Bear market trading: how to trade falling markets

When it comes to markets, there are two top animals in the zoo: bears and bulls. Find out how to trade declining markets and learn more about bearish strategies.

What's on this page?

- What is a bear market?

- 9 strategies traders use when prices are falling

- Why do people want to trade in bear markets?

- How to start trading in bear markets

- What causes bear markets and how long do they last?

- How often do downward markets occur?

- Bear markets vs economic recession: what's the difference?

- What are the different types of bear markets?

What is a bear market?

A bear market is a term for describing a type of economic climate characterised by markedly declining prices for most asset classes. In other words, markets are trending downward.

When most asset classes’ prices on the market fall by 20% or more, that generally signals the start of a bear run.

The opposite of a bull market, bear markets usually mean conservative and negative investor sentiment in which many opt to withdraw their money to avoid fading yields or cut their losses. This can lead to prices falling even further.

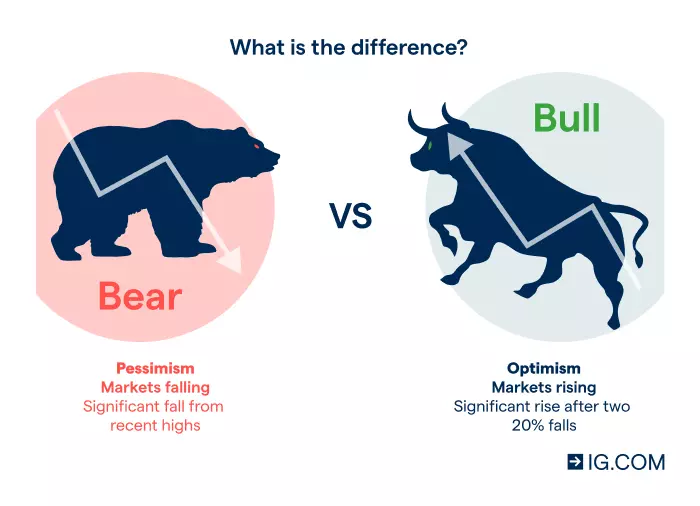

What’s the difference between a bear market and a bull market?

The difference between a bear market and a bull market is that bear runs are on a downward trend, while bull runs trend upwards. They also differ in terms of supply and demand, as well as in traders' behaviour.

Certain periods of time will be bull markets, during which demand (and risk-taking) is at a high with traders. This drives up market prices and, with it, even more enthusiasm for buying.

Later, markets will contract once again, leading to a bear run. This is due to the cyclical nature of macroeconomics. Typically associated with a receding economy, bearish downturns signify more supply than demand when it comes to trading.

Bear markets are largely pessimistic ones, so profits can be realised from short-selling early in the bear market. They can also come from buying at the bottom of a bear market or a buy and hold strategy, where traders simply wait out the bear market and ride the price rally up.

Knowing how to spot the difference between a bear and a bull market is key to trading successfully, because both have very different rules.

It’s important to be able to recognise a true bear market and how to move in it. If a short-term correction during a bull run is confused with a bear market, for instance, the outcome of trades will probably fall far short of what you’re hoping for.

9 strategies traders use when prices are falling

Take a short-selling position

Going short in bearish times is one of the most common bear market strategies among traders. As a trader, you’ll short-sell when you expect a market’s price will fall. If you predict this correctly and the market you’re trading on does decline in value, you’ll make a profit. If the price rises instead, you’ll make a loss.

Shorting can be done via CFD trading with us. It lets you speculate on price movements without taking ownership of the underlying asset. They’re also leveraged, meaning you’ll only need to put up a small initial deposit (called margin) to open a larger position. However, leveraged trades are inherently risky, as both profits and losses are calculated on the total position size, not your margin amount.

Also, short positions can, in theory, incur unlimited losses if the underlying stock appreciates in price instead of falls. This is because there’s no limit to how high a market can rise. This, plus leverage, means having a risk management strategy in place is crucial. Part of this means attaching stops to your positions.

There are many ways to short, depending on which market you want to trade.

Indices – going short on indices is a common way to trade in bearish times, as these track major global stock markets like the FTSE 100 and US 500 and enable you to track the price movements of an entire index in one go.

This means it could be less risky than putting all eggs in one basket by taking a position against one stock. Shorting major indices comes with low spreads and is the only way to speculate on the real index price directly. Plus, with us, you can short key indices 24/7, including at the weekend.1

Shares – you might short-sell shares if you think an individual stock has further to fall in a downturn. Let’s say you think rising interest rates spell bad news for the technology sector. You might short a tech stock that you think is exposed to this downside. If you predict a drop in price correctly, you’ll make a profit off your position.

ETFs – like indices, ETFs give you the opportunity to go short across a number of stocks all at once. An ETF’s exposure can span an index or a whole sector or industry. Going back to the tech sector example, ETFs might enable you to spread risk by shorting a tech ETF that tracks multiple stocks rather than shorting just the one.

If you’re looking to short an index specifically, indices trading might be better for you. That's because the price will be based on the real underlying index price (unlike ETFs) and there are likely to be lower spreads.

Commodities – you can go short on the price of commodities like oil, gold or silver. For example, you may believe supply is going to outstrip demand for soybeans in the near future. So you’d decide to short the price of soybeans. If you’re correct and the commodity’s price falls, you’ll profit.

Pros and cons of going short:

- There’s potential to make a profit by shorting, as it means you can make money if prices fall

- You can, however, also make a loss. Since there’s no limit to how high asset prices can climb, your potential for loss when going short is also theoretically unlimited

- When you short-sell with us, you’ll use CFDs, which is leveraged. This means you can open a larger position with a smaller amount of capital (called margin) as an initial outlay

- However, leveraged trades mean a greater potential for larger profits and losses, since both are calculated on your position size and not your margin amount

- If you have gone long with other positions, going short enables you to hedge in a bearish market

The main cost is the spread, except for shares and ETFs where a commission fee is charged instead. There are no overnight fees for futures but you’ll incur on cash, spot, undated positions

Find an entry position

In any sort of market, finding the right entry position for you – the exact point at which to open your position – can make or break a trade.

This is especially true of bear markets. Opening your position at the exact right moment during a downturn creates opportunities for traders to go short and make a profit if they speculate correctly.

On the other hand, bearish climates are ones when underlying assets’ prices can rapidly fall, sentiment may be negative and volatility often spikes. This means greater risk of bigger losses, fast – but also means potential for profit. Hence an effective risk management strategy, with stops on your positions, is all the more important.

Traders also use technical analysis to determine the best entry position for them.

Trade the VIX

A useful index to keep an eye on during downturns is the VIX (volatility index).2 Because the VIX charts volatility in the market, it’s a good indicator for trader sentiment. When bear markets cause panic, pessimism and sudden sell-offs, the VIX is often one of the first gauges to predict it.

While some traders watch the VIX only, others will actively speculate on it. The VIX often exhibits negative correlation between it and other indices and stocks – meaning that when other assets’ prices are going down, the VIX is likely to go up.

This means the VIX is a popular choice among traders for diversification and hedging one’s market exposure – two very effective strategies for bear markets.

Trade indices and ETFs

The VIX is only one avenue traders use during a bear run. You can also trade many other indices and ETFs, which is a popular strategy when markets are trending downward. That’s because both give you broad exposure to a whole group of stocks all at once, enabling you to speculate on them directly.

For example, you can trade directly on indices like the South Africa 40 Index to gain exposure to all 40 of the top companies in South Africa with one position.

ETFs encompass an entire basket of shares, often representing an entire industry or sector as a whole. They also fall into the category of ‘thematic trading’ – for example, you can trade cannabis stocks on the whole as a theme.

Both indices and ETFs are ways to diversify your portfolio during a bear market. Generally, the more different types of assets you have or trade during a bearish time, the more they’ll help you manage risk by hedging your exposure to any one market.

Diversify your holdings

This brings us onto an often underestimated, but very well-known strategy to remember during bear markets – diversity is your friend.

Traders can diversify by keeping open various positions of completely different asset classes. If your portfolio is made up of things that behave differently to one another and do well (or poorly) in opposing market conditions, you’ll always have something performing well, softening the risk of other underlying assets underperforming.

For example, the US 500 may go down during a bear market, but some of the companies within the index may not. So, instead of only trading on the US 500 itself, you could even trade on bonds where prices often move in the opposite direction of stock prices.

The more diffused your risk is during unpredictable times – like bear markets – the better you’ll be able to weather the storm, most of the time.

Focus on the long term

Like bears themselves, one of the strategies to employ during downturns is to hunker down and wait out the winter.

This is because of the cyclical nature of markets. While bearish periods are difficult to endure, history shows you probably won’t have to wait too long for the market to recover. Bear markets are followed by bullish rallies and often upswings occur sooner rather than later.

The 2019 to 2021 market was a good example of this. Before the Covid-19 pandemic downturn, we’d experienced the longest bull run in history, spanning nearly 11 years.

Trade 'safe-haven' assets

It makes sense to look for a harbour of refuge in stormy economic climes. For many traders, that’s 'safe-haven' assets.

These are markets that tend to retain or increase in value during volatile times when many asset classes do poorly. This is often because they’re negatively correlated with the economy.

The most shining (and famous) example of a safe haven asset is gold, but there are others too. These include government bonds, the US dollar, the Japanese yen and Swiss franc.

However, it’s important to remember that, just because an asset is traditionally considered a 'safe haven', doesn’t guarantee it’ll be one in every bearish market.

Trade currencies

As you can see from the 'safe-haven' list above, there’re some currencies that are known for doing well when markets are declining.

To try profit from this, you could take a position on the price of a declining economy by opting to short a currency. For example, you’d sell GBP/USD, if you thought the value of the pound would fall in comparison to the dollar.

A word of caution here, though – forex markets are famously volatile in tough times. During market downturns, it’s a good idea to understand the relationship between exchange rates and stock prices as much as possible to take advantage of any declining prices. However, there isn’t necessarily a clear-cut relationship, making it vital to perform thorough fundamental and technical analysis before opening a position.

Trade options

Trading options contracts, commonly known as options, gives you the right – but not the obligation – to buy or sell an underlying asset at a specific price by a set point of expiry. This means that you can choose not to exercise this right if you want.

Two common options strategies for hard times are:

- Buying put options

- Writing covered calls

When you buy a put option on a stock, you’d do so believing that the company’s share price will not rise in value. If the share price falls – or even stays the same – you’ll make a profit. This is different to going short with normal derivatives trading such as CFDs, where you’ll only make a profit if the share price drops.

This can be less risky than traditional short-selling because you can just let an option expire at no cost to you, should markets suddenly turn more optimistic.

Writing covered calls is more of a hedging strategy – you’re selling a call option against a stock that you already own. Basically, this involves accepting the obligation to sell that stock to the holder of a call option. If the buyer chooses to exercise the option, you’ll sell that stock, at that specified price.

This can be useful in a bear market if you were planning selling your shares anyway, as a way to earn some profit from the sale.

Remember, with us you can only trade derivatives via CFDs.

Why do people want to trade in bear markets?

Traders want to open positions during a bear market because:

- Bear markets can mean opportunities to buy quality stocks and other assets for lower amounts than you’d be able to otherwise

- Some markets, such as bonds, defensive stocks and certain commodities like gold often perform well in bearish downturns

- If you have the risk appetite for it, bear markets may also be an opportunity to short-sell if trading, making a profit if you predict correctly when prices will fall (and make a loss if you don’t)

How to start trading in bear markets

- Research your preferred market

- Create a live account or practise on a demo

- Take steps to manage your risk

- Open and monitor your first position

What causes bear markets and how long do they last?

The different types of bear markets (which we’ll discuss later) are caused by various things. These include macroeconomic events like a recession and normal downturns in the business cycle.

As such, there are no hard and fast rules as to how long a bear market will last. The best way to determine this is on a case by case basis, watching each bear market for signs that it will continue or that an upswing will occur.

*Please note: this is a pictorial representation of bear and bull markets and is used for illustration purposes, not an accurate representation of the US Tech 100 index.

How to identify bear markets

There are a few signs that herald bearish times. These include:

- Economies decline – when the economy contracts, it’s usually a sign that the stock market will take a downturn too. This can even lead to a recession

- Market rallies fail – uptrends that don’t gain any momentum and fizzle out are the most common sign that a bear market is nigh, because it means that the bulls are losing control of the market

- Interest rates rise – this usually means consumers and businesses will cut spending, causing earnings to decline and share prices to drop

- Defensive stocks outperform – if consumer staples companies start to enjoy significant gains, it often signifies that a period of economic growth is over, as people are purchasing less luxury or unnecessary items

How often do downward markets occur?

As we’ve discussed, a depressed market can be caused by different things. This means it’s hard to know when and how frequently they’ll hit.

Plus, not all downward markets are created equal. Retracements and pullbacks can happen multiple times a day during volatile times, while larger downturns like corrections, bear markets and recessions happen less frequently. For example, analysts tend to expect one market correction every two years.

One thing that can be predicted is that upswings and their correlated downturns are often in proportion to one another. So, bigger swings in market momentum like bear runs tend to happen less, but last for longer and have a greater fallout. For example, the most recent bear markets of note were caused by the Covid-19 pandemic and the 2008 global financial crisis. Both lasted hundreds of days.

However, it’s just as important to remember that markets are cyclical and upswings, or periods of bullishness, almost always last longer and happen more often than bearish downturns. In between the Covid-19 and 2008 bear runs, for example, was a bullish period so long that it almost spanned 11 years.

Bear markets vs economic recession: what’s the difference?

Bear markets are closely associated with economic recessions, but they’re not the same thing.

A bear run is a period of continuing decline in the prices of the market, but how much of a decline and for how long is imprecise. It simply means a significant downturn.

Recessions, on the other hand, are far more specific. They’re times with negative growth or at least 2% reduction in the gross domestic product (GDP). They usually need to last for at least two consecutive quarters for analysts to declare a recession.

While they’re not the same thing, bear markets and recessions often have the same causes and effects, such as negative investor sentiment, geopolitical crises, uncertainty and reduced consumer spending.

What are the different types of bear markets?

Analysts and market experts differentiate between bear markets based on what caused the downturn. There are three different types of bears:

- Event-driven: when macroeconomic headwinds cause a downward spiral in markets’ prices

- Cyclical: when the market automatically corrects itself after a time of bullishness at the end of a business cycle, usually set off by climbing inflation and interest rates

- Structural: when a financial bubble or some other kind of economic imbalance collapses, the resulting instability causes bear markets. For example, the misplaced internet-related overoptimism in the market during the 1990s caused what was known as the ‘dotcom bubble’

Is a bear market good for trading?

A bear market is neither good for trading, nor bad for it – it’s simply a part of the business cycle. This means some markets will underperform during a bear market, while others will outperform.

Just like during any other market, doing research and technical and fundamental analysis will determine what trading strategy is best for you during a bear run.

What’s the difference between a bear market and a market correction?

A bear market is a period of significantly depressed or falling prices for most asset classes and can be caused by multiple things, such as economic crises.

A correction is limited to that specific asset, and is usually far shorter-term. It’s the market changing momentum to decline slightly after a period of significant optimism in order to balance or ‘correct’ itself.

How can I tell if a bear market is coming?

Watch for signs like market upswings failing to gather momentum, economies contracting sudden uptrends in defensive stocks like consumer staples and rising inflation and interest rates.

How can you profit from a bear market?

No one can guarantee you a profit, or a loss, from any market. But you can maximise your chances of a profit in a bear market by following bearish-friendly strategies. These include diversifying your holdings, focusing on the long-term, taking a short-selling position, trading in 'safe haven' assets and buying at the bottom.

Can you lose money during a bear market?

You can lose money in any market. With the volatility, pessimism and uncertainty that tend to come with bear markets, it’s an especially important time to ensure you’ve got an adequate risk management strategy in place. This is especially true if you use short-selling as a bear market strategy.

Try these next

Discover how to take advantage of volatility in a variety of ways – and trade over 17,000* markets

*IG Group's total markets

Start trading over 70 US markets with our exclusive out of hours offering.

We're clear about our charges, so you always know what fees you will incur.

1 24/7 excludes the hours from 10pm Friday to 8am Saturday (UK time), and 20 minutes just before the weekday market opens on Sunday night. International times may vary.

2 We price our Volatility Index (VIX) contracts in a different way to the rest of our cash index markets. Rather than aiming to replicate the underlying index price, we follow the method used to derive our undated commodity prices. This means that there is a difference between our undated price and the underlying index price on these markets. Funding is also calculated in line with the undated commodity method. Please see our overnight funding page for more details.