Q4 earnings season review – solid but unspectacular performance

Q4 earnings season is nearly done, and we look at the main trends arising from the reporting period for US stocks.

As the fourth quarter (Q4) 2023 earnings season drew to a close, S&P 500 companies delivered a performance that was satisfactory overall but fell short of historical averages in several key metrics. While profit growth remained positive, both the proportion of companies beating estimates and the magnitude of positive surprises lagged behind recent trends.

Slight drop in earnings beats

Overall, 73% of S&P 500 companies reported actual earnings per share (EPS) above analysts' mean estimates for Q4 2023. This percentage trails the 5-year average of 77% and the 10-year average of 74% for companies beating projections.

Tech stocks did well, while real estate struggled

At the sector level, there was a wide dispersion in the percentage of companies surpassing earnings expectations.

The Information Technology sector led the way, with an impressive 88% of companies reporting positive EPS surprises.

On the opposite end, only 55% of companies in the Real Estate sector topped EPS forecasts - the lowest across all sectors.

Size of earning & revenue surprises well below historical average

Not only were there fewer EPS beats, but the aggregate earnings surprise was also subdued compared to historical norms. In aggregate, S&P 500 companies reported earnings 4.1% above estimates - below the 5-year average of 8.5% and the 10-year average of 6.7%.

The revenue side of the equation showed a similar trend, with fewer companies beating top-line estimates and a muted surprise percentage compared to prior periods.

64% of S&P 500 companies reported actual revenues above estimates, short of the 5-year average of 68% (though in line with the 10-year average).

Collectively, companies reported revenues just 1.2% above expectations - lagging both the 5-year average of 2.0% and the 10-year average of 1.3%

Investors reward earnings surprises & forgive earnings misses

Despite the somewhat muted results, companies that managed to exceed earnings estimates were rewarded by investors more generously than historical averages would suggest.

Companies reporting positive EPS surprises saw their stock prices rise 1.4% on average surrounding the earnings release window. This exceeds the 5-year average price increase of 1.0% for companies beating bottom-line estimates. Conversely, negative earnings misses were punished less severely than usual, with those companies averaging a 1.0% stock price decline compared to the 5-year average of 2.3% for EPS misses.

Winners & Losers

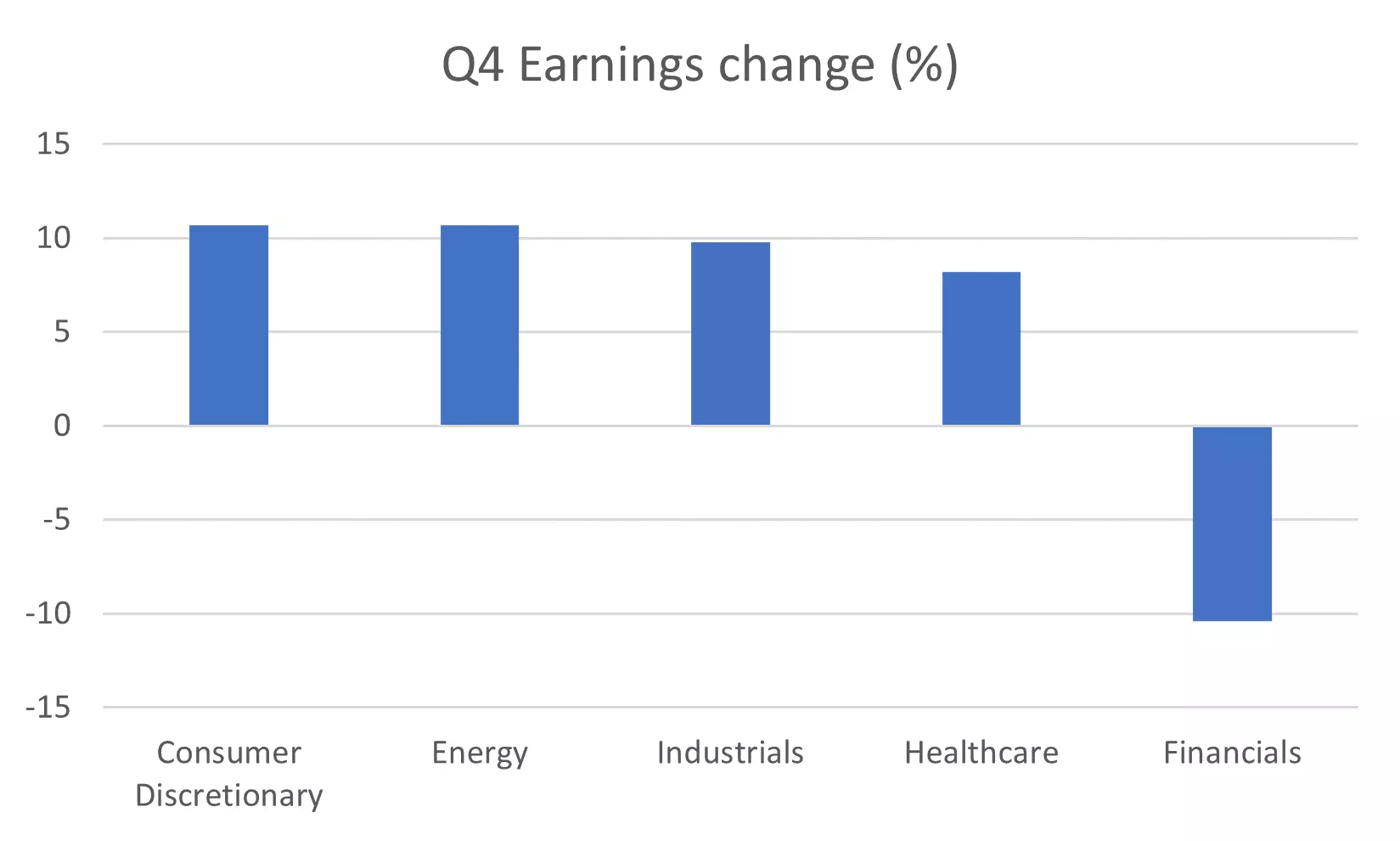

While most sectors contributed positively to the overall earnings growth number, there were a few clear outperformers and underperformers in Q4, as seen in the chart below:

Big names like Ford, Marriott, Amazon, Marathon Petroleum and Valero Energy drove large positive surprises in consumer, energy and industrials. Healthcare was boosted by companies like Illumina, Moderna and Pfizer.

The financial sector stood out as a weak spot, with names like Citigroup, Truist and Comerica missing estimates due to impacts from FDIC assessments. This sector reported the largest aggregate negative earnings surprise.

Pace of profit growth slows

Despite the below-average metrics, S&P 500 earnings still grew year-over-year (YoY) for the second consecutive quarter. The blended earnings growth rate for Q4 2023 currently stands at 4.0%.

However, this growth rate is noticeably slower than prior quarters.

Analysts expect the deceleration to continue in Q1 2024 with projected earnings growth of just 3.6%, before potentially re-accelerating to 9.2% in Q2 2024 and 11.0% for full-year 2024.

Valuations still higher than average

The somewhat tepid earnings performance comes against the backdrop of relatively elevated stock valuations for the S&P 500. The forward 12-month price-to-earnings (P/E) ratio currently stands at 20.4 - well above both the 5-year average of 19.0 and the 10-year average of 17.7. This lofty valuation implies that investors remain optimistic about future earnings growth materialising.

Outlook for Q1 2024

As companies enter the Q1 2024 reporting period, they will need to clear a higher profitability bar to sustain current stock prices and valuations. While the Q4 earnings season kept the profit growth streak alive, the path ahead appears more challenging amid economic uncertainties.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices