What’s on this page?

What are oil CFDs?

Oil CFDs are contracts used to exchange the difference in value of the oil price between the point at which the contract is opened to when it’s closed. Trading oil CFDs will enable you to speculate on both the rise and fall of the underlying asset’s price movement without taking ownership of it.

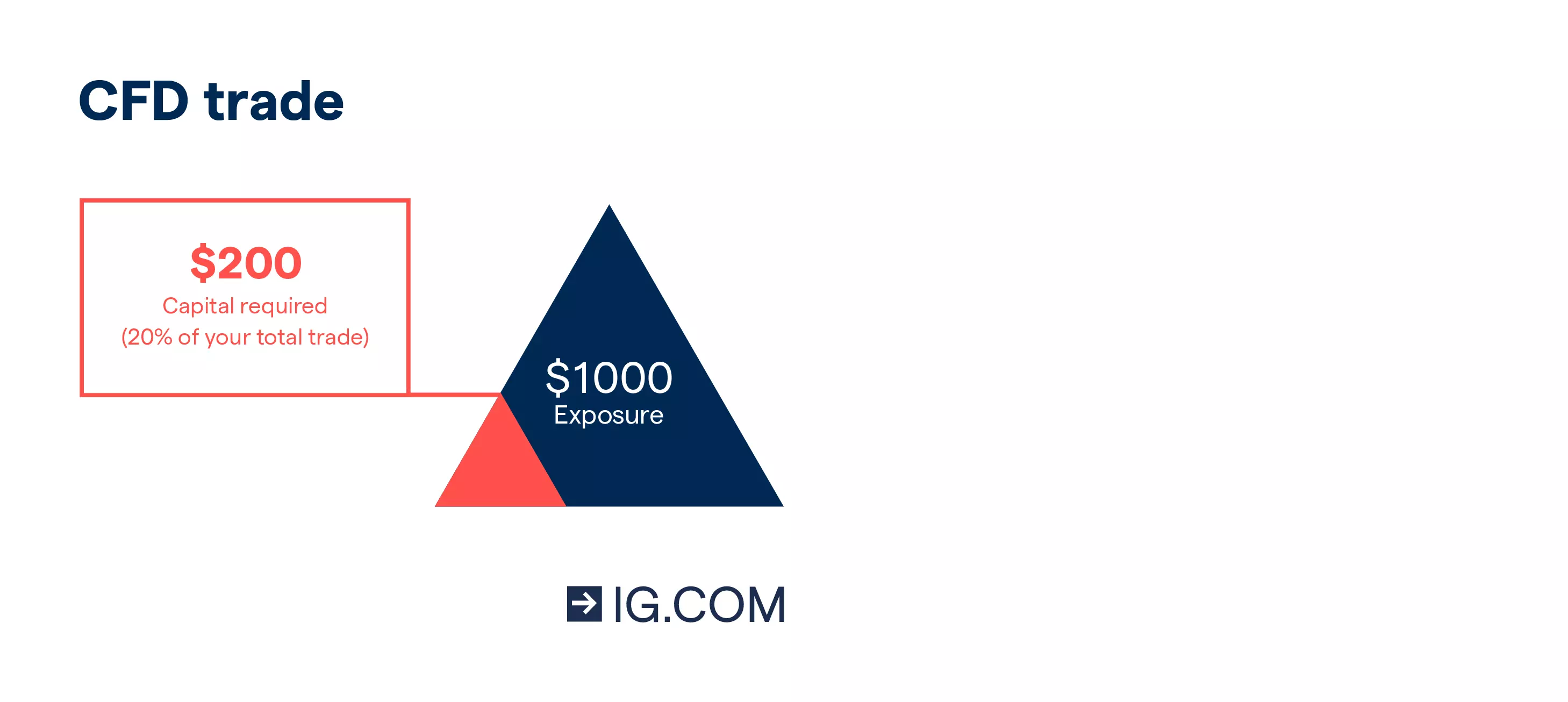

CFDs are leveraged derivatives, which means you’ll get exposure to the full value of the underlying oil market by only paying a deposit – called margin. For instance, with leverage, if you wanted to open a position worth $1000, you’d only need to put down $100, which is equivalent to a 10% margin.

Essentials of trading oil CFDs

Oil CFDs are popular among individuals who want to trade oil markets without having to buy and own physical barrels of the commodity. You can go long (‘buy’) or short (‘sell’) on the rise and fall of the oil markets.

You’ll make profits if the markets favour the direction of your trade, however, you’ll make a loss if the markets turn against you. Oil CFDs are also a preferred option for you if you’re looking to make short-term trades.

You can trade oil CFDs on our award-winning platform1 at an average execution speed of 0.0107 seconds.2

1. All oil CFDs are traded using leverage

You can trade oil using leveraged derivatives like CFDs, which enable you to speculate on the oil market price movement without taking ownership of the underlying asset.

When trading oil CFDs using leverage and you’d like to open a position, you'll be expected to pay an initial deposit that’s a percentage of the full value of the underlying market. Note that leverage may magnify your profits, but it’ll also result in your losses exceeding the initial margin.

It's important to manage your risk carefully and to ensure you’re not staking more than you’re willing to lose.

2. You can go long or short with oil CFDs

When trading oil CFDs you’ll go long (‘buy’) if you think the market’s oil price movement will rise and go short (‘sell’) if you believe it’ll fall. This can be done at just a click of a button when you trade CFDs on our award-winning platform.1

3. You can hedge with oil CFDs

Oil CFDs can be used for hedging to reduce the risk that comes with any losses against profits for capital gains tax liabilities that may apply.3 When hedging, you might decide to open two positions that directly offset each other, which means when the one makes a loss or gain it offsets the change in value of the other.

CFDs are free from stamp duty, but you may pay capital gains on your profits.3 Note that when hedging you’ll incur costs, be sure to factor these into your hedge calculations and projections.

4. Trading oil CFDs vs other alternatives

CFD trading is one way to get exposure to oil using leverage and you won’t be taking ownership of the underlying oil markets.

Note that leveraged products are complex, it’s important that you understand how they work before trading them and if you can afford to lose your money.

If you'd rather not trade with leverage, you would opt to buy and own oil stocks or exchange-traded funds through share dealing. Since share dealing doesn’t use leverage, you would be liable to pay the full value of your position upfront.

Remember, with us you can only trade derivatives via CFDs.

5. Oil CFDs: undated (spot) vs futures vs options

Most people trade oil CFDs using the spot market – sometimes called the undated or cash market. The spot market uses the real-time trading oil prices with lower spreads, making it popular among day traders.

Oil futures can be kept open for longer because they don’t have overnight fees. Oil futures are financial contracts in which a buyer and a seller agree to trade a specified number of barrels of oil at a fixed price set for a future date. However, remember that they have larger spreads.

Oil options give you the right to buy or sell the market before the commodity reaches its expiry on a specific date in the future. With options, you won’t be obligated to buy or sell the oil market, so if it moves against you, you’d decide to pay only the initial margin you used to open the position.

How to trade oil CFDs

- Fill in a simple form

We’ll ask you about your trading knowledge to ensure you've got the best experience when trading CFDs with us. - Get verification

We’ll verify your identity as soon as possible - Fund and start trading

Deposit funds into your CFD account. You can withdraw it whenever you want to.

If you need to build more confidence in your trading skills, open a free demo account with us. You can practise in a risk-free environment using $20,000 in virtual funds.

1. Learn all about CFDs and oil trading

Oil trading using CFDs involves speculating on the rise and fall of the market price of the underlying asset.

To learn more about how to trade oil via CFDs, enrol for a free course on IG Academy.

Applying for a live account is a simple process. You’ll fill in an online form and once the application is complete, you’ll receive a notification when it’s accepted. Note that there’s no obligation to fund your account once opened, and you can wait until you’re ready to place your first trade.

2. Open and fund your live CFD trading account

We offer over-the-counter trading for oil markets on our award-winning platform using CFDs on oil spot markets, oil futures and oil options.1 When you open a CFD account with us, there’s no minimum deposit. * You also make withdrawals fast and at no cost to you.

The deep liquidity on our platform offers fast execution with orders being filled on average at 0.0107 seconds. You’ll also receive support 24/5 per week by telephone, email and Twitter.

* The minimum amount for a card payment is $300, and there is no minimum for a bank transfer. The minimum deposit is shown on the payment screen when you go to process the payment.

3. Choose the oil market you want to trade

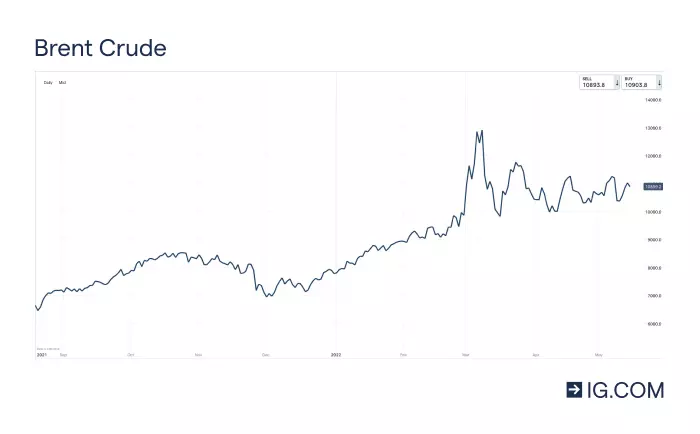

There are two dominant oil markets for you to trade – Brent Crude and West Texas Intermediary (WTI) also known as US Crude. Brent crude is extracted from oil fields in Europe’s North Sea, while WTI is mined in North America.

Brent crude is the benchmark when trading oil contracts, futures and derivatives at an international level. While in North America WTI is used as a benchmark.

The price difference between the oil markets are based on the commodities’ varying properties. Both Brent crude and US crude are light in nature and can be easily refined and processed by petrol manufacturers.

Live oil and oil-linked prices

4. Decide whether you want to trade undated (spot), futures or options

When you trade the oil markets you have a choice to either trade CFDs on the oil spot price, futures or options. When trading CFDs on the oil spot market you would need to pay for overnight funding. This can be avoided by opening longer-term positions on the underlying oil market by trading futures or options.

5. Open your first CFD trade on oil

You can open your first CFD trade on oil by clicking the commodities section in the top left toolbar of our trading platform. This will display a list of financial instruments in the energies sector. You can then choose the oil market you’d like to trade.

Once this is done, open the deal ticket then buy or sell your oil market of choice. Go long if you believe the oil market price will increase and go short if you think it’ll fall.

You can set the size of the position you'd like to place on your deal ticket. This will calculate the amount you must pay for the initial margin so you can get exposure to the underlying oil market.

With us, you’ll get trading alerts when the oil market price moves some points above or below the level you’ve set. Note that despite setting these alerts, it remains your main responsibility to monitor your position. It’s important to also use our tools to manage your risk carefully.

To gain access to a list of markets you can get ‘buy’ and ‘sell’ suggestions from our trading signals by clicking on ‘signals’ in the bottom left toolbar of our platform. These suggestions are based on emerging chart patterns and key levels that’ve been met.4

Remember not to solely rely on third-party generated chart patterns on our platform to make your trading decisions, conduct your own due diligence using technical and fundamental analysis.

6. Monitor your position

Once you've opened your position using your CFD trading account, you can set your signals and alerts, and monitor your position Our award-winning platform1 will also enable you to see the running profits and profits made on your open position.

What affects the price of oil?

The demand and supply of oil, as well as various macroeconomic trends, tend to affect the oil market prices. Here are some examples of what affects the price of oil:

- Controlling the global oil supply. Only five countries produce about half of the world’s oil in total, which increases their power and sovereignty to control the global oil supply. This directly impacts the oil price since the handful of countries can manipulate it

- Driving global oil demand through growing economies. Positive performance in global economies increase oil demand. When global economies grow exponentially, it increases the oil price. However, weakening global economies decrease oil demand and its price

- Geopolitics at play. When war or conflict erupts in oil-producing regions, this impacts its supply. This, in turn, increases volatility of oil and its price within the market

Try these next

Seize the opportunity to trade on our easy-to-use platforms and apps

Watch market developments in real-time using charts generated by fast cutting-edge technology

Learn how to trade online and access key markets using our award-winning platform1

1 Best Finance App, Best Multi-Platform Provider and Best Platform for the Active Trader as awarded at the ADVFN International Financial Awards 2024.

2 Correct as of 1 February 2022. Average speed calculated from 1 to 28 February 2022.

3 Tax laws are subject to change and depend on individual circumstances. Tax law may differ in a jurisdiction other than the UK.

4Our signal service does not constitute and shouldn’t be regarded as investment advice. We provide an execution-only service. You act on signals entirely at your own risk.