Lyft shares slump after poor earnings and guidance

Lyft shares dropped over 33% in extended hours, after the ride hail company posted a surprise loss in Q4 and forecast current-quarter profit far below Wall Street targets.

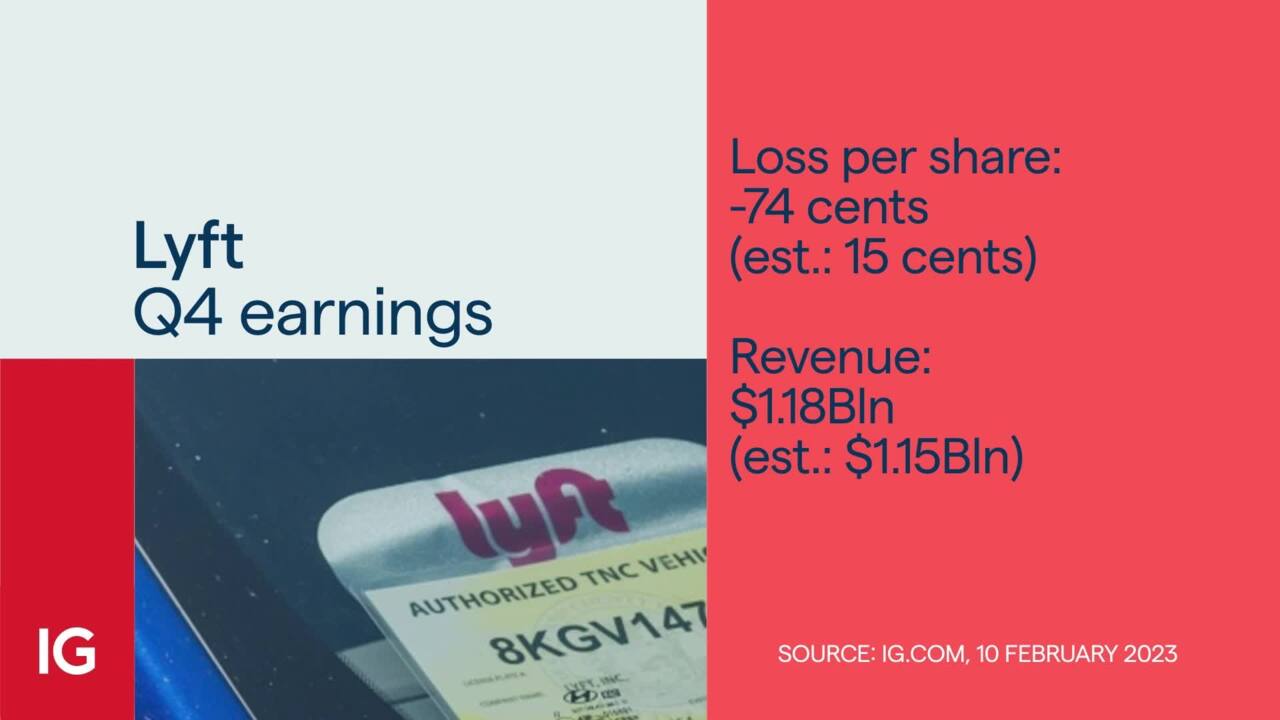

Lyft reported adjusted EBITDA of $126.7 million, above analysts' forecasts, but after setting aside $375 million for increasing insurance reserves, the group posted a loss of 74 cents per share, to be compared with EPS expectations of 15 cents.

As for the current quarter, Lyft forecast adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), a key measure of profitability that strips out some costs, of between $5 million and $15 million.

The average analyst target was $81.1 million. It also forecast revenue of about $975 million, below analyst estimates of $1.09 billion.

(Video Transcript)

Lyft shares slumped more than 30% last night all-sessions on the IG platform after posting a surprise loss in the fourth quarter (Q4) of last year and forecast current quarter profit far below Wall Street targets.

Share price chart

Let's take a look at what we saw there last night from the ride hail company, reporting adjusted EBIDTA $126.7 million. That was above analyst forecasts. But after setting aside $375 million for increasing insurance reserves, the group posted a loss of $0.74 per share compared with earnings per share (EPS) expectation of $0.15, way below forecasts.

In an interview, the group's president, John Zimmer, said they wanted to strengthen their insurance reserves to prevent that type of volatility going forward.

Active riders rising 8.7% to 20.36 million for the fourth quarter, Lyft said, above the FactSet estimate of 20.3 million.

As for the current quarter, Lyft forecast adjusted earnings before interest taxes, depreciation and amortisation, or EBIDTA, a key measure of profitability that strips out many of the costs, of between $5- and $15 million. The average analyst target was $81 million.

Lyft also forecast revenue below analyst expectations of about $975 million, below estimates of just over a billion. So whichever way you cut it, it looks pretty poor.

And if you look at the share price chart last night, absolutely massive losses. You can see in terms of the movement that we saw last night on the IG platform, closing down 33.79%, a massive swing around MACD.

Obviously, as a result of this with a lot of that, the simple moving average is taken out, support taken out, and this move down was substantial, not quite to record lows down at 965, but this stock is well off the highs that we saw back in March last year at 68.30. So at 1129, the stock will open again all-sessions on the IG platform at 9:00 this morning UK time.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices