Trading vs investing: your guide to the key differences

Trading and investing offer different types of exposure to the financial marketplace. In this guide, we’ll unpack how the two vary, including how features compare.

What’s the difference between trading and investing?

Trading is speculating on financial market underlyings without having to own them; whereas, investing is taking outright ownership of financial assets. Remember, with us you can only trade derivatives via CFDs.

Below are some key points of comparison between the two:

Trading

- Can speculate on both rising and falling market movements

- Only a margin deposit, known as ‘leverage’ is required to open a position

- Typically done over the short term

Investing

- Caters to bullish market assumptions only

- Have to commit the full investment value upfront

- Generally done over the long term

What is trading?

Trading is taking a position on the price of an asset without owning the asset itself, ie you’re only predicting how it performs on the financial market. With us, you’d trade using CFDs, which are financial derivatives that enable you to get exposure to the full value of the position at only a fraction of the cost.

Without ownership, you can speculate on both rising (going long) and falling (going short) prices – either way, you’d make a profit if your prediction is correct. Going long means you’re speculating that the market price for that asset will rise, while going short means you believe that the asset will fall in value.

CFDs are leveraged, which means that you’d only put down an initial deposit to open a larger position. In essence, you’d borrow that amount from the provider to make a bigger trade. With leverage, you can make your capital go further. While leverage brings your initial outlay down significantly, it also amplifies both possible profits and losses – so it’s vital to manage your risk properly.

Markets to trade

You can trade more than 13,000 markets with us. These include:

- Forex

- Indices

- Shares

- ETFs

- Commodities

Bonds and interest rates

What is investing?

Investing is the act of buying a financial asset, owning it outright, with the aim of making a profit down the line. For example, purchasing a company’s shares in the hopes that its share price will appreciate in future.

The full investment value, which can be a significant amount, needs to be committed upfront. This initial outlay also represents the full extent of risk involved, eg if a company goes bankrupt, with its share price dropping to zero, the entire capital amount would be on the line.

Potential for profit is exclusively linked to an appreciation in the asset’s value – so, going long is the only option. Going long represents a belief that the price of an asset will rise. In addition to the possibility of buying low and selling high, dividends are another way to potentially profit (in the case of equities). But some companies don’t pay dividends as there’s no obligation to do so.

Trading vs investing overview

Trading and investing differ characteristically, which affects various factors such as buying power, capital efficiency and how the outcome of the trade is determined.

Below are some important questions to consider when comparing trading and investing:

|

Trading |

Investing |

Will you own the asset? |

No |

Yes |

Can you go short? |

Yes, you can go short to speculate on prices falling or long to speculate on prices rising. |

Not as standard. To short stocks with traditional short-selling, shares would need to be borrowed (from a broker) to be sold, and then bought back later. However, we don’t offer this. |

Is the position leveraged? |

Yes |

No |

What’s the deposit required to open a position? |

Varies depending on the market and the total position size |

You’ll pay the full value of the position upfront |

What’s the timeframe? |

Intra-day, short and medium term |

Medium to long term |

How to start trading

CFD trading

With us, you’d trade via CFDs, which stands for ‘contracts for difference’ – you’d be entering into an agreement to exchange the difference in an asset’s price between the time you open a position and the time you close it.

With CFDs, you can go long or short depending on whether you think the market price will rise or fall. If your prediction is correct, the difference in price between when you opened the trade and when you closed it is your profit. If your prediction is incorrect, you forfeit that difference, instead, as a loss.

Right-click and edit to add details.

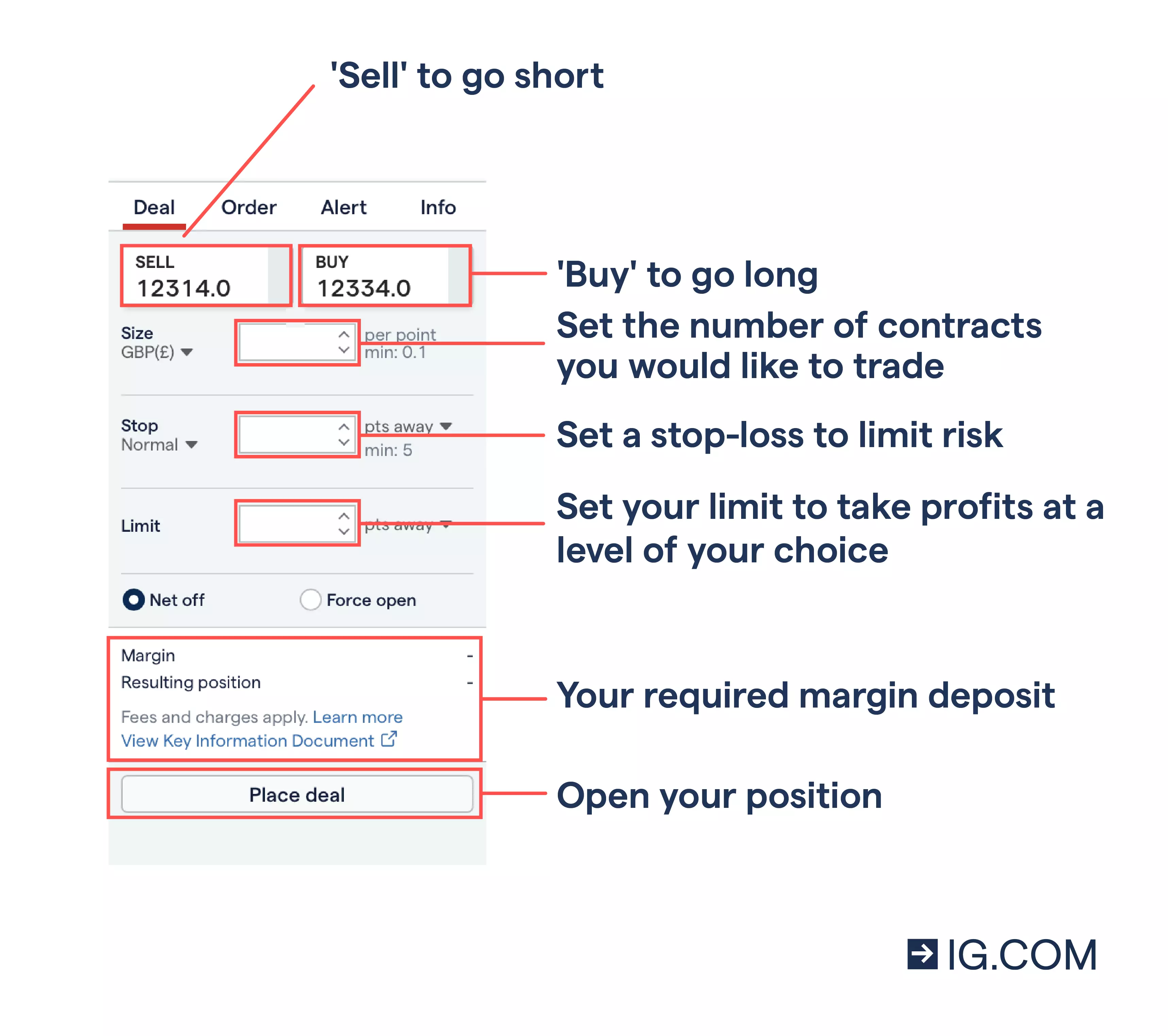

How to trade CFDs

- Do your research to get a solid understanding of how CFD trading works

- Create a live account or log in

- Look for opportunities and select your preferred asset

- Select ‘buy’ to go long, or ‘sell’ to go short

- Choose your position size and take steps to manage your risk

- Open and monitor your trade

Trading example

To illustrate how CFD trading works, we’ve put together a brief example based on a position of 5000 Greenlane shares.

| CFD trading | |

Buy price |

$0.50 |

Directional assumption and position size |

Buy (go long on) |

Margin amount |

20% |

Initial outlay |

$500.00 |

Sell price |

$0.51 |

Difference from |

0.01 |

Your gross profit |

$50.00 (0.01 x 5000)1 |

Value of full position |

$2550.00 (0.51 x 5000) |

Remember, this example may not be applicable to everyone as tax is based on the relevant jurisdiction and your individual circumstances and your position may require unique analysis. The table is for illustrative purposes only.

Essential trading concepts

Before you launch your trading journey, you need solid knowledge of the relevant base concepts. Here are a few you need to know:

What’s going long and going short?

In trading, going long and going short are the terms for the two main directions a market can move in. You’ll go long (or ‘buy’, also known as being bullish) if you think that the underlying will appreciate in price. Going short or ‘shorting’ a market (also known as ‘selling’ or being bearish) is the reverse – taking a position with the belief that the asset price will decline.

You’ll make a profit or loss depending on whether your prediction is correct. In other words, you’ll make a profit going long if market prices rise, or you’ll lose money if they fall. When shorting a market, you’ll make a profit its price depreciates, or you’ll incur a loss if it rises instead.

Remember, going short is an inherently risky strategy when trading, as your potential for loss is theoretically unlimited. This is because there’s no limit to how much an asset’s price can rise. So, ensure you always take steps to manage your risk.

What’s leverage?

Leverage is a feature that determines the way you open a position, how much you pay for it and how your losses are calculated – it enables you to open a larger position at only a fraction of the cost.

Unlike with investing, where you’d pay the full value of the trade upfront to buy that asset, leverage means you’d pay a small portion of the position’s worth upfront to take a position on the asset. When you close your trade for either a profit or loss, the calculation is based on the full position size, not the initial deposit you committed. Just as profits are payable to you, you’re solely liable for any losses.

Essential investing concepts

The start of a solid foundation when investing is knowledge of the key concepts. Here are a few you need to know:

What’s a stock exchange?

A stock exchange is a centralised financial marketplace where assets such as shares and bonds are bought and sold for money. Just as you’d go to a marketplace to buy and sell goods like food or clothing, financial assets like shares and ETFs have marketplaces, too.

What are dividends?

Dividends are payments given to shareholders by the company they’ve bought shares in, which usually come out of company profits. Companies that do well financially are more likely to give dividends, or larger dividend payments, than ones that are struggling. However, some companies choose to not pay dividends to fund ventures such as product development or expansion.

It’s important to note that companies aren’t required to pay dividends, but may choose to. Some companies pay dividends regularly and predictably, for example each quarter, while others give ‘special’ dividends more sporadically and only if certain profit margins are met. In such cases, dividends can be regarded as ‘bonuses’ rather than primary source investment income.

Companies announce their dividends ahead of time. When a stock is ‘cum dividend’, it’s due to be paid out soon, on the specified ‘payment date’. Close to this time, that stock is ‘ex dividend’, meaning that payouts are imminent and, if you were to become a shareholder at this point in time, you’d only be eligible for the next dividend and onward.

What causes share prices to rise or fall?

Share price appreciation and depreciation are determined by a number of factors, both within the company itself and the wider market.

Different shares are worth different amounts of money. A share’s value will vary depending on whether you’re looking at its fair value or its market value. The fair value is the intrinsic value of a stock based on the company’s fundamentals, while the market value is the amount that individuals are currently willing to pay for the stock.

At its simplest level, share prices and the value of ETFs increase when the company or fund is performing well in the marketplace, is well managed and has support or popularity from the public. Events like the company’s latest earnings season or a high-profile press conference can spike or drop share prices temporarily.

However, no company or ETF is an island – and wider market conditions and sentiment can affect share prices, too. These factors include macroeconomic events (for instance, the Covid-19 pandemic affected almost every company and ETF globally), major geopolitical events in the country that the company or ETF is domiciled in, as well as news and fiscal decisions on interest rates and the like. If the company or ETF in question is linked to a certain industry, for instance mining, the supply and demand for resources from that industry will also materially affect the share price or ETF value.

Remember, with us you can only trade derivatives via CFDs.

FAQs

How can I open a trading account?

Once you’re ready, you can open a live trading account with us by filling in the application form. We’ll ask you a few questions about your trading experience and verify your identity. Once you’re account is opened successfully, you can fund your account and start trading.

What is a demo account?

We offer a free practice account, called a demo, to help you maximise your probability of successful trading through gaining experience and confidence in a risk-free environment before opening a live account.

Opening a practice account with us is free and gives you access to a demo version of our live platform, plus R1,000,000 in virtual funds to practise trading (on the demo).

Where can I learn more about trading?

With us, you get free access to educational resources to learn more about trading and investing. This includes IG Academy, where you can undertake courses in your own time at various skill levels, from the most basic terms to advanced concepts.

We also have useful insights in the learn to trade section, including strategy and planning articles and news and trade ideas for more current events to keep abreast of in the trading world.

Try these next

Explore details on how to trade online

Learn how to trade shares online

Discover thousands of markets for you to trade on

1 With share CFDs, we charge a small commission when you open the position, and again when you close it. Commission fees affect net profits and losses. The amount payable in commission fees depends on your region. Explore the details on fees and charges.