Oil prices: trading the growing surplus

The latest evidence of excess oil supply has come through from the American Petroleum Institute as it reported another rise in crude oil stocks.

Crude inventories increased by 3.7 million barrels last week, while gasoline and distillate inventories fell by 2.5 million and 900,000, respectively.

Refineries have been running above 90% for the past few weeks as fuel demand remains high, but motor fuel stocks remain below their 5-year averages, 7% below for gasoline inventories, and 16% below for distillates, according to investment firm Tudor Pickering Holt & Co.

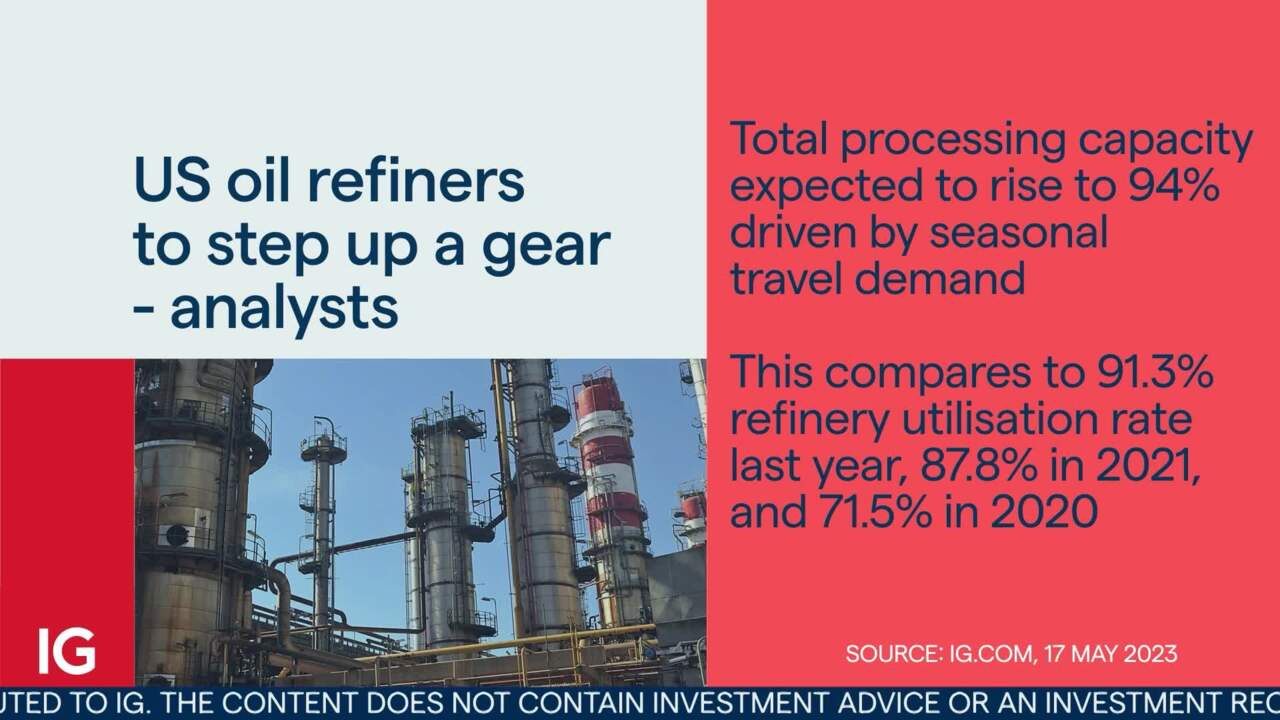

Analysts expect US oil refiners aim to run at up to 94% of total processing capacity this quarter, driven in part by expectations of seasonal travel demand.

This compares to 91.3% refinery utilisation during the same quarter a year ago and 71.5% and 87.8% run-rates in 2020 and 2021.

(Video Transcript)

Oil surplus

There's a growing surplus of oil around at the moment with the latest evidence coming through from the American Petroleum Institute (API) reporting another rise in crude oil stocks.

We'll take a look at how to trade this in just a minute. Crude inventories increased by 3.7 million barrels last week. While gasoline and distillate inventories falling by 2.5 million and 900,000 respectively.

Refineries have been running above 90% for the past few weeks as fuel demand remains high, but motor fuel stocks remaining below their five-year averages, 7% below gasoline inventories, 16% below for distillate according to the investment firm, Tudor Pickering Holt & Co. Now analysts expect us oil refiners aim to run up to 94% of total processing capacity this quarter driven in part by expectations of seasonal travel demand. This compares to 91.3% refinery utilisation during the same quarter last year and the 71.5% and 87.8% run-rates in 2020 and 2021.

US crude oil chart

Now all this could end up being negative for the price of oil. Now, in the long-term you'll see, we've seen some big declines in the highs we had back on the 8th of March 2022 all the way up at $124.71. Here we are now at 7035. This is for US crude and this downward pressure I suspect could well persist at $70.

If you're short on that, your stock would go in this area up here just above recent highs at around about the $74 level, your price target for the lowest we had there back on the 24th of August 2021 at 6155.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Speculate on commodities

Trade commodity futures, as well as 27 commodity markets with no fixed expiries.

- Wide range of popular and niche metals, energies and softs

- Spreads from 0.3 pts on Spot Gold, 2 pts on Spot Silver and 2.8 pts on Oil

- View continuous charting, backdated for up to five years

Live prices on most popular markets

- Forex

- Shares

- Indices