DFSA’s measures are broadly consistent with measures implemented in many overseas markets particularly in Europe. Their intention is to better regulate leverage products offered to retail clients. IG firmly believes in the implementation of robust and proportionate measures to improve client outcomes.

The Dubai Financial Services Authority have introduced changes to how CFDs are traded by Retail clients. Here you can find out how the new rules affect your trading.

What is the background to the new rules?

In November 2020, the Dubai Financial Services Authority (DFSA) announced several proposals which, if adopted, would impact Retail clients who trade CFDs.

In August 2021, the DFSA published their final rules, which included increases to the minimum margin requirements for Retail clients across all CFD markets.

These changes came into effect for IG Retail clients on the 4th of December 2021.

The rules don't apply to traders who are classified as 'Professional', that is, traders who fulfil specified wealth and experience criteria, and elect to be treated as 'Professional'.

How do DFSA's rules affect you?

Minimum margin rates for retail clients

The below tables detail the changes in margin rates. The increase in margin requirements apply to all existing and new positions from 6 December 2021.

| Asset class | Previous minimum margin rate | Minimum margin rate from 6 December 2021 |

| Oil | 2% (50:1) | 10% (10:1) |

| Gold | 2% (50:1) | 5% (20:1) |

| Major forex pairs1 | 2% (50:1) | 3.33% (30:1) |

| Major indices2 | 2% (50:1) | 5% (20:1) |

| Minor forex pairs1 | 5% (20:1) | 5% (20:1) |

| Minor indices2 | 5% (20:1) | 10% (10:1) |

| Commodities (excluding gold and oil) | 5% (20:1) | 10% (10:1) |

| Shares | 10% (10:1) | 20% (5:1) |

| Cryptocurrency | 20% (5:1) | 50% (2:1) |

| Bonds (UK, US, Germany, Japan, France) | 5% (20:1) | 5% (20:1) |

| Other markets | 5% (20:1) | 20% (5:1) |

Examples showing new margin requirements for retail clients:

| Asset | Price | Previous minimum margin rate | Minimum margin rate from 6 December 2021 |

| 1 contract Spot Gold ($100) | 1,775 | $3,550 | $8,875 |

| 1 contract oil - US crude ($10) | 7,155 | $1,431 | $7,155 |

| 1 contract GBP/USD ($10) | 1.3650 | $2,730 | $4,545.45 |

| 1 contract Wall Street ($10) | 34,450 | $6,890 | $17,225 |

| 1 contract Bitcoin ($1) | 44,200 | $8,840 | $22,100 |

What else has changed for retail clients?

| New rule | Description | Date of change |

| Negative balance protection | The total losses on your CFD positions are limited to the funds in your trading account*. * Negative balance protection only applies to trading losses. |

Dec 4, 2021 |

| Limited Risk Account | Limited risk accounts will automatically be migrated to a standard account with negative balance protection. This means if you now have a limited risk account, you will have an ongoing margin obligation from 4 December 2021.

If you have an MT4 account with IG it will also no longer be classed as ‘limited risk’. We will convert it after 4 December, and only once all your current open positions have been closed. |

Dec 4, 2021 |

| Margin close-out and how we calculate margin call | New DFSA requirements require us to automatically close your positions when your equity drops below 50% of your margin requirement. If you trade exclusively with normal stops or without stops altogether, you will not notice any change as this is how IG accounts have been operating for a number of years. If, however, you trade using guaranteed stops, position closure will now be triggered under slightly different terms from 6 December 2021. When we calculate account equity today, we do not currently include running losses on positions with guaranteed stops. Under the new DFSA requirements, such positions will need to include running losses as part of the deposit ratio calculation. This means that your positions will be closed out when your cash, including all profit and loss, reaches 50% of your margin requirement.

If you have guaranteed stops attached to existing positions and are running losses on your account, you will be at risk of closure if you do not have sufficient funds on the account to cover your full margin requirement. We will be making this change from 6 December 2021.

For long option positions where you have paid the option premium in full upfront, the margin requirement equates to the premium paid. The margin and profit/loss on these positions will therefore not be included in the deposit ratio calculation. These positions are still at risk of closure if other positions cause losses greater than the equity on your account. |

Dec 6, 2021 |

| Non-Guaranteed Stops | From the 6 of December adding or amending a non-guaranteed stop will no longer result in a margin reduction. | Dec 6, 2021 |

| Guaranteed Stops | From the 6 of December the margin rate when using a guaranteed stop will be the higher of: (a) The maximum risk on the trade; or (b)The minimum margin rate for that product Adding or amending a guaranteed stop will no longer result in a margin reduction. |

Dec 6, 2021 |

| Offsetting | From the 6 of December 2021 if you open any new offsetting positions (e.g. long and short on the same market) then you will be required to cover the full margin on both trades. Offsetting options positions will no longer be eligible for a margin reduction. |

Dec 6, 2021 |

| Volume Based Rebates | We will no longer offer volume based rebates to Retail clients. | Dec 1, 2021 |

| Working orders | We will be removing all active working orders on the 6 of December 2021 in order to implement the new margin rates. Please monitor your account closely and replace deleted working orders if you choose to. |

Dec 6, 2021 |

A global leader in online trading

IG firmly supports the implementation of robust and proportionate measures to improve client outcomes across the industry.

We’re here to help you navigate through these changes and continue enabling you to make the most of opportunities in the world’s financial markets. DFSA’s measures are similar to regulations applied in Europe, Singapore, Australia and Japan, and IG remains focused and committed to empowering traders in the UAE.

We will continue to operate to the highest regulatory standards and are well placed to adapt and thrive in this regulatory environment.

Professional clients will not be affected by these changes

The DFSA’s changes do not apply to Professional Clients.

If you think you may be eligible for Professional and would like to apply to be categorised as a professional client, you can elect to do so in My IG or the IG Trading app. You’ll need to answer several questions, so that we can assess whether you fulfil the eligibility criteria. As a Professional client, you will not be entitled to certain protections normally afforded to retail clients.

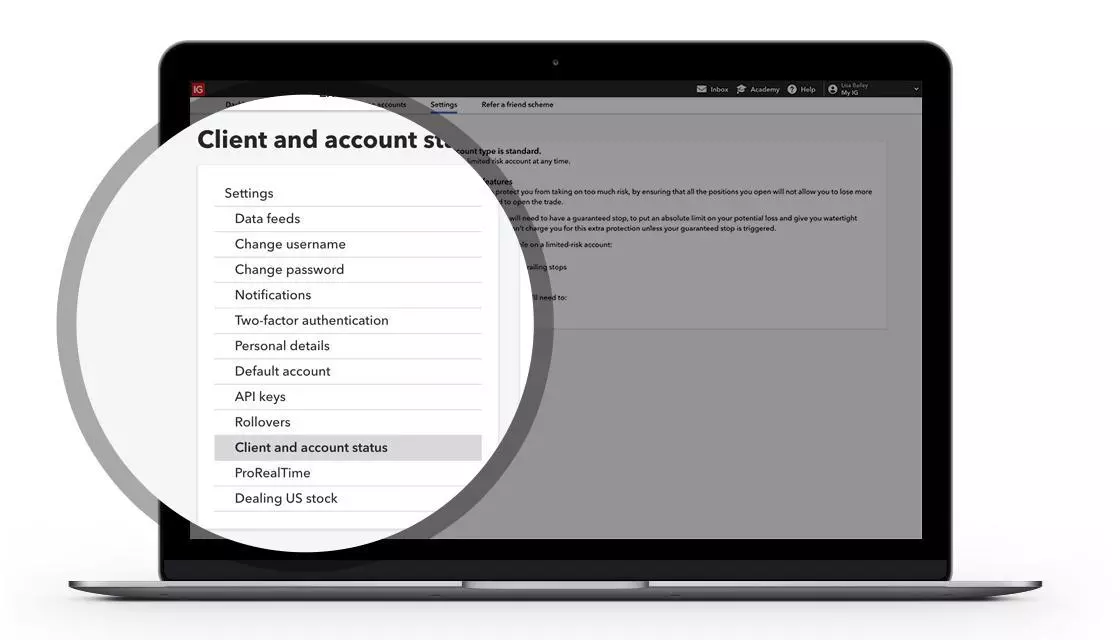

Log in to My IG or the app and follow the prompt, or go to ‘settings’>‘client and account status’ on desktop, or the 'accounts' area in-app.

FAQ

1. Why has the DFSA chosen these measures?

IG Limited has implemented the DFSA’s measures on the 4th of December 2021

3. What is a Professional Account and how can I apply?

These measures only apply to retail clients, so those clients who are categorised as Professional and trade through a Professional account will not be impacted.

Clients can choose to elect to be categorised as Professional if they meet the eligibility criteria.

More information can be found at: https://www.ig.com/ae/professional-trading

IG has delivered a sustainable business for more than 45 years by placing good client outcomes at the heart of everything it does. IG’s business model ensures that its interests as a business are aligned with the interests of its clients, which sets it apart from others in the industry.

IG will continue to lead the way in the industry, and the business is well placed to manage regulatory change as we have already shown leading into, during and after the European regulatory changes and continue to deliver sustainable growth.

5. How does the change impact me when using guaranteed stops?

When we calculate account equity today, we do not currently include running losses on positions with guaranteed stops.

Under the new rules, running losses on positions with guaranteed stops will be included as part of the Margin Close-Out calculation. Accordingly, positions with guaranteed stops will now be subject to new Margin Close-Out rules.

1 Major forex pairs are those that include two of the following: USD, GBP, EUR, JPY, CAD, CHF, AUD, NZD. Minor forex pairs are all pairs not included as a major pair.

2 Major indices include: FTSE 100, FTSE Mid 250, US 500, Wall Street, US Tech 100, Russell 2000, Germany 40, France 40, EU stocks 50, Hong Kong HS 50, Australia 200, Japan 225, Netherlands 25, Singapore Index, Spain 35, Sweden 30, Austria 20, Belgium 20 and Switzerland Blue Chip. Minor indices are all indices not included as a major.