Nasdaq 100: Marathon Digital continues to surge after earnings

Recent earnings from Marathon Digital have driven the stock to an eleven-month high.

Marathon Digital fundamental background ahead of its Q1 trading statement

Marathon Digital Holdings, Inc (MARA) which works in the digital asset technology industry, recently shared its impressive earnings for the quarter that ended on May 10th. The company did better than expected, reporting a loss per share of 5 cents, compared to the forecast loss of 10 cents.

Marathon Digital focuses on mining digital assets within the blockchain ecosystem in the United States. It was originally named Marathon Patent Group, Inc., and changed its name to Marathon Digital Holdings, Inc in February 2021 to better reflect its main operations.

With a market value of $2.66 billion and a beta of 5.02, Marathon Digital has proven itself to be a major player in the digital asset technology industry. The company has strong financial indicators like a current ratio and quick ratio of 16.22, showing that it can meet its short-term financial obligations.

A debt-to-equity ratio of 1.34 indicates that borrowing levels remain under control, an important factor in this period of rising interest rates.

What do analysts think of Marathon Digital Holdings?

Refinitiv data shows a consensus analyst rating of ‘buy’ for Marathon Digital – 1 strong buy, 2 buy and 3 hold - with the median of estimates suggesting a long-term price target of $14.40 for the share, roughly 17% lower than the current price (as of 11 July 2023).

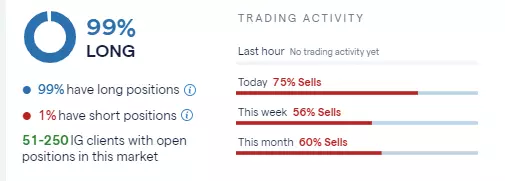

IG sentiment data shows that 99% of clients with open positions on the share (as of 11 July 2023) expect the price to rise over the near term, while only 1% of clients expect the price to decline. This week and month 56% and 60% of clients respectively sold the share, though.

Marathon Digital share price – technical view

Marathon Digital’s share price has risen by nearly 400% year-to-date and after five consecutive weeks of rising prices doesn’t show any technical signs of topping out.

The next upside targets are the May 2021 low at $18.32, followed by the August 2022 high at $18.88 and the July 2021, January-to-March 2022 lows at $19.43 to $20.61.

Marathon Digital Weekly Candlestick Chart

After a six week sideways trading spell from May to mid-June the Marathon Digital’s share price has suddenly taken off and has been rising in a steep upward manner ever since.

Slips should find support along the one-month uptrend line at $15.67, followed by the last daily reaction low made at last Thursday’s $14.51 low. While above this level, immediate upside pressure should be maintained.

Marathon Digital Daily Candlestick Chart

Further potential support at the $12.83 April peak is more significant but isn’t expected to be revisited anytime soon.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Seize a share opportunity today

Go long or short on thousands of international stocks.

- Increase your market exposure with leverage

- Get spreads from just 0.1% on major global shares

- Trade CFDs straight into order books with direct market access

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only