Rates preview: will the Fed signal an end to rate rises?

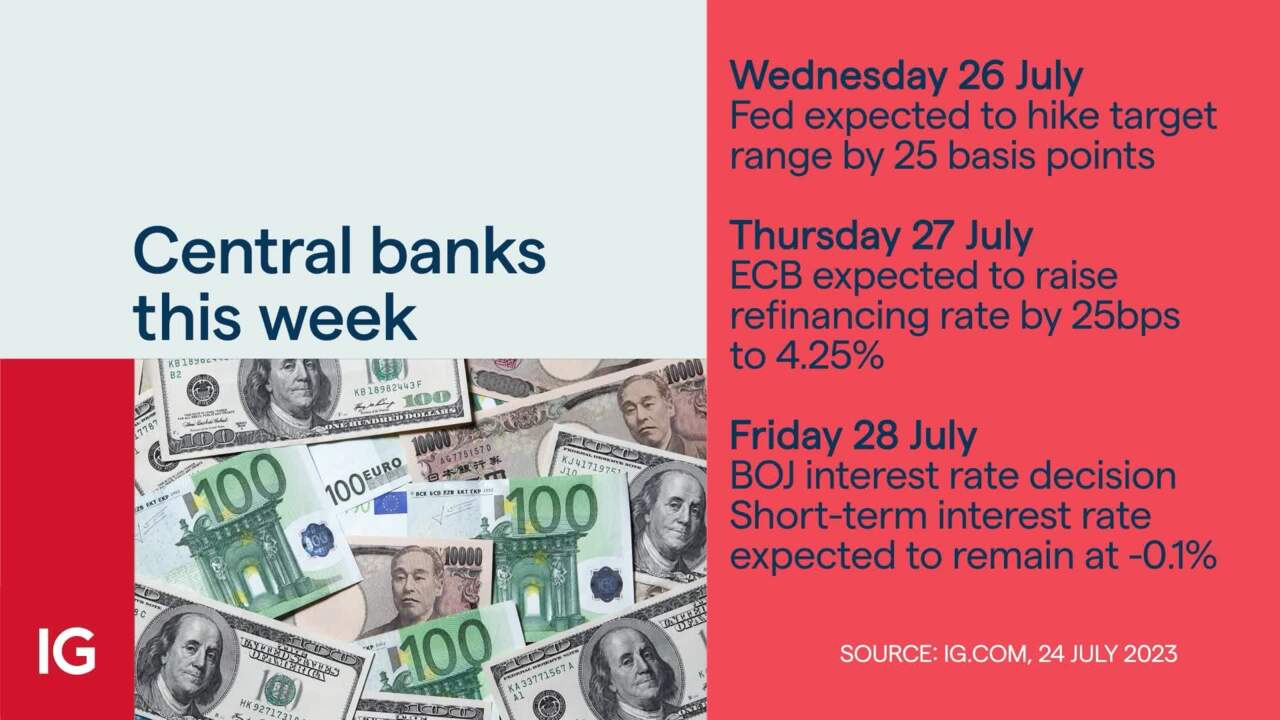

It’s a big week for central banks, kicking off on Wednesday, with the US Federal Reserve’s (Fed) rate decision.

While the target rate is expected to rise by 25-basis points, the most interesting thing about this release is the press conference to see what's behind the decision and to what degree will there be dissent. There's building evidence that the Fed may already have done enough, and this expected rate rise may be indicated as the last, at least for the time being.

On Thursday the European Central Bank (ECB) is forecast to raise rates by 25bp but at the same time signal that their job is far from over. Finally, on Friday, it’s the turn of the Bank of Japan (BoJ). Economists are united that the rate decision will be as it's been since it first adopted negative rates in 2016, to have a short-term interest rate target of -0.1%. That's been the policy to fight chronic deflation that has plagued the Japanese economy for decades and help jump-start economic growth.

(Video Transcript)

Central banks

This is a big week, though, for central banks, and a week where there may be little coordinated action on Wednesday. It is the Federal Reserve (Fed)'s rate decision. 7 p.m. UK time. While the target rate is expected to rise by 25 basis points, the most interesting thing about this release will be the press conference to see what's behind the decision and to what degree. There will be dissent in this building. Evidence suggests that the Fed may already have done enough, and it is expected that this rate rise may be an indicator that will last at least for the time being.

European Central Bank

Then, if we look ahead to Thursday, we've got the European Central Bank's interest rates. 1:15 p.m. UK time The ECB will announce its decision. While the outcome that's expected is forecast to be the same as for the U.S., but with the refinancing rate up by 25 basis points to four and a quarter percent, it is a fair bet that the ECB would indicate that their job is far from over.

Bank of Japan

And finally, you can see here on Friday, the 28th of July, the Bank of Japan interest rate decision. Economists are united in their belief that the Bank of Japan (BOJ) rate announcement will be as it has been for the last five or six years since it first adopted negative rates back in 2016, with a short-term interest rate target of -0.1%. Now that's the policy. The chronic deflation that's plagued the Japanese economy for decades, and it'll continue to help jumpstart economic growth.

Japanese yen

We'll have to see how all that develops. But certainly, the JPY is one area of the market where we've seen a lot of movement on the foreign exchange markets, and recent consumer price inflation data was the back end to last week's weakening in the Japanese yen. This is the dollar rising against the yen. And as you can see here, having drawn this Fibonacci on here, it has pretty much hit this line of resistance at 142 and nine, and it's now on the way down.

Depending on what happens over the next few days and possibly into Friday, we will see if the Bank of Japan does exactly as expect. We could well see a continuation of this weakness, but it'll be interesting to see what we can do to forcefully break through it. One 4209 may have to wait till Friday to see whether or not there's any major move out of that, depending on what the central bank is, say on Friday.

The European Central Bank and the Federal Reserve

And of course, outside of that, it's really all about the European Central Bank and the Federal Reserve. And the direction of travel at the moment is for a weaker euro against the US dollar. We got the support line down here, 110, which is the price target in the risk event that we had last week from the World Bank. I think it's from the daily effects he was looking at that it's a better price to go long on the euro-dollar at some point in the future.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Take a position on indices

Deal on the world’s major stock indices today.

- Trade the lowest Wall Street spreads on the market

- 1-point spread on the FTSE 100 and Germany 40

- The only provider to offer 24-hour pricing

Live prices on most popular markets

- Forex

- Shares

- Indices