Futures vs options: what are the key differences?

Learn how to navigate the complex arena of futures and options trading by understanding the differences. Plus, find out how to trade both with us.

What’s the difference between futures and options?

The difference between futures and options lies in the obligation passed on to you when you purchase them. They are both financial contracts you would open to trade on a wide variety of markets. You’re required to settle your trade in full with futures. But with options, you can simply choose not to and pay the premium – also known as the deposit or margin.

As both futures and options are leveraged, they both have expiry dates, upon which you would settle the difference between the contract’s opening and closing price.

It’s important to note that while trading leveraged derivatives amplifies profits, it also magnifies losses. That’s because both are based on the full value of the trade, not the margin used to open it. If the market moves against you, you may lose more than your original. It’s important to manage your risk when trading leveraged derivatives.

Both options and futures are exchange-traded derivatives (ETDs), and can be traded over the counter (OTC) with us using a CFD account. By trading futures and options OTC with us, you’re guaranteed easier market access, you may get certain tax benefits and you won’t have to sign contracts or take delivery of the underlying futures and options you trade.

To help understand the difference between futures and options, we have included a detailed breakdown of each.

What are futures?

Futures are derivative financial contracts between a buyer and a seller, in which they both agree on a price and expiry date to exchange an underlying market for. When these two parties enter a futures contract, the buyer is obligated to buy the underlying market, and the seller is obligated to sell it, at or before the contract’s predetermined expiry date and price.

Futures are often used to hedge against anticipated but undesirable price changes in an underlying market to protect against losses. For example, a company may buy futures in a specific commodity to hedge against the possibility of said commodity’s price rising.

This is because buying a commodity’s futures contract means companies can lock in a price, and the price for the futures contract will remain the same – even if the underlying commodity’s price rises.

What are options?

Options are financial derivative contracts that give the buyer the right to buy or sell an underlying asset at a price and expiry date, which is agreed upon between the buyer and the seller. The buyer will pay a premium – also known as a margin – for each contract. This margin is based on the expiry date of the contract and the strike price, which is the price for buying or selling an underlying asset until the expiry date.

Unlike with futures, investors who purchase options contracts are under no obligation to sell or buy the underlying asset when the contract expires (or if the strike price moves beyond the price range before the expiry). They can simply choose to pay the premium and not exercise their right to buy or sell.

You can buy or sell options if you believe a market’s price will rise or fall. You can purchase an option to buy – known as a call option – if you think the market will rise. If you think the market will fall, you can purchase an option to sell – known as a put option.

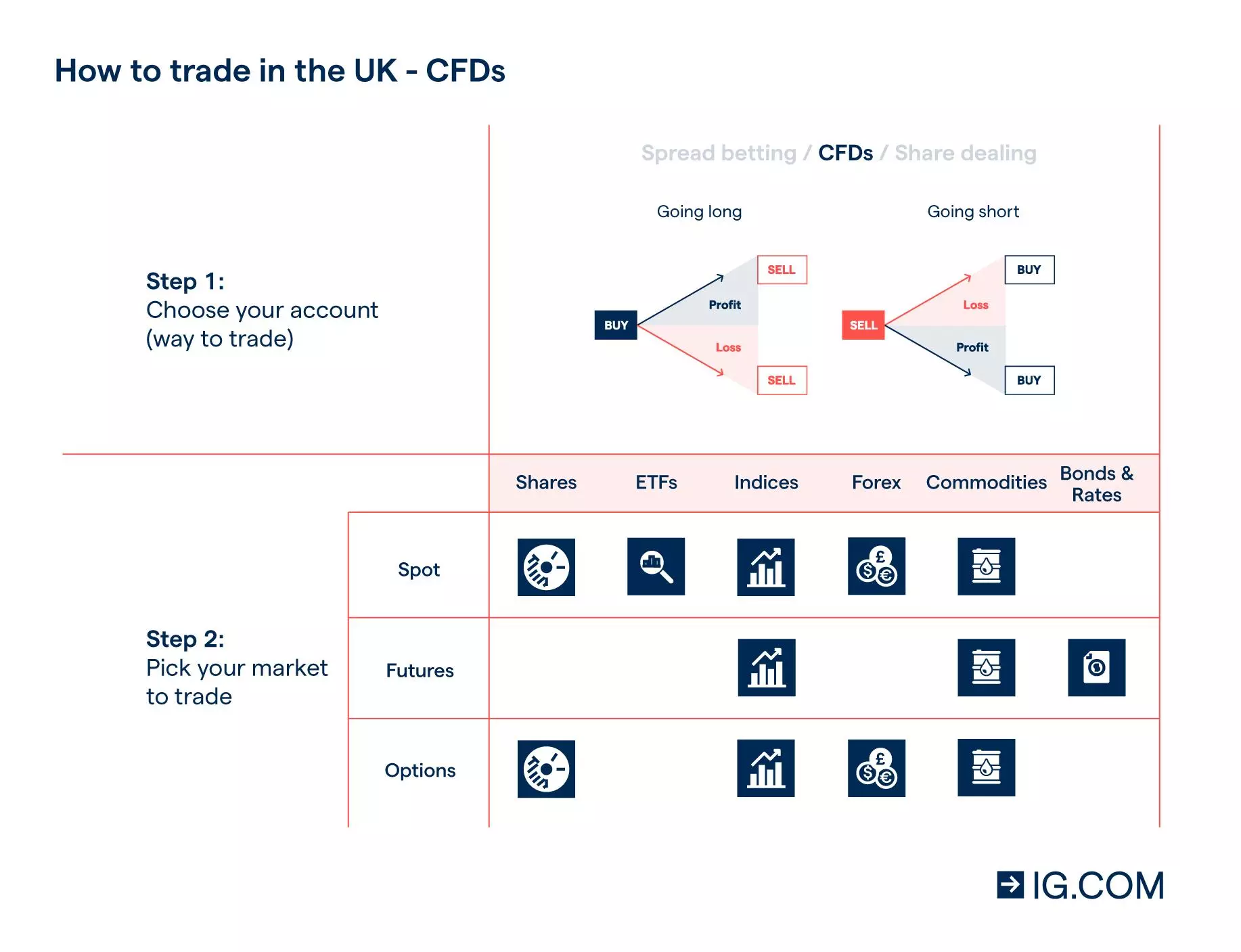

Futures vs options: how to trade

With us, you can trade futures or options with CFDs. You can also trade CFDs on spot prices. Using CFDs to trade futures or options gives you exposure to their markets, but you aren’t required to take on any obligations or worry about the complexity associated with options and futures trading.

By using financial derivatives, you’ll be able to speculate on rising and falling market conditions of the underlying asset. This is because you can ‘buy’ (or go long) when you feel a market is going to rise or ‘sell’ (go short) when you believe it’ll fall. This also allows you to escape the institutionally dominated space of traditional futures trading.

The margin for 'buying' an option is the opening price (or premium) multiplied by the size of the bet. This is the maximum amount that the bet can lose. The margin for 'selling' an option is the same as the margin incurred when trading the underlying futures market.

CFDs allow you to trade a wide variety of financial markets, like forex, commodities, indices, equities and more.

Interested? Open a live account if you are feeling confident.

We also offer spot trading, which allows you to trade on the current market of an underlying asset with no fixed expiry date. Spot prices have tighter spreads, but they also require you to pay overnight funding. This makes spot trading ideal for intraday traders.

CFD markets for futures, options and spot

| CFD market | Futures | Options | Spot |

| Shares | No | Yes | Yes |

| ETFs | No | No | Yes |

| Indices | Yes | Yes | Yes |

| Forex | No | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Bonds and rates | Yes | No | No |

Benefits and risks of futures trading

- Benefits of trading futures using derivatives:

- Pay no capital gains tax or stamp duty

- Gain access to 24-hour dealing

- Get no commission, just our spread

- Trade with leverage

- Enjoy no overnight funding charges

- Speculate on long-term market movements

- Hedge against volatility

- Find deep internal liquidity and ensure best execution no matter the expiry

Risks of trading futures using derivatives:

- If the market moves against you, you may lose more than the initial deposit

- Potentially amplify your profits and your losses

Benefits and risks of options trading

- Benefits of trading options using derivatives:

- Gain access to 24-hour dealing

- Get no commission, just our spread

- Trade with leverage

- Receive no overnight funding charges

- Enjoy limited risk

- Find daily, weekly, monthly or quarterly contracts

- Trade intraday or longer term

- Pay zero spread on expiry

Risks of trading options using derivatives:

- Amplified profits and losses

Unsure of where to start? Try our demo trading account. You’ll be able to familiarise yourself with the nuances of trading not only futures and options, but CFDs as well – with £10,000 in virtual funds. Or, dive into our wealth of informative content on IG Academy and learn all about trading.

Futures vs options summed up

- Both futures and options are financial contracts used to speculate on a market’s price movements

- Futures and options differ in the obligation passed onto the contract buyer. With futures you are required to settle your trade in full, but with options you can choose to pay the margin, or deposit

- You can trade futures and options with us on your CFD account, allowing you to trade without any obligations or the need to understand the nuances of the contract

This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients.

Explore the markets with our free course

Discover the range of markets and learn how they work - with IG Academy's online course.