Plug Power shares slump on downgrade

Plug Power, all-sessions, falls almost 5% after Piper Sandler downgraded the hydrogen fuel cell turnkey solutions provider to underweight from neutral. IGTV’s Angeline Ong explains what’s behind the move.

(AI Video Summary)

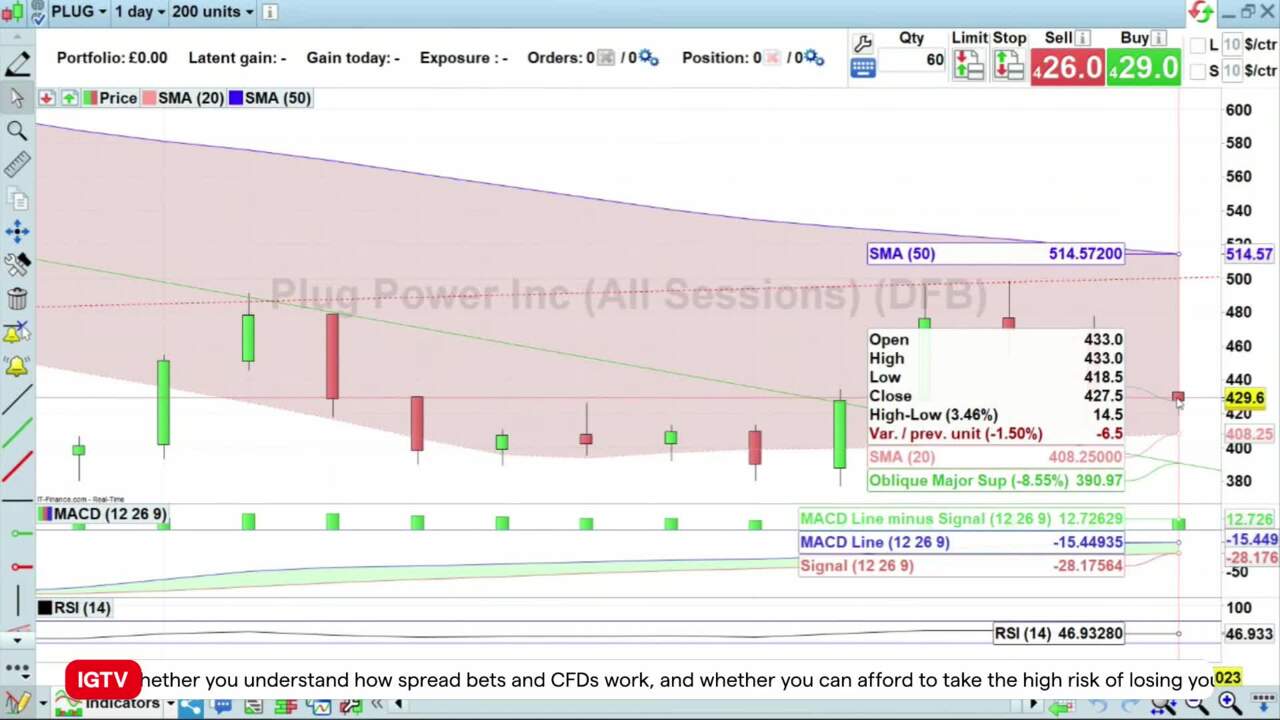

Plug Power share price falls amidst downgrade

Plug Power, a company that specialises in hydrogen fuel cell technology, is currently facing a decrease in its stock price. An investment firm called Piper Sandler recently downgraded Plug Power and lowered its target price for the stock. This downgrade caused the stock price to initially drop by more than 3%, although it has since recovered a bit to a 1.5% decrease.

The fast-moving nature of Plug Power in the market has caught the attention of investors. The IG platform is closely monitoring the company's performance. However, the recent downgrade by Piper Sandler has raised concerns about Plug Power's future prospects. It is possible that this downgrade contributed to the drop in the stock price.

Investors still see potential

Despite the negative reaction to the downgrade, some investors still see potential in Plug Power. The slight recovery in the stock price suggests that there is some level of support. However, the downgrade and the reduced price target indicate that there are concerns about the company's performance.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices