US earnings forecast: Walt Disney Q2 2023 results preview

NYSE listed, the Walt Disney Co. is likely to see an increase in second quarter revenue, although underlying earnings could fall from the prior year's comparative period.

When are Disney’s Q2 2023 earnings expected?

The Walt Disney Co., listed on the New York Stock Exchange (NYSE), is the largest media and broadcasting company in the world. The company is set to report its second quarter (Q2) earnings for 2023 on Wednesday the 10th of May 2023.

The Walt Disney Co. Q2 2023 earnings: What to expect?

Data compiled by Refinitiv data arrives at the following consensus estimates for the Q2 2023 results:

- Revenue of $21.8bn for the quarter

- Revenue to have increased 7.54% (from the prior year’s comparative period)

- Earnings per share $0.99 (vs Earnings per share of $1.08 in the prior year’ comparative period)

Traders and investors alike will look to assess the influence on the business the return of CEO Bob Iger has had. Subscriber numbers for the Disney+ service could be negatively affected by the company’s failure to renew IPL India cricket broadcasting rights as well as an increase in subscription costs. The business will be hoping to see earnings supported by a continued post covid momentum in the Theme Park business, which saw revenue increase by almost 30% in 2023.

How to trade the Walt Disney Co. results

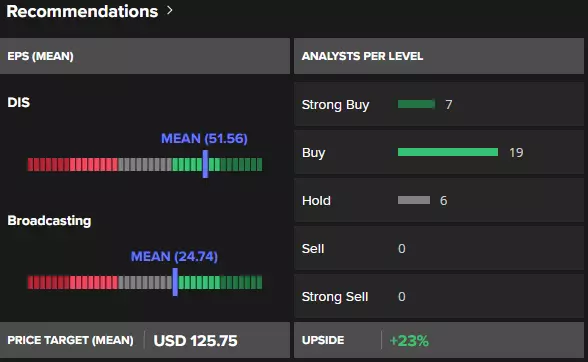

The below two graphics provide traders with both a retail short term view on the stock, as well as an institutional longer-term view on the company, as to how market participants are positioning themselves on the Walt Disney Co. ahead of the results release.

A Refinitiv poll of 33 analysts maintain a long-term average rating of buy for the Walt Disney Co. (as of the 2nd of May 2023), with 7 of these analysts recommending a strong buy, 19 recommending a buy, 6 hold and no sell or strong sell recommendations on the stock.

A mean of analyst price targets for the stock suggests a longer-term fair value of $125.75 a share, roughly 23% higher than the current traded price (as of the 2nd of May 2023).

From a retail trader perspective (as of the 2nd of May 2023), 99% of IG clients with open positions on the Walt Disney Co. expect the price to rise over the near term, while 1% of IG Clients with open positions expect the price to fall.

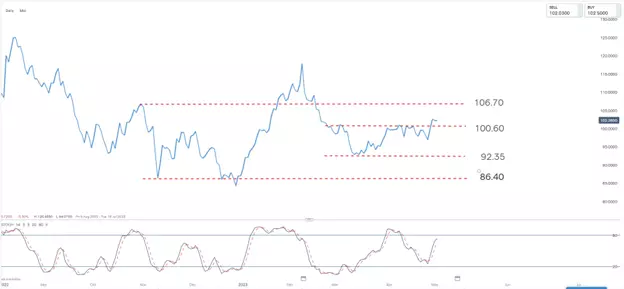

Disney earnings: technical analysis

The share price of Disney continues to trade in a broad sideways price environment. Range trading between price levels might in turn be preferrable than trend following techniques at this stage. In the near term a break of the 100.60 level suggests 106.70 as the next upside resistance target.

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Live prices on most popular markets

- Forex

- Shares

- Indices