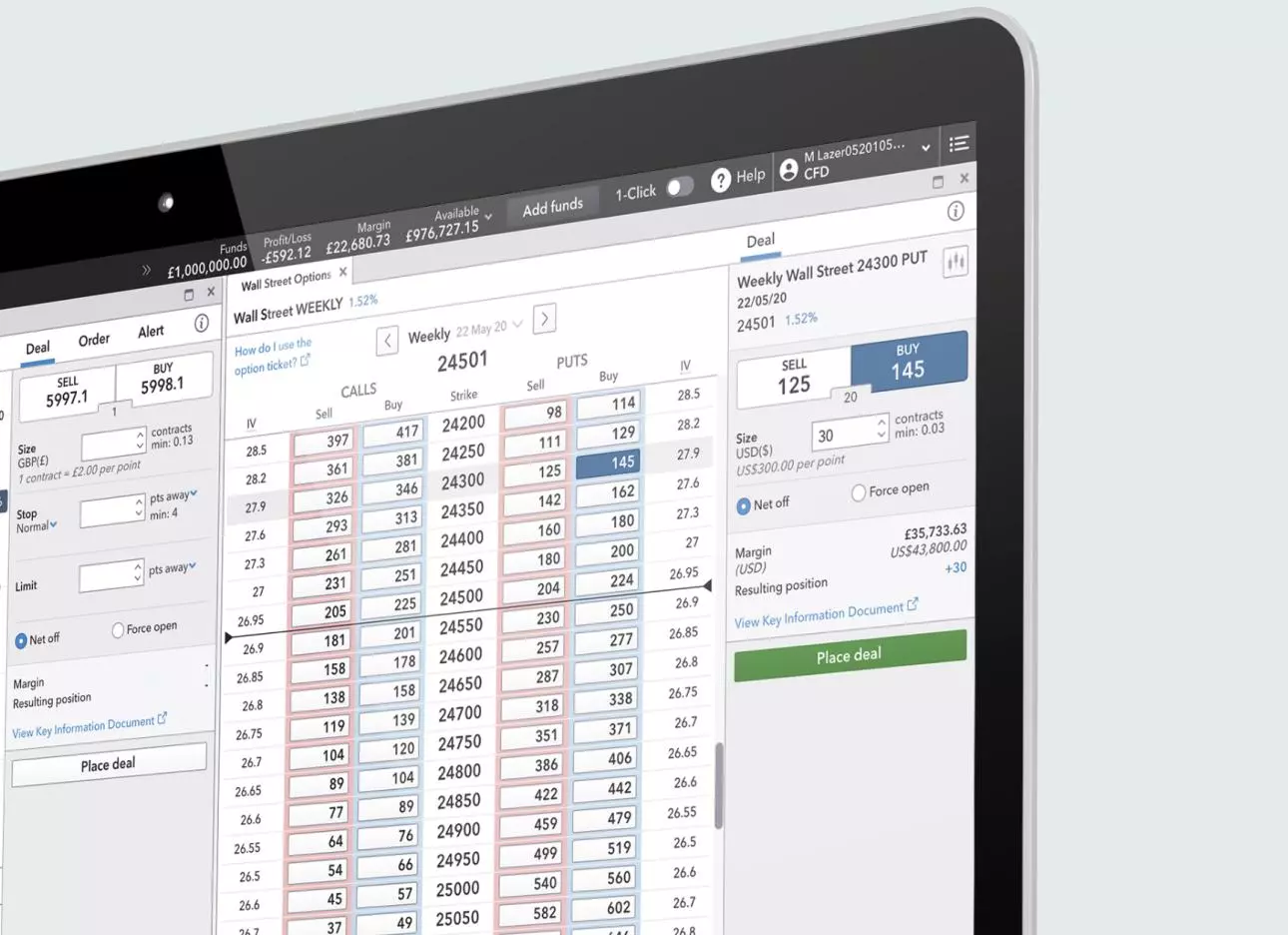

Weekly and monthly options

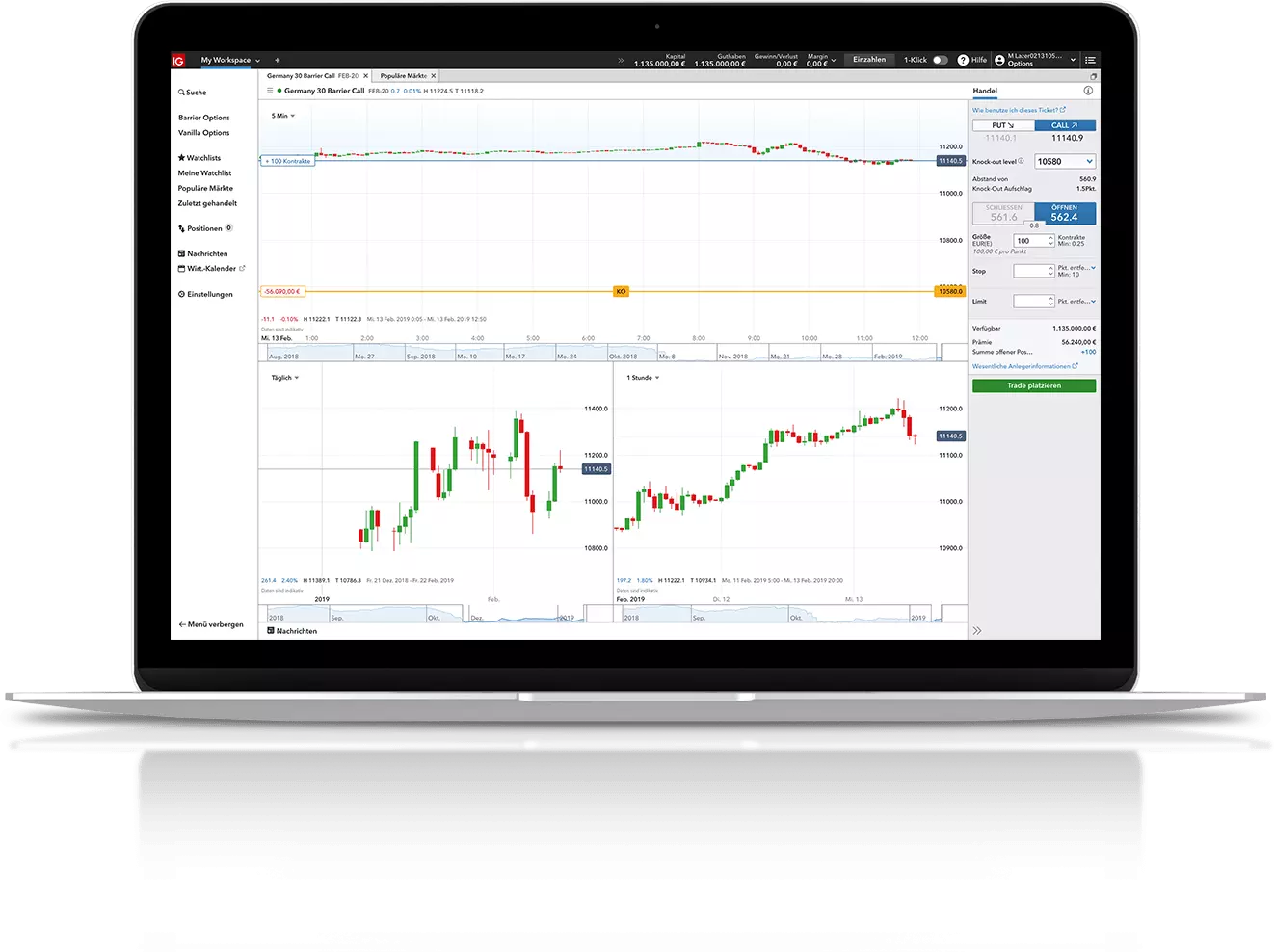

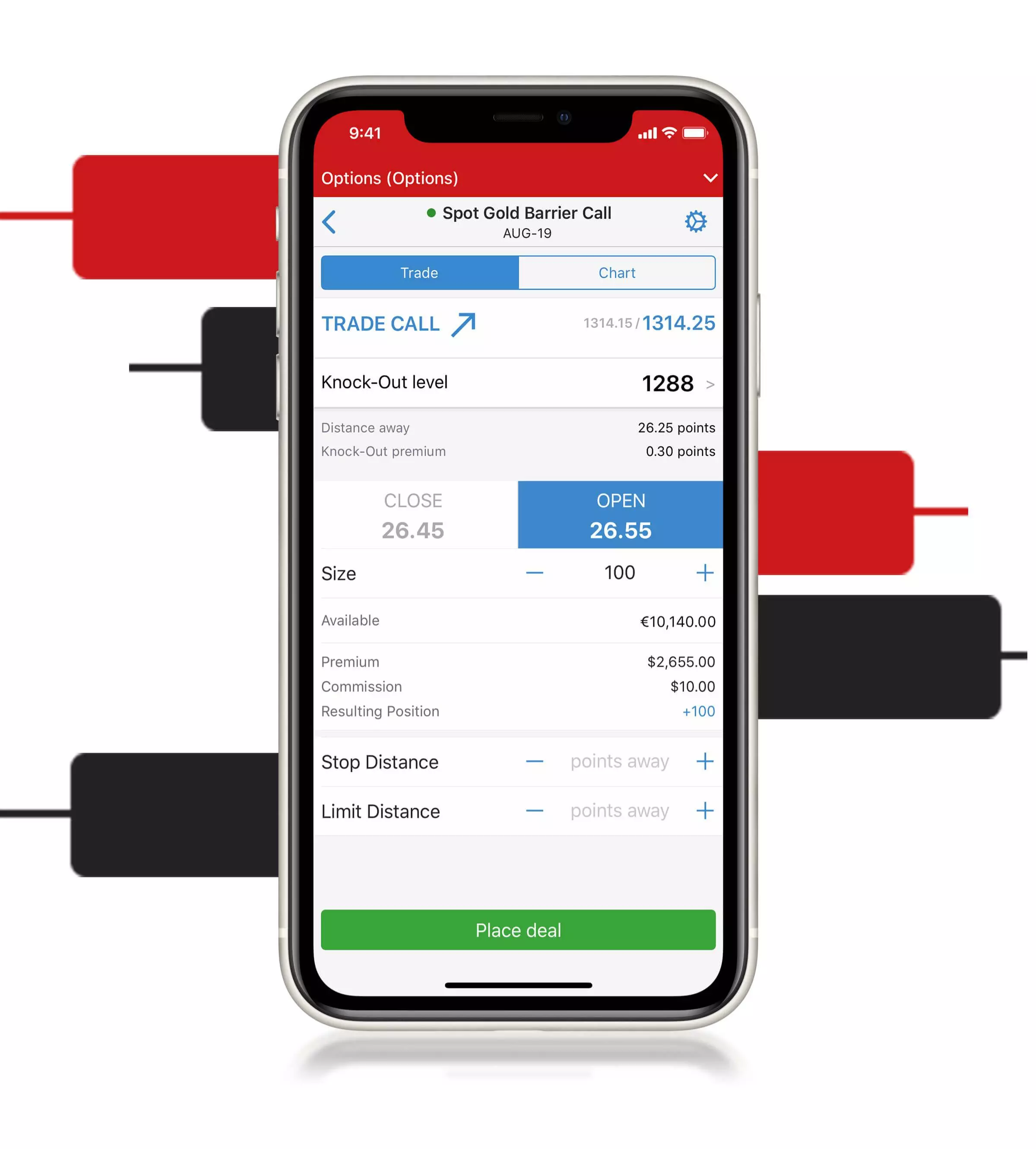

Trade options in the timeframe that suits you with our weekly, monthly and quarterly options. Get greater control over your leverage and risk when buying options, and take positions confidently with our intuitive options trading platform and award-winning app.1

The features of trading weekly, monthly and quarterly options

Zero overnight funding

You don’t pay overnight funding as on regular spot markets, so you can hold longer positions for less.

Know your risk

Your risk is only as much as the margin you pay to open when you buy options, even when the expiry is months in the future. However, when selling options your risk is potentially unlimited.

Leveraged trades

Trade weekly and monthly options with and gain exposure to a larger position.

Take control of trades

Discover a range of trading strategies that are unique to options, and get greater control than when trading CFDs. Profits (when buying) and losses (when selling) may still outweigh your initial outlay.

Unparalleled market range

Take positions on major indices, shares, FX and more.

Keep costs down

Trade on competitive spreads, from as low as 0.53 points.

No spread at expiry

Don’t pay any spread to close your position when you hold it to expiry.

Standard negative balance protection

If your account balance goes negative, it’ll be brought back to zero.2

What are weekly, monthly and quarterly options?

Weekly, monthly and quarterly options are contracts that give you the right – but not the obligation – to buy or sell an underlying asset before a certain date, with weekly, monthly or quarterly expiry dates.

With us, you can trade CFDs on an option’s price. Your positions will always be cash-settled at expiry. You’ll never have to deliver, or take delivery of, the underlying.

You can use options to speculate on whether the price of a financial market will move above or below a certain level – the strike price – at the option’s expiry. For weekly options this is on the following Friday, and for monthly options the third Friday of the month. The date of expiry for quarterly options will depend on the market being traded.

You can find more details of the expiry time in the ‘information’ tab of the deal ticket. If you want to use options for intraday trading, take a look at our daily options – trade with low spreads and get greater leverage than on spot market positions.

Types of weekly, monthly and quarterly option

There are two types of weekly, monthly and quarterly option – calls and puts.

- If you think the market is going to rise, you’d buy a call

- If you think the market is going to fall, you’d buy a put

Find out more about call and put options here.

Opening an IG account is easy

Fill in the form

We’ll ask a few questions about your trading experience.

Send required document

That includes proof of identity and proof of residency.

Fund and trade

Deposit funds and start trading options.

Weekly, monthly and quarterly options trading strategies

You can use most options trading strategies when trading weekly, monthly and quarterly options, you just need to consider the timeline when choosing your strategy. For instance, a covered call (selling a call option) might be a good weekly option strategy if you foresee losses on an asset that you already own.

Try these next

We’ve been at the forefront of online trading and investment services for 45 years.

Trade whenever and wherever with our range of award-winning apps.

Open a demo account to explore our platform and practise your trading risk-free.

1 Awarded ‘best finance app’ at the ADVFN International Financial Awards 2019, 2018, 2017 and 2016.

2 Negative balance protection is a requirement which means your bank account with us can never fall below zero. Negative balance protection does not apply to professional traders.

3 On spot gold