Oil prices up as Saudi Arabia extends crude cut

Oil prices extended gains on Friday after Saudi Arabia announced it was extending its crude production cuts into September. The one-million-barrels-per-day reduction was implemented in July and August, says IGTV’s Angela Barnes.

(Video Transcript)

Saudi cuts boost oil price

Oil prices are on the rise again today after Saudi Arabia announced that it was extending its crude production cut. The one-million-barrels-per-day cut was first implemented in July and August, but it could still be further extended and deepened beyond September.

Brent chart

Let's have a look at what the oil prices are doing. Let's start with the Brent chart, where you can see that the price is actually up slightly by 0.40% at $85 a barrel, so extending gains there. It's 3 May, it has gained about 20%.

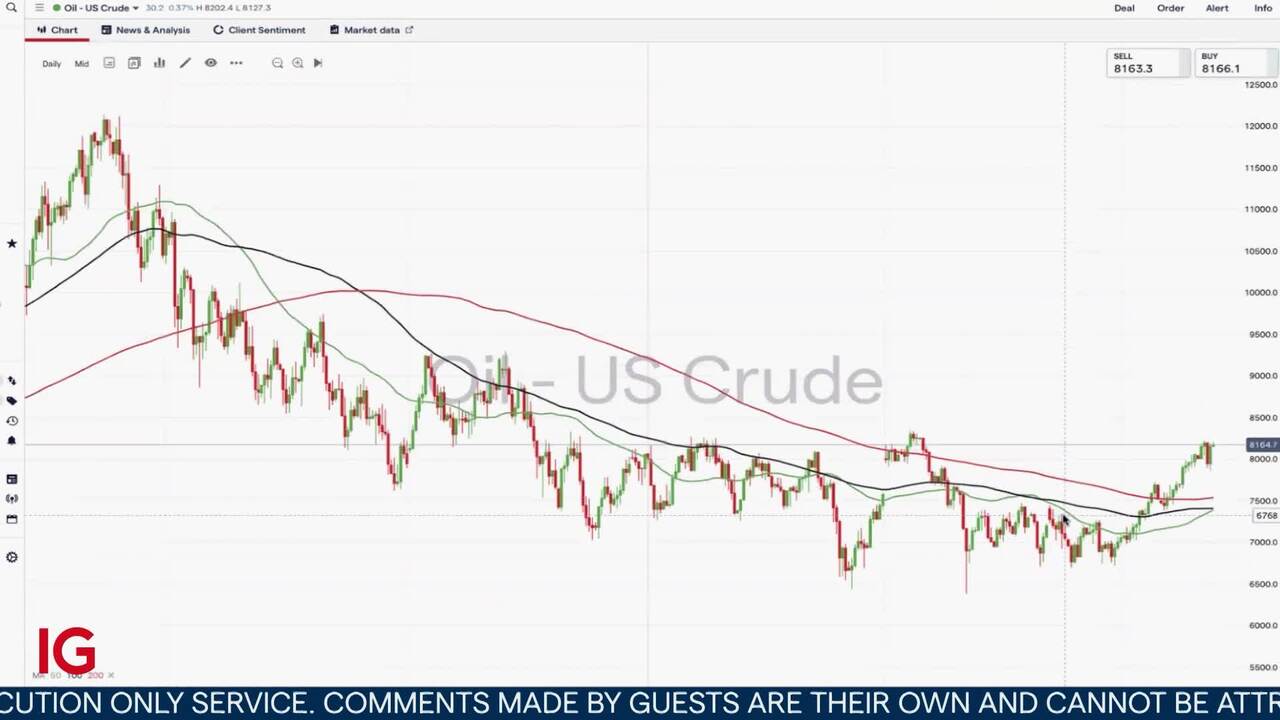

US crude also climbing

And if we look at the crude chart, well, US crude, otherwise known as West Texas Intermediate (WTI), that's also extending gains again today, up by about 0.35% and trading around $81 a barrel. Since 3 May this year, the price is also up about 30%.

The low seen on 3 May was after the US Federal Reserve raised interest rates. Oil prices have been under pressure due to that economic uncertainty and a slow recovery in Chinese demand, also. The production cuts from Saudi Arabia have been slightly supporting prices due to those supply tightness concerns.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

React to volatility on commodity markets

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.1

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

1In the case of all DFBs, there is a fixed expiry at some point in the future.

See opportunity on a commodity?

Try a risk-free trade in your demo account, and see whether you’re onto something.

- Log in to your demo

- Try a risk-free trade

- See whether your hunch pays off

See opportunity on a commodity?

Don’t miss your chance. Upgrade to a live account to take advantage.

- Analyse and deal seamlessly on fast, intuitive charts

- Get spreads from just 0.3 points on Spot Gold

- See and react to breaking news in-platform

See opportunity on a commodity?

Don’t miss your chance. Log in to take your position.

Live prices on most popular markets

- Forex

- Shares

- Indices