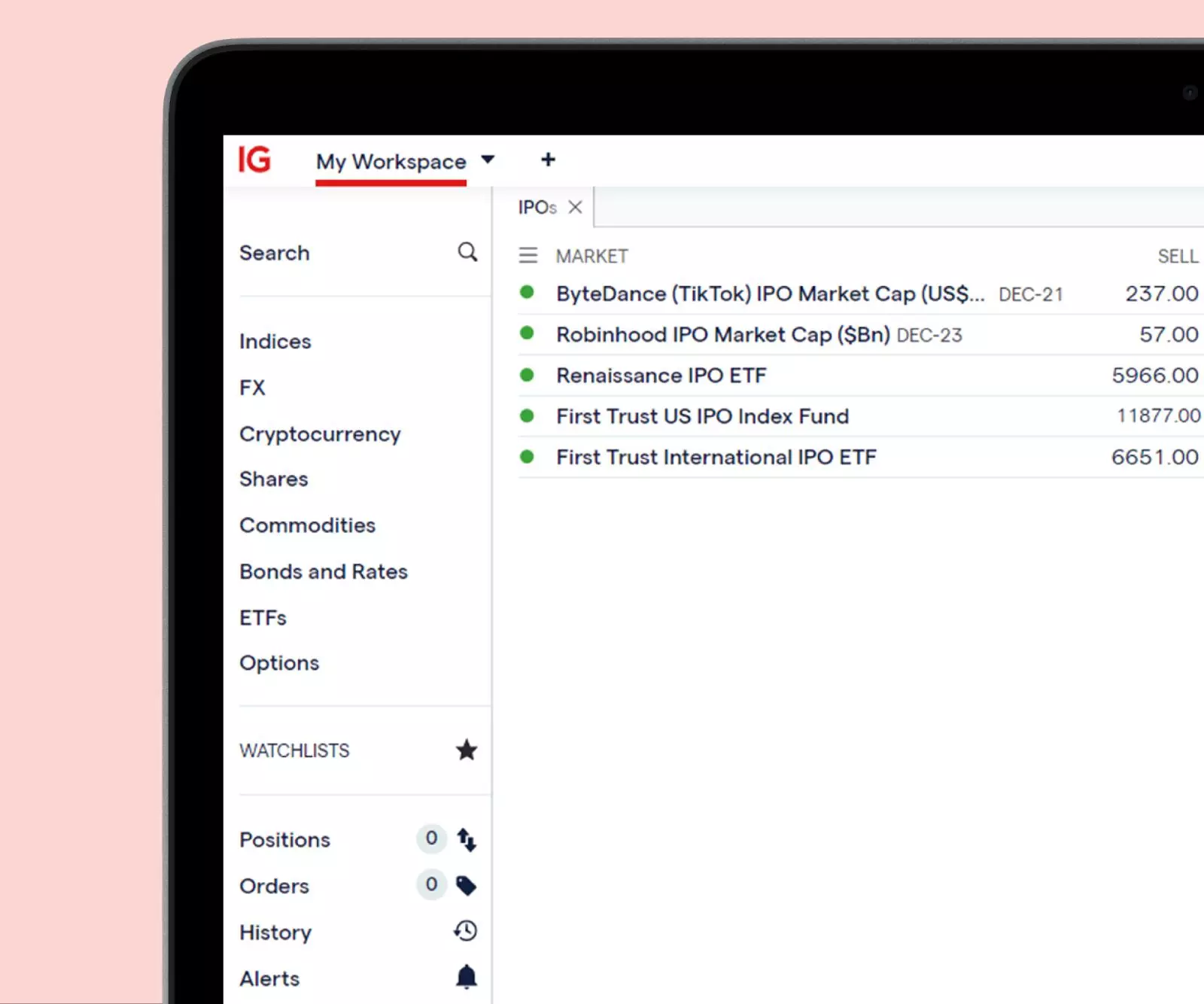

IPOs are how many companies go public, and there are several ways to take a position. Discover how to get exposure to IPOs with us.

How can you get exposure to an IPO?

Once the company has listed, the secondary market will open. This is where retail investors can buy and sell the stock between themselves, or where you can trade on a share’s price movements with derivatives.

To invest on the secondary market, you’ll need a stock trading account. Investing gives you direct ownership of the stock – making you a company shareholder. To trade on the secondary market with us, you’ll use CFDs. You won’t own the shares when you trade, but you will get a range of benefits.

You’ll be able to take a CFD position on the secondary market for UK IPOs as soon as it opens – which is usually at 9am (UK time) on the day of the IPO. US IPOs might take a few hours to be available to traders, which is the case for all brokers.

Make sure you always have an effective risk management strategy in place when trading an IPO, as the share price could experience increased volatility right after the listing.

To take a long or short position on a newly listed stock, open a CFD trading account.

Learn how IPOs work

The IPO process starts long before the shares list on an exchange. First, a company has to make the decision to go public. This is followed by a financial audit of the business and a registration process. The news of an upcoming IPO will usually be released a few months before the planned listing – which gives you time to study a company’s fundamentals and decide whether you want to take a position on its shares.

Decide how to take a position on an IPO

With us, you can invest in the company’s shares with a stock trading account on the secondary market. Investing in the secondary market will give you ownership of the shares once the company has completed its IPO.

You can also speculate on the company’s share price on the secondary market with CFDs.

Investing in shares

You can create a stock trading account to invest in shares once they’re available on the secondary market.

When you’re investing, you’ll pay the full value of the position up front which will give you direct ownership of the company’s stock. This’ll make you a shareholder, and you’ll be eligible to receive any dividends that the company pays, and get shareholder voting rights if the company grants them.

With us, you can invest in US and UK shares at zero cost, no commission, no FX conversion fee, and no custody fee up to 100 trades per month.

Trading derivatives

You can create a CFD trading account to speculate on a share’s price movements with CFDs. After the IPO you can use them to speculate on a stock’s price rising (by going long) and falling (by going short).

You might choose CFDs because they enable you to open a position with leverage, which requires a small deposits (margin) rather than committing the full value of the shares upfront. This can magnify profits and losses, as both will be calculated from the full exposure of the trade, not just the margin you put up a deposit.

Build your IPO trading plan and strategy

A good trading plan and risk management strategy will provide guidance on how to find opportunities, and when to take profits and cut losses. There are several ways you can minimise your risk, which include attaching stops to your positions. Stops will close your trade at a certain level if the market moves against you, minimising your losses.

To learn more about trade planning and risk management, join IG Academy. It’s a great tool for developing your knowledge on all things trading, with free online courses, webinars and seminars.

IPO trading and investing strategies

We’ve highlighted some IPO trading or investing strategies below. Remember that before using any of these strategies, you should take steps to manage your risk.

1. Let the stock establish some price discovery

Taking a position on an IPO on its opening day can be very different compared to other market opportunities. Support and resistance levels haven’t been established yet and people are often excited with certain expectations. One of the best ways to handle hot IPOs is to wait for the morning volatility to cool off and allow the stock to establish some ‘price discovery‘.

This will give you levels to trade off and price action will likely be less erratic and volatile. Having levels to trade off helps you manage risk, which is your number one goal when trading an IPO. Placing hard stops and managing trade size is a must.

2. Wait for the lock-up period to end

IPO shares are often subject to a ‘lock-up’ period. These can last up to six months and mean that existing shareholders cannot sell their shares immediately after a listing. If you notice that they are holding on to shares after this period, it could mean that shareholders think there is potential for growth and it’s time to buy because the share price could remain stable or increase.

But, if the share price falls after the lock-up period, it could indicate that confidence in the company is low. This could be an opportunity to go short with a derivative like a CFD.

Following this strategy means that you’ll miss out on the initial market volatility that IPOs often cause – which could be a good or a bad thing, depending on your individual appetite for risk.

3. ‘Buy’ or ‘sell’ the IPO stock with derivatives

If you want to capitalise on upward and downward movements in a company’s share price on the day of its IPO, you could take a position with a derivative like a CFD. You can use these products to ‘buy’ (go long) if you think the company’s share price will rise, or ‘sell’ (go short) if you think it’ll fall.

But, bear in mind that CFDs are leveraged products, and leverage can increase both your profits and your losses.

Open your first IPO position

Once you’re ready to start trading or buying shares, you can open your first IPO position on the day of the IPO when the secondary market opens.

Before you open your IPO position, make sure you take steps to manage your risk like adding stops and limits to your open positions, and by monitoring your positions closely.

FAQs

Can I make money on initial public offerings (IPOs)

Yes, you can make money on IPOs if you correctly predict share price movements. With us, you can take a position after the IPO on the secondary market.

What are the ways you can trade an IPO?

With us, trading an IPO means that you’ll be taking a position with CFDs. You can use these to take a position on the secondary market on the day of the IPO.

With us, you can also invest in an IPO. Just create a stock trading account – which will also give you access to the secondary market offering once the company has completed its IPO.

How long before you can sell IPO shares?

IPO shares – the shares acquired by investors before the listing – are often subject to a ‘lock-up’ period. These can last up to six months and mean that private investors who held shares prior to the IPO cannot sell their shares immediately after a listing. However, the general public won’t be affected by lock-up periods, as they exist mainly to prevent those who acquired shares before an IPO from immediately selling the stock.

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.

Try these next

Start trading over 70 US markets out of hours

Learn how to trade several leading markets when others can’t

Discover how to buy and trade shares