The benefits of cryptocurrency trading

If you’re looking to get involved in the cryptocurrency sphere, one of the first steps to consider is whether you will buy the digital assets or speculate on their prices. Take a look at some of the benefits to trading on cryptocurrencies, and discover why it has become a popular alternative to buying coins outright. Interested in cryptocurrency trading with IG?

Why trade cryptocurrencies?

When you trade cryptocurrencies with IG, you are speculating on whether your chosen market will rise or fall in value, without ever taking ownership of the digital asset. This is done by using derivative products such as CFDs.

The benefits of cryptocurrency trading include:

Cryptocurrency volatility

Although the cryptocurrency market is relatively new, it has experienced significant volatility due to huge amounts of short-term speculative interest. For example, between October 2017 and October 2018, the price of bitcoin rose as high as $19,378 and fell to lows of $5851. Other cryptocurrencies have been comparatively more stable, but new technologies are often likely to attract speculative interest.

The volatility of cryptocurrencies is part of what makes this market so exciting. Rapid intraday price movements can provide a range of opportunities to traders to go long and short but also come with increased risk. So, if you decide to explore the cryptocurrency market, make sure that you have done your research and developed a risk management strategy.

Cryptocurrency market hours

The cryptocurrency market is usually available to trade 24 hours a day, seven days a week because there is no centralised governance of the market. Cryptocurrency transactions take place directly between individuals, on cryptocurrency exchanges all over the world. However, there may be periods of downtime when the market is adjusting to infrastructural updates, or ‘forks’.

With IG, you can trade cryptocurrencies against fiat currencies – such as the US dollar – from 8am Saturday to 10pm on Friday (UK time).

Improved liquidity

Liquidity is the measure of how quickly and easily a cryptocurrency can be converted into cash, without impacting the market price. Liquidity is important because it brings about better pricing, faster transaction times and increased accuracy for technical analysis.

In general, the cryptocurrency market is considered illiquid because the transactions are dispersed across multiple exchanges, which means that comparatively small trades can have huge impact on market prices. This is part of the reason cryptocurrency markets are so volatile.

However, when you trade cryptocurrencies with IG, you can get improved liquidity because we source prices from multiple venues on your behalf. This means that your trades are more likely to be executed quickly and at a lower cost.

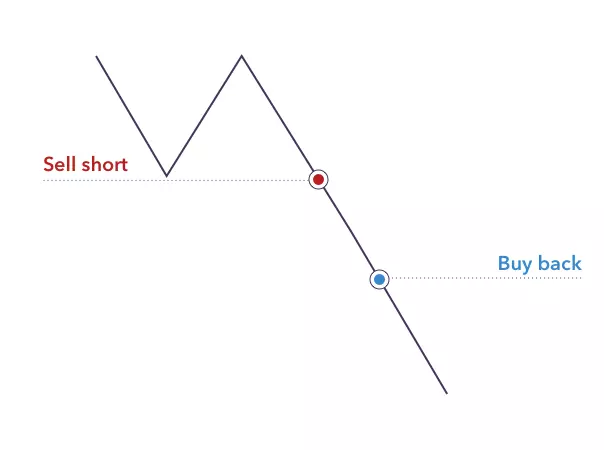

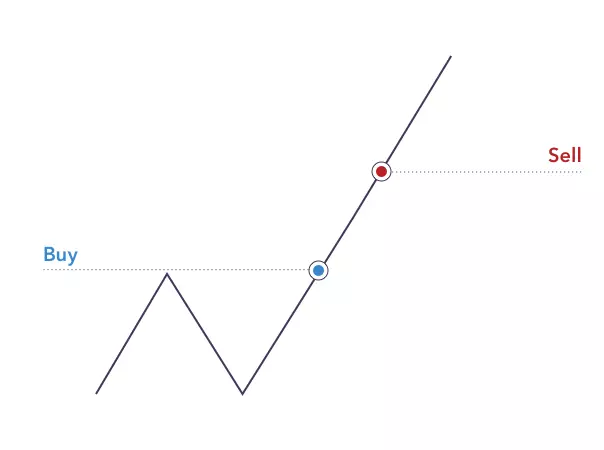

Ability to go long or short

When you buy a cryptocurrency, you are purchasing the asset upfront in that hope that it increases in value. But when you trade on the price of a cryptocurrency, you can take advantage of markets that are falling in price, as well as rising. This is known as going short.

Short Selling

Going long

For example, let’s say that you have decided to open a short CFD position on the price of ether because you believe that the market is going to fall. If you were right, and the value of ether fell against the US dollar, your trade would profit. However, if the value of ether rose against the US dollar, your position would be making a loss.

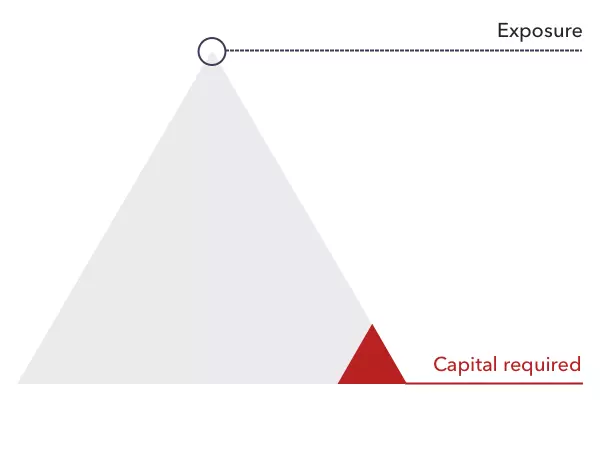

Leveraged exposure

As CFD trading is a leveraged products, it enables you to open a position on ‘margin’ – a deposit worth just a fraction of the full value of the trade. In other words, you could gain a large exposure to a cryptocurrency market while only tying up a relatively small amount of your capital.

The profit or loss you make from your cryptocurrency trades will reflect the full value of the position at the point it is closed, so trading on margin offers you the opportunity to make large profits from a relatively small investment. However, it can also amplify any losses, including losses that could exceed your initial deposit for an individual trade. This is why it is crucial to consider the total value of the leveraged position before trading CFDs.

It is also important to make sure that you have a suitable risk management strategy in place, which should include the appropriate stops and limits.

Faster account opening

When you buy cryptocurrencies, you’ll need to buy and sell via an exchange, which requires you to create an exchange account and store the cryptocurrency in your own digital wallet. This process can be restrictive and time consuming.

But when cryptocurrency trading with IG, you won’t need access to the exchange directly because we’re exposed to the underlying market on your behalf. You won’t need to set up and manage an exchange account, so you could be set up and ready to trade much more quickly.

Should I buy or trade cryptocurrencies?

Before you make a decision about whether to buy or trade cryptocurrencies, it is important to consider the differences between the two methods in detail. Watch our video and view the table below for more information.

You might be interested in buying cryptocurrencies if...

- You want to take full ownership of the cryptocurrency

- You’re happy to pay the full value of the asset upfront

- You want to gain direct exposure to one underlying exchange per account

- You’re happy to wait for an exchange account before you can buy or sell

- You don’t mind introductory limits or maximum deposits

- You don’t mind paying additional fees for deposits or withdrawals

You might be interested in trading cryptocurrencies if...

- You want to speculate on the price of a cryptocurrency without owning the digital asset

- You want to leverage your position, so that you only put up a fraction of the cost upfront

- You want to gain exposure to multiple exchanges from one account

- You want to start trading straight away

- You don’t want a maximum deposit limit

- You don’t want to pay deposit or withdrawal fees

FAQs

What are good cryptocurrency pairs for beginners to trade?

There is no right cryptocurrency to trade for beginners because each is different, providing a range of benefits and risks to the trader. The best cryptocurrency for you will also depend on your trading goals, attitude to risk and interests more generally.

With IG, cryptocurrencies are traded against fiat currencies. The main pairings are bitcoin/USD, ether/USD and litecoin/USD.

How risky is cryptocurrency trading?

Due to the high levels of volatility, the cryptocurrency market can be considered risky. Before you start to trade cryptocurrencies, you should outline your appetite for risk, and implement a suitable risk management strategy.

What are the benefits of cryptocurrencies for the global economy?

The benefits of cryptocurrencies for the global economy are thought to range from lower transaction fees for the online exchange of money, to increased protection from identity theft due to the secure nature of cryptocurrencies.

It is also thought that cryptocurrencies will help break down the barriers to finance in developing nations. For example, cryptocurrencies could easily be accessed via mobile phones in countries without banking infrastructure.

Will cryptocurrencies be regulated?

Although there has been a lot of discussion surrounding the regulation of cryptocurrencies, for the most part the solution has just been to warn consumers about the dangers. However, it is likely that there will be increased regulation as governments attempt to react to the decentralised nature of the cryptocurrency market and assess the impact it could have on illegal activities.

Will cryptocurrencies replace fiat currencies?

Although there are those who speculate that cryptocurrencies will eventually replace fiat currencies, there has not yet been a wide enough acceptance of cryptocurrencies and this change looks unlikely to happen anytime soon. While some businesses rushed to incorporate cryptocurrencies as a method of payment, there has more generally been scepticism about their use and implementation – particularly from central banks and governments, who are responsible for issuing fiat currencies and regulating the markets.

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.

You might be interested in…

Deal on bitcoin volatility without the risk of buying and storing actual bitcoins

Use IG charts, plus advanced ProRealTime and Autochartist packages

Manage the risk of trading cryptocurrencies with a choice of stops and alerts