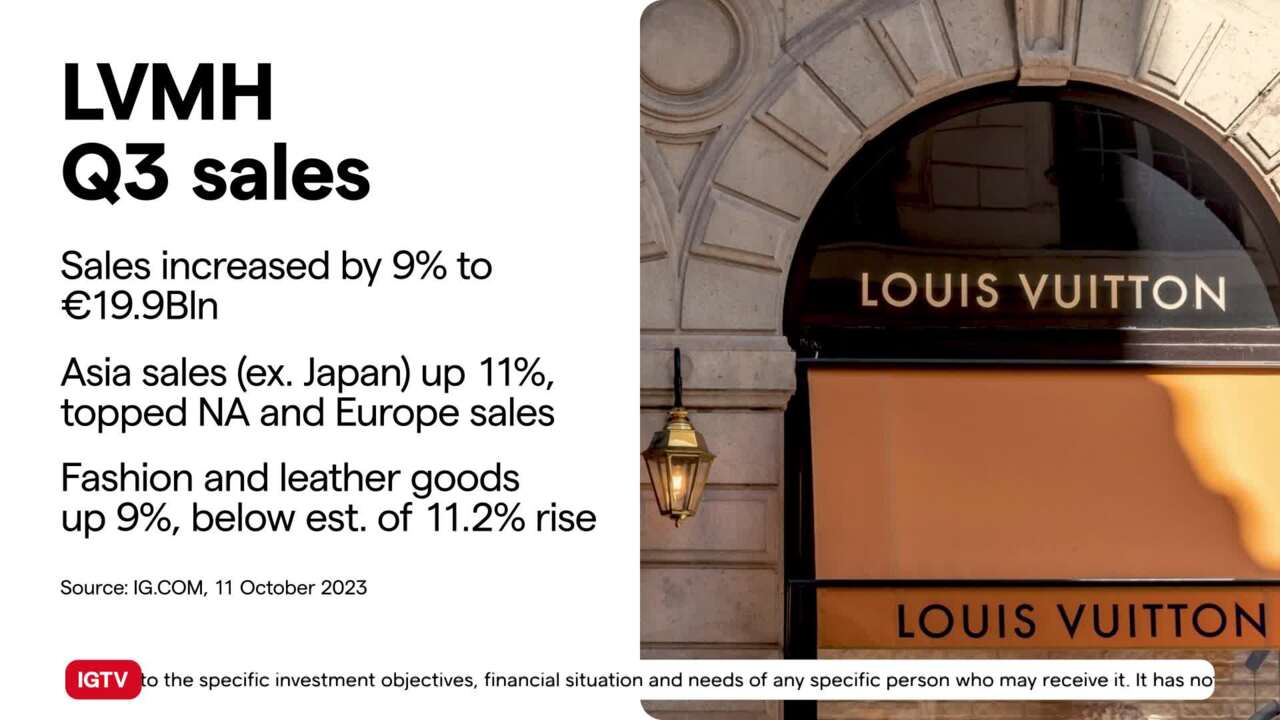

The French group, controlled by the world's wealthiest individual, Bernard Arnault, said sales grew 9 per cent in Q3 to €19.9 billion, down from a 17 per cent rise in the preceding quarter, reflecting softer luxury sales worldwide, notably in the US and Europe. Sales at LVMH's fashion and leather goods division - its biggest - grew 9 per cent in Q3, a slower pace than the 21 per cent growth in the second quarter and below estimates of 11.2%.

LVMH shares

Shares of the luxurious goods company LVMH have taken a big hit at the beginning of trading, reaching their lowest point in almost a year. The reason for this drop is that the company reported a decline in the demand for handbags in the third quarter, as well as a slowdown in the sales of its spirits division, which had been growing strongly before. Despite these challenges, LVMH's overall sales still increased by 9 percent to almost 20 billion euros.

One interesting thing to note is that Asia, excluding Japan, performed well with an 11 percent increase in the quarter. However, this is a drop from the 34 percent growth seen in the previous three months. LVMH has mentioned that there haven't been any significant changes in China. In Europe, most countries are experiencing a mid single-digit growth, according to LVMH's statement.

LVMH's share price

The fashion and leather goods unit, which is the biggest division of LVMH, grew by 9 percent in the third quarter. Even though this is a slower pace compared to the 21 percent growth seen in the second quarter, it is still lower than the expected growth of 11.2 percent. As a result, the overall decline in performance has caused a fall in LVMH's share price, which is now down 6.1 percent after only thirty minutes of trading. Looking at the chart of the share price, it's clear that all the gains made earlier this year have been erased. LVMH had been doing well based on the hope that China, which came out of lockdowns earlier, would continue buying their products. However, China has actually been one of the weaker regions for the company. Today, the share price is trading at levels not seen since 2022.

LVMH share drop

In conclusion, LVMH's shares have dropped significantly due to a decline in demand for handbags and spirits. Despite this, the company's sales still increased overall. The biggest division, fashion and leather goods, also saw growth, although at a slower pace. However, the disappointing performance led to a fall in LVMH's share price, which has wiped out all the gains made earlier this year. China has not been as strong of a market as anticipated, and the share price is now at its lowest point in several

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices