USD/ZAR Price forecast: rand lingers ahead of CPI & SARB

SARB likely to pause; US retail sales data keeps rand on the front foot; 200-day MA under the spotlight.

USD/ZAR Fundamental backdrop

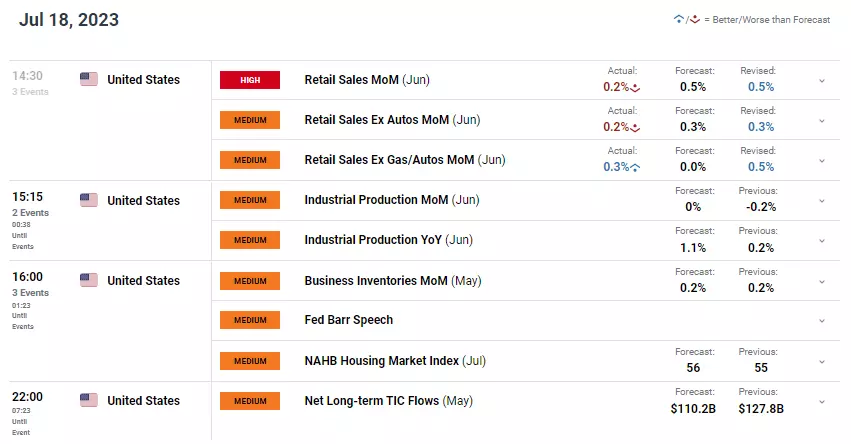

The rand is in for a volatile week with South African CPI and the South African Reserve Bank (SARB) interest rate decisions due. USD/ZAR has been on a downward trajectory over the last few weeks but has since stalled as incoming economic data comes into focus. US retail sales data (see economic calendar below) missed estimates further exacerbating fears around a US slowdown.

USD/ZAR Economic calendar (GMT +02:00)

Looking ahead, the SARB rate decision is most likely to result in a rate pause following many major central banks including the Federal Reserve as inflationary pressures are showing signs of decline. On a negative note, Chinese growth concerns have extended this week with GDP numbers hindering commodity price upside. That being said, markets have largely priced this in and any Chinese optimism could bolster ZAR gains.

Technical analysis

USD/ZAR Daily chart

Daily USD/ZAR price action above trades at a key area of confluence around the 200-day moving average (blue) and the 18.0000 psychological handle. Although there is bullish divergence unfolding between USD/ZAR prices and the Relative Strength Index (RSI) oscillator, there is still room for further downside to come. Considering inflation is projected to decline alongside a rate pause, a slowdown in recent rand gains may subside short-term. Should the pair end the week below 18.0000, this could be seen as a bearish signal, exposing subsequent support zones thereafter.

Resistance levels:

- 18.2500

- 18.0000/20-day moving average (blue)

Support levels:

- 17.7000

- 18.5000

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only