What is a stop order and how do you place one?

Stop orders are a way to enter the market at a predetermined price. Explore important information that you need to know about stop orders in trading.

What is a stop order?

A stop order, sometimes called a stop-entry order, is an instruction to your trading broker to open a trade when the market level reaches a worse, predetermined price. If you’re buying, ‘worse’ means a higher price but if you’re selling, it means a lower price. You can place a good-till-cancelled or good-till-date order – but selecting a price that’s worse than the current price will always be a stop order. If the price you select is better, it’s a limit order.

What’s the difference between a stop order and a stop-loss?

While a stop order is a type of working order, a stop-loss is a risk management tool that you can attach to your trades to mitigate potential losses once your position is open.

For example, for a long position on Tesla shares, you can set a stop-loss at a lower price that will automatically close out your position if the share price drops to this level or beyond. You can place a stop-loss on a leveraged stop order, but the position won’t be open until the price level you set is reached – so, the stop-loss won’t affect the trade until it’s filled.

What’s the difference between a stop order and a market order?

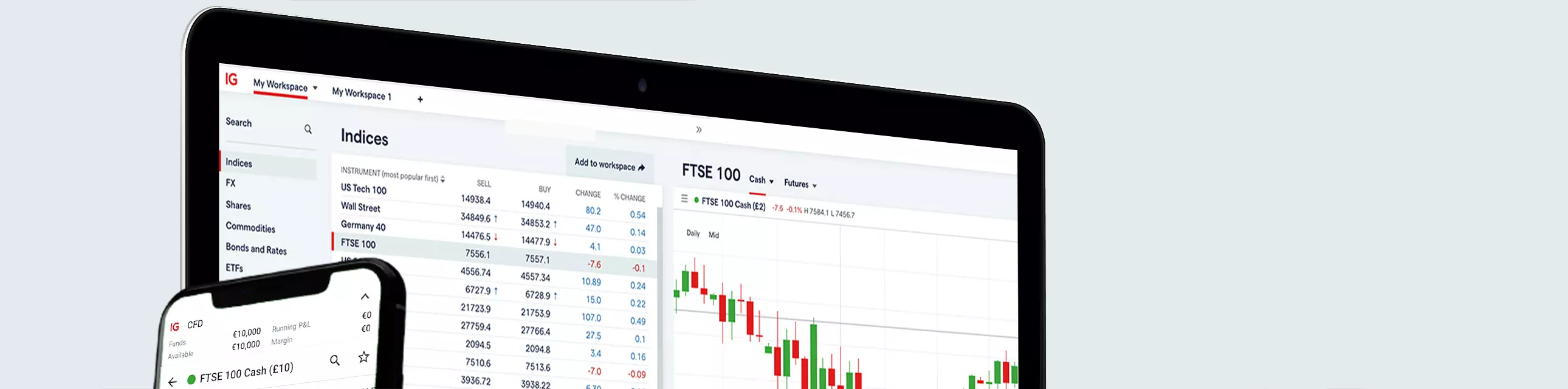

The main difference between a stop order and a market order is the entry price level that you accept to open your position at. A stop order is a type of working order – that’s set via the ‘Order’ tab of the deal ticket on our platform – to enter a position once a specific, less favourable price level has been reached. Whereas a market order is an instruction to open a trade immediately, at the current market price; or as soon as possible, at the next available price – this is set using the ‘Deal’ tab of the deal ticket on our platform.

With stop and limit orders, your trade could be filled partially if your preferred price level is reached – this is based on liquidity, ie whether there are enough willing buyers or sellers to counter your position. Whereas with market orders, your trade will be opened at the full position size you set – but it could be opened at the next available price, instead of the current price you see on the deal ticket.

How does a stop order work?

Once set, stop orders are designed to work automatically, so you don’t have to watch the market constantly to check whether prices will become more favourable for you. This is especially useful in volatile markets when prices change suddenly, and you don’t have time to manually open a trade during a short window of opportunity.

Remember, if you’re buying (going long), your stop-entry order level will be above the current price. If you’re selling (going short), your stop-entry order will be below the current price.

How to place a stop order

- Open a trading account to get started, or practise on a free demo account

- Conduct technical and fundamental analysis on the market you want to trade

- Select the 'Order' tab on the deal ticket of the market you're trading on

- Decide whether you’re going long or short

- Choose between a ‘good till cancelled’ stop entry, which will run until the predetermined price level is met (unless you cancel it), and a ‘good till date’ order, which will close out automatically on a predetermined future day if the order isn’t executed

- Pick your price level – the ‘worse’ amount at which you want your stop entry to be triggered – and place your order (based on the opening price that you choose, our platform will show you whether it’s a stop or limit order on the ‘Place order’ button)

- Your position will open automatically when the market hits your price level

Example of a stop order

Let’s say you’ve conducted your own analysis and believe that the Apple share price, which is currently at 142.50, will start rising soon. So, you decide to go long on the shares and place a stop-entry order at 145.00.

You set up the order to automatically buy 10 share CFDs of AAPL when the price hits 145.00. The margin requirement is equal to the number of shares x the price x the margin factor of 20%. That is, (10 x 145.00) x 20% = $290.

As you’ve predicted, the share price rises, and your position is automatically opened at 145.00. To protect any profits you might make, you set a limit at 159.50. If AAPL hits this level, you’ll be closed out, making a profit of $145 (calculated as 10 x [159.50 – 145.00]).

You also want to limit possible losses on this position, so you set a stop-loss at 134.50. If the Apple share price does drop to this level, your position will automatically be closed out and you’ll make a loss of $105 (calculated as 10 x [134.50 – 145.00]).

Benefits and risks of stop orders

Benefits of using stop orders

- You won’t need to constantly monitor the market, waiting and checking manually open a trade at your preferred opening price

- It could lead to a phenomenon called ‘positive slippage’ – where the market suddenly moves beyond your set amount, fulfilling your order at an even more desirable price

Risks of using stop orders

- There’s the chance that a position may never be opened, which could affect your trading strategy, because a stop order is ‘your price or worse’

- Stop orders don’t necessarily protect against losses – for that, you’ll need a stop-loss. However, a stop order could act as a stop loss if you set a working order to ‘net off’. While this is also possible on contract for difference (CFD) trading with us, it’s generally not an efficient way to go about it

Try these next

Discover key factors to consider when choosing a trading broker

Learn how you can find the best platform for intraday trading

Discover how to trade online, and access key markets