Wall Street: All eyes on CPI and market correction signals

US equity markets faced headwinds last week as rising yields and economic data signaled challenges ahead; the Nasdaq, S&P 500, and Dow Jones experienced losses and all eyes are on the crucial CPI release.

US equity markets closed lower last week as US yields resumed their march higher on the back of robust economic data, corporate issuance, and higher energy prices. For the week, the Nasdaq lost 1.4%, the S&P500 lost 1.29%, and the Dow Jones lost 0.75%.

Ahead of Wednesday night's all-important CPI release, the rates market is assigning a 93% chance that the Fed will keep rates on hold in September. It then sees a 43% chance of a rate hike in November, which we think will likely be the one that ends the Fed's rate hiking cycle.

What is expected from the CPI data

Thursday, September 7 at 12:00 am AEST

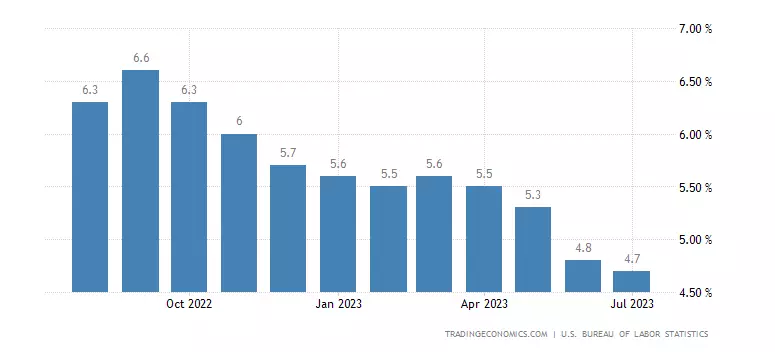

In the previous month, the headline CPI accelerated to 3.2% from 3.0% in June but remained below forecasts of a rise to 3.3%. This marked the end of 12 consecutive months of declines in headline inflation due to base effects. Core CPI, which excludes volatile items such as food and energy, eased to 4.7% last month from 4.8%, reaching the lowest level in twenty-two months but still remaining well above the Federal Reserve's target.

For the current month, the forecast for US headline CPI is a 0.6% month-on-month (MoM) increase, which would result in an annual rate of 3.6% year-on-year (YoY). In contrast, core inflation is expected to rise by 0.2% MoM, leading to an annual rate decline to 4.3%.

While it is likely that inflation has reached its peak, core inflation remains persistent. The Federal Reserve will closely monitor the data in the coming months to confirm that progress is being made toward lower inflation levels.

US core inflation chart

S&P 500 technical analysis

The prevailing perspective suggests that the correction in the S&P 500, which commenced in July, still has room to extend. Specifically, we anticipate another downward move to retest and breach the mid-August low, with the potential to challenge the uptrend support at 4250, thereby completing a Wave IV (Elliott Wave) corrective pullback.

If the anticipated pullback unfolds as projected, we would then foresee a recovery phase. This recovery could entail the S&P 500 testing and surpassing the highs of July, possibly positioning itself for a test of the bull market's 2022 peak at 4818.

S&P 500 daily chart

Nasdaq technical analysis

Similar to the setup above in the S&P 500, the view remains that the correction in the Nasdaq, which started in July, has further to go. Specifically, we are looking for another leg lower to retest and break the mid-August low with the potential to test wave equality support in the 14,200/14,000 area to complete a Wave IV (Elliott Wave) corrective pullback.

Should the pullback play out as expected, we then expect to see a recovery, which would see the Nasdaq test and break the highs of July and possibly set up a test of the bull market of 2021, with a high at 16,764.

Nasdaq weekly chart

- TradingView: the figures stated are as of September 11, 2023. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation.

This information has been prepared by IG, a trading name of IG Markets Ltd and IG Markets South Africa Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. See full non-independent research disclaimer and quarterly summary.

Live prices on most popular markets

- Forex

- Shares

- Indices

Prices above are subject to our website terms and agreements. Prices are indicative only